‘Haters spontaneously combusting’ — shorts squeezed as Bitcoin pumps to $47k

Getty Images

Bitcoin is back in the black, baby.

After an awful start to 2022, the original cryptocurrency made up its losses for the year with a strong rally this morning that began around 7.30am AEDT. BTC rose nearly US$2,000 to $46,750 in the space of two hours, in a possible short squeeze. It reached a 12-week peak of US$47,658 around 11.30am.

$47,300. Haters spontaneously combusting suddenly and without warning. $50,000+ coming. #Bitcoin

— Mike Alfred (@mikealfred) March 28, 2022

At 12.15pm, BTC was trading for just over US$47,000 on Binance, up 4.9 per cent in the past 24 hours — and, crucially, up 2.4 per cent for the year.

“Today’s huge candle is literally the best-case scenario for the bulls,” wrote one analyst who goes by FieryTrading.

“All resistances have been obliterated and the way to $50k is practically free of any obstacles,” he wrote, although cautioning that there was the potential for a “minor dip” in the coming days after six straight days of gains.

Sydney-based City Index analyst Tony Sycamore saw it slightly differently, saying the next test for Bitcoin was the 200-day moving average at US$48,300.

Bitcoin’s renaissance, Sycamore told Stockhead, was supported by the rally in stocks and comments over the weekend by high-ranking Russian lawmaker Pavel Zavalny that the country might accept Bitcoin for oil and gas payments.

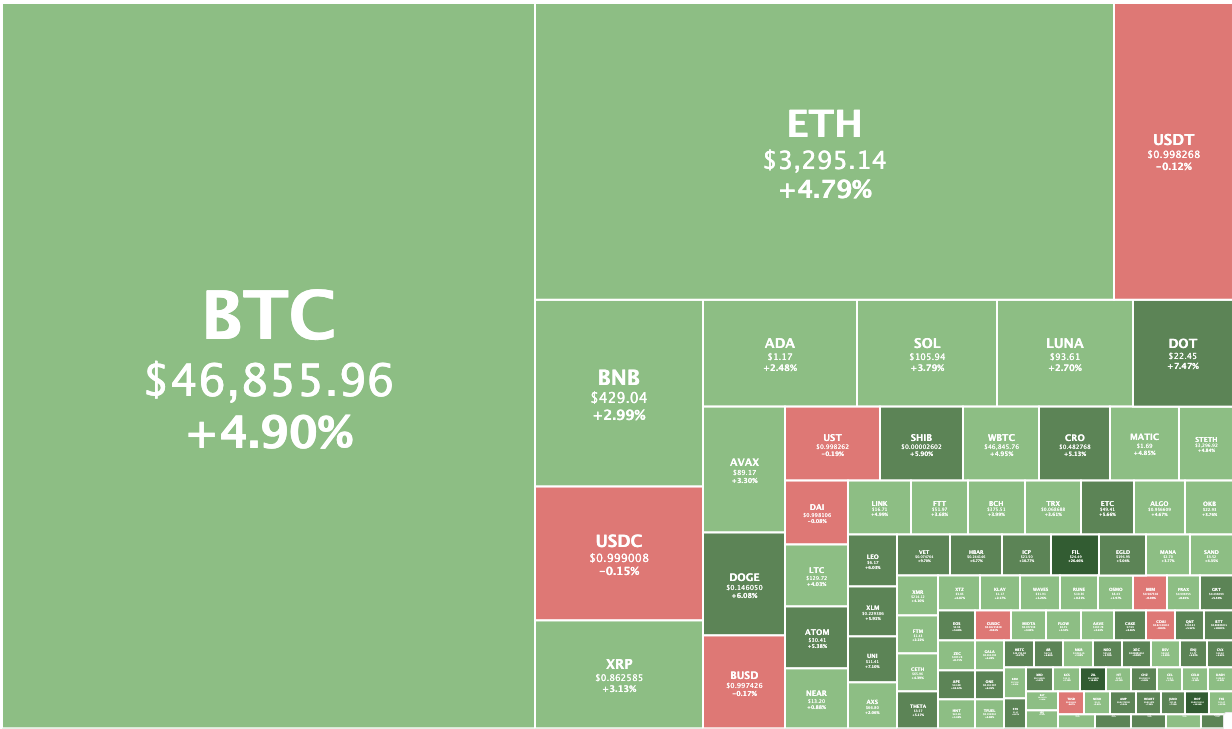

Crypto market up 4.4%

Overall the crypto market was at US$2.19 trillion, up 4.4 per cent from yesterday, according to Coingecko.

Ethereum was up 4.5 per cent to US$3,284 and Polkadot had risen 7.1 per cent to US$22.

Holo (HOT) was the biggest gainer in the top 100, rising 38.4 per cent to US0.7c.

Filecoin was up 24 per cent, Zilliqa had gained 17 per cent and Apecoin was up 11.2 per cent.

Stablecoins were the only top 100 cryptos in the red, according to Coingecko. They sometimes marginally lose their dollar peg during market rallies.

Australian-founded institutional lending protocol Maple Finance was consolidating after hitting an all-time high of US$56 on Sunday, trading down 4.6 per cent to $47.

That’s still up more than sevenfold since when Stockhead first profiled the project in the Apollo Capital’s Apollo’s Moonshots column last July.

Maple has now originated US$1.1 billion in loans to institutional crypto-native firms, earning lenders US$16.5 million in interest.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.