FTX ‘accounts drainer’ is moving Ethereum around again. Is ETH bound for $1k or below?

Getty Images

Whoever it is who drained the FTX accounts of 250k in Ethereum (more than US$275m) last week appears to be preparing to dump more ETH bit by bit. And the price of the asset isn’t loving it.

Ethereum, the crypto market’s leading “altcoin” and the no.1 smart contract platform, has been feeling some price pressure over the past few days as the FTX accounts drainer (some are referring to him or her as a “hacker”) sells large quantities of ETH on the open market.

The culprit managed to siphon almost US$447 million from several FTX global and FTX US exchange wallets not long after FTX filed for Chapter 11 bankruptcy on November 11. The majority of those funds were ETH, making the exploiter (or potentially corrupt FTX insider) the 27th largest ETH “whale” (bag holder).

According to various reports and posts across Crypto Twitter, the exploiter dumped 50,000 ETH on Sunday, which still makes them about the 37th largest ETH whale out there.

#FTX hacker decided that Sunday is a great day to dump his $250 mil in #Ethereum

His wallet: https://t.co/G9zDsfQkA5 pic.twitter.com/uoYGdmGnpr

— Duo Nine ⚡ YCC (@DU09BTC) November 20, 2022

And it appears they’re more bullish on BTC than ETH, as they’ve been moving out the latter to new addresses and swapping for renBTC, a form of “wrapped”, 1:1, version of BTC that lives and operates on the Ethereum blockchain.

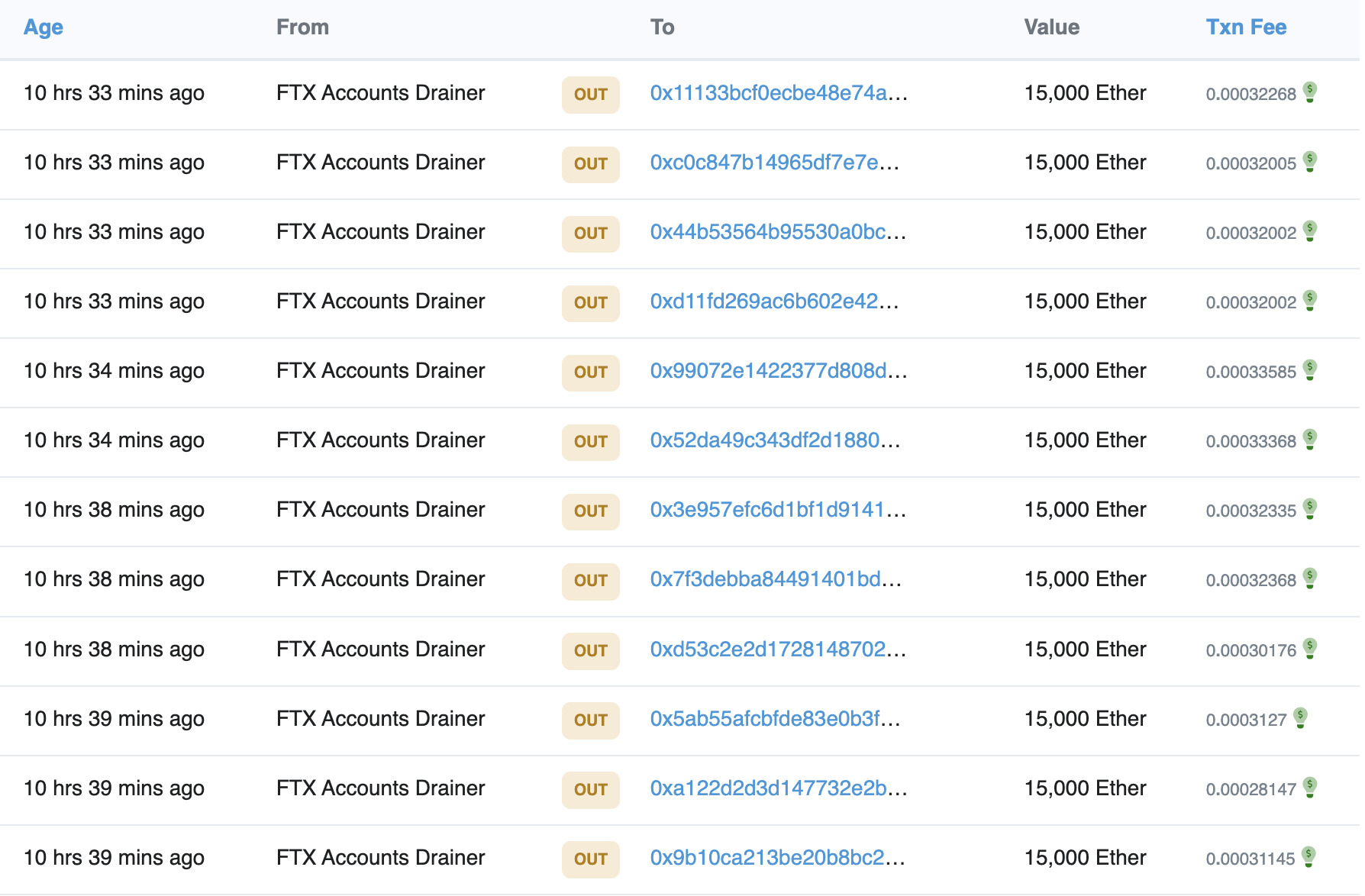

Possible ‘peel chaining’

As of today, it appears the FTX accounts drainer is moving more ETH around in preparation for further dumpage. According to a Cointelegraph report that cites Etherscan data, some 180,000 ETH has now been moved into 12 freshly created wallets, bringing the total amount moved in dollars to almost US$200 million.

As of about 17 hours ago, those funds have not moved from the 12 wallets (see below).

Reports and Crypto Twitter accounts are suggesting the FTX accounts drainer may be employing a crypto-based money-laundering technique known as “peel chaining” – essentially dividing the crypto into incrementally smaller amounts through a lengthy series of transactions. A laborious process but one that’s an attempt to throw investigators off the trail while the smaller amounts are transferred to fiat off exchanges or to other cryptocurrencies.

The beginnings of a peel chain. rookie mistake. #FTXhacker #FTX #StolenFunds #Crypto #Bitcoin pic.twitter.com/BZ1CCHyryG

— Richard (@IlIllIllllllIII) November 21, 2022

A mixing service such as Tornado Cash (now officially banned by the US Treasury) might also be an option for the “hacker” to attempt to obfuscate these funds.

Either way, this isn’t a particularly good sign for the short-term health of the price of Ethereum as large dumpage tends to beget panic selling.

The upshot of all this is that the second largest crypto by market cap could be in line for some further selling pressure until this particular part of the FTX storm blows over. The exploiter still has more than 200,000 ETH tokens all up, sitting in various wallets. And it doesn’t exactly look like the actions of a HODLer.

Seems like it's only a matter of time before $ETH makes a run at $1k.

I wouldn't be at all surprised to see it this week.#Ethereum pic.twitter.com/y52UYU6wJN

— Justin Bennett (@JustinBennettFX) November 21, 2022

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.