‘Grab the vomit bags… what a wild ride!’ — Aussie traders on the crypto carnage

Getty Images

With Bitcoin crashing and some crypto enthusiasts fearing the end to the bull market, Stockhead this afternoon reached out to a few Australian crypto-heads to get their take on where things are headed.

David Pugh, the amateur Perth trader whom Stockhead profiled last month after he sold the top on Bitcoin shortly before a major correction, said he wasn’t able to avoid the crash this time.

He had diversified into more top 10 altcoins, but that didn’t save his portfolio.

“Grab the vomit bags… what a wild ride!!!!!!!” he wrote in a message. “I don’t think i’ll be handing in my notice at my day job anytime soon after yesterday.”

Still, Pugh was still bullish overall and thought Bitcoin was still on track to hit six figures this cycle.

“The institutions have arrived in this market cycle and they have left their mark to shake out the weak hands and scoop up their BTC at 70 per cent off, after the panic sell from last night,” he wrote.

“For the last few weeks we were expecting a reversal in trend and my weekly and monthly RSI’s were showing 120, so the market had been in the boiling over for way too long and needed to cool off.

“I wasn’t expecting the ice bath that it jumped into though…. holy moley!!!”

Pugh said he thought that smaller traders had tired of Bitcoin and hoped that Ethereum would emerge as king, while other top 20 projects would start to get their time to shine.

A technical analysis

Meanwhile Gold Coast crypto trader David Haslop says he’s sitting on the sidelines for now, and thinks it’s possible an even deeper correction is possible.

“We are trending down, until we’re not,” the Crypto Den founder told Stockhead in a message on Thursday afternoon, as BTC was trading for around $US$37,950 after yesterday’s massive crash.

“Any decent trader will wait for confirmation/retest before entering at the moment.”

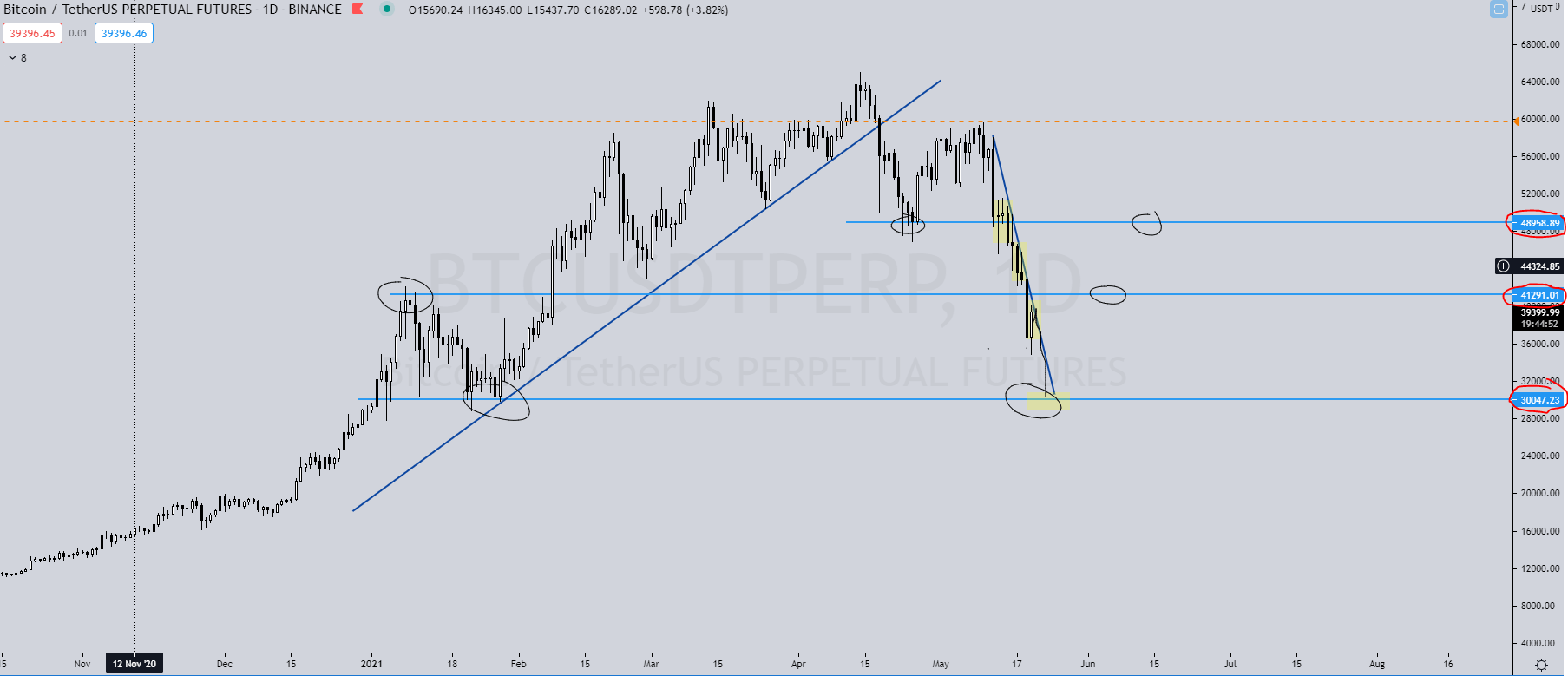

The black line on this chart is his primary plan:

“Looking at the daily it could still test 30k again,” he said.

Haslop was watching three key levels — US$30,047, US$41,291, and US$48,958 — as indicated on this chart.

“To be honest I don’t think its really showing a lot of strength,” he wrote. “It has one strong buy back, but then not a lot after that just yet. BTC usually rallies a lot better after such a strong (drop).”

A drop to US$20,000 — the peak of the 2017 bull run — wasn’t out of the question, Haslop said. He shared one possible scenario of how this could play out that he had sketched out before Wednesday’s big drop.

Other views

Sydney crypto trader Eunice Wong was also waiting to re-enter the market – and was optimistic there’d be another leg up.

Look at the past few runs. We still have another wave coming up, be ready.

Being ready doesn’t mean to frantically fomo buy, be patient.

You’ll know when the time is right. #CRYPTOINDEX #CIX #CRYPTO pic.twitter.com/H5zx9VmVKb

— Eunice D Wong (@Eunicedwong) May 19, 2021

But Kiwi crypto influencer Lark Davis, who has over 300,000 followers, said he was buying the dip.

#bitcoin will be worth 6 digits, I just got to buy some for 31k, nice!!!!

— Lark Davis (@TheCryptoLark) May 19, 2021

I always have dry powder on hand for days like this, I now have much less dry powder!!! #bitcoin

— Lark Davis (@TheCryptoLark) May 19, 2021

At 4.26pm AEST, Bitcoin was trading for US$39,533, having bounced off the US$40,000 level a half hour earlier.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.