Have cryptos found a bottom? BTC surges after dip under US$29k; miners flee China

Picture: Getty Images

Bitcoiners are hoping BTC has finally hit bottom after it gained nearly $5,000 in 12 hours and talk of moves out of China grows louder.

BTC dropped under US$30,000 around 10 o’clock last night (Sydney time), reaching a nadir of $US28,894 shortly before midnight – its lowest level since late January.

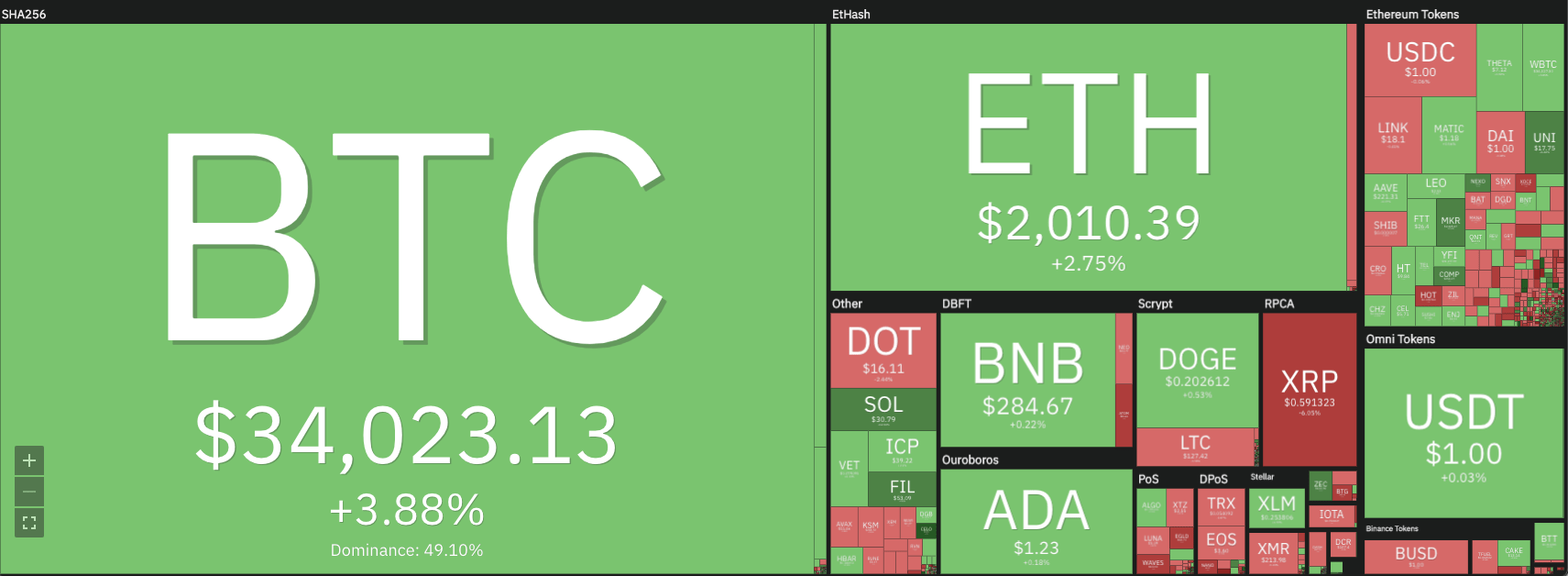

But since then Bitcoin has rebounded nicely, trading over US$34,100 at lunchtime, up 4.1 per cent from 24 hours ago.

Ethereum was trading just below US$2,000, up two per cent.

Overall the total crypto market cap was up 4.3 per cent to US$1.38 trillion, but the altcoin market was definitely mixed with over 30 coins in the red. Amp was the biggest loser, down 13 per cent, while Livepeer the top gainer, rising 25 per cent

This morning a bunch of folks were screaming bitcoin was going lower.

Now those people are screaming that bitcoin is going higher.

Nobody knows what is going to happen to price in the short term.

Stop trying to day trade a highly volatile asset.

Think long term & chill.

— Pomp (@APompliano) June 23, 2021

BTC miner migration out of China

There were multiple reports that Chinese Bitcoin miners were packing up after a crackdown on the energy-intensive process that seems more serious than previous China “bans”. China has historically accounted for as much as of three-quarters of the Bitcoin mining power, thanks to low electricity costs.

BIT Mining, the operator of the BTC.com mining pool, announced that it had sent 320 of its mining machines to Kazakhstan, with 2,600 more expected to arrive by the end of the month. More machines will be shipped to data centres outside of China later in the year, the company said.

Altogether the company’s mining pool accounts for about nine per cent of Bitcoin’s total hash power, Bitcoin Magainze reported.

“We are committed to protecting the environment and lowering our carbon footprint,” said Xianfeng Yang, CEO of BIT Mining.

“We have been strategically expanding our operations overseas as part of our growth strategy. Following our investments in cryptocurrency mining data centers in Texas and Kazakhstan, we are accelerating our overseas development for alternative high-quality mining resources.”

Kevin Zhang, the vice president of mining company Foundry Services, estimated in a tweet after talking to colleagues in China that 70 per cent of the mining capability in the country had gone offline.

3) In the most extreme cases, some colleagues in Kangding, Sichuan have been instructed by the power plants/stations they have installed their mining facility on to remove ALL infrastructure (low-medium voltage, racks/shelving, containers, etc…) with 1-2 weeks notice

— Kevin Zhang (@SinoCrypto) June 23, 2021

“Short-term, the Chinese ban could be bearish for bitcoin. The ban causes uncertainty, slower blocks, and possibly selling pressure from miners,” crypto company Luno wrote in a weekly update.

“In the long run, however, this ban might be a net positive for bitcoin. Miners will move to other more stable regions, and the narrative of China’s strong grip on the bitcoin mining industry will die.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.