Geopolitical, monetary policy risks remain for Bitcoin despite enthusiasm following Biden rally – analyst

Getty Images

With US monetary policy all but certain to tighten next week and a war raging in Europe, there’s still downside risk to Bitcoin despite its rally following Joe Biden’s crypto executive order, one Aussie analyst is warning.

Sydney-based City Index analyst Tony Sycamore told Stockhead that while the rally was encouraging, “I still need to see Bitcoin punch above resistance at 46k to negate downside risk and open up a stronger move towards $50k.”

At lunchtime (Sydney time) BTC was changing hands at US$41,860, up 7.3 per cent from 24 hours ago, but down from a one-week high of US$42,465 hit overnight.

Sycamore said Biden’s executive order outlining a whole-of-government approach to assessing the risks and benefits to crypto was very positive, as it eliminated a lot of regulatory uncertainty and confirmed the US was looking into a digital dollar.

But, “obviously bigger picture macro thematics still playing out in the background,” he said.

“Whether Ukraine and Russia can get anywhere near agreeing (on) terms for a peace deal is questionable in my mind and next week the Fed will start its rate hike cycle as inflation continues to steam higher.”

That two-day Federal Reserve meeting is set for Tuesday/Wednesday, and Fed chairman Jerome Powell made it clear in testimony to Congress last week that the central bank was likely to raise the federal funds rate by 25 basis points at the policy meeting.

‘Watershed moment’

Reviews were continuing to pour in for Biden’s overnight order and they were very positive.

Gemini exchange president Cameron Winklevoss called it a “watershed moment” that “paves the way for thoughtful national crypto regulation that will allow builders to build onshore and ensure that the US remains a leader in crypto — creating greater independence, choice, and opportunity for all.”

The White House and the Treasury had recognised the importance of a “coordinated and thoughtful national strategy on crypto,” Winklevoss added.

Messari crypto founder Ryan Selkis tweeted while the devil was in the details, having read the executive order in full, “it’s about as good as it gets”.

He added that crypto-critics Senator Elizabeth Warren and US Securities and Exchange Commission chairman Gary Gensler “were unsuccessful in inserting crippling language into the Biden crypto EO”.

Microstrategy founder and chief executive Michael Saylor tweeted that “regulation will accelerate the adoption of Bitcoin”.

I thought the order was overall optimistic, although with legislation, the devil is in the details.

As an American, I’m exceptionally excited that Biden is recognizing the importance of fostering the industry domestically.

— Jack Niewold (@JackNiewold) March 9, 2022

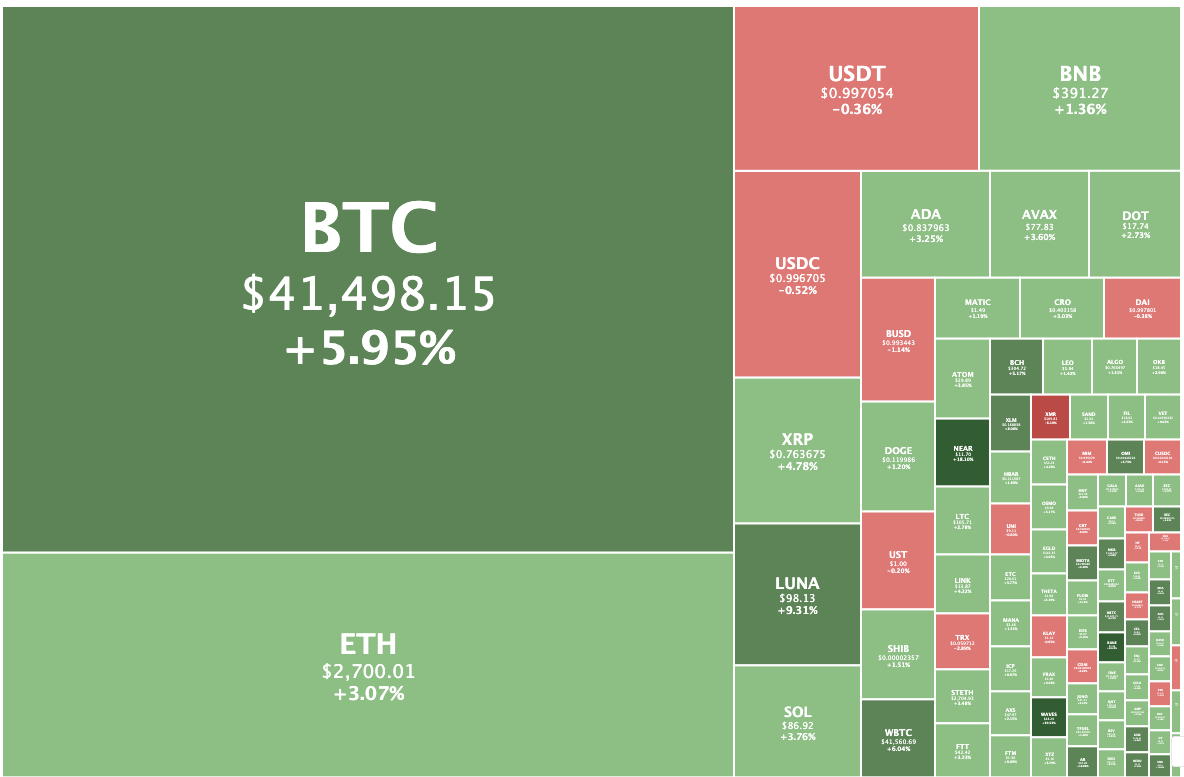

Crypto market up 5.6%

Overall the crypto market stood at $1.92 trillion, up 5.6 per cent in the past 24 hours.

Ethereum was trading at US$2,720, up 4.2 per cent from yesterday.

Terra (LUNA) was up 10.9 per cent to just under $99, and overnight had hit an all-time high of US$103.88 — the only top 20 crypto other than Cosmos (ATOM) to set a new record high this year.

Russian-linked crypto Waves was the biggest gainer again, climbing 31.4 per cent to a five-month high of US$29.39. Its value has tripled in the past fortnight, possibly because Russians are using it to get around sanctions and banking issues.

Are the Russians putting all of their cash & assets into $WAVES or why else is it pumping this hard.

Insane volume too. pic.twitter.com/xgWIEwlMYe

— Johnny (@CryptoGodJohn) March 9, 2022

Thorchain (RUNE) was up 29 per cent, Near Protocol rose 16 per cent and Synethix had jumped 12 per cent.

Monero was the biggest loser in the top 100 after yesterday’s pump, falling 6.1 per cent to US$189.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.