Former US treasurer gives Ripple Labs tactical support in XRP vs SEC stoush

Getty Images

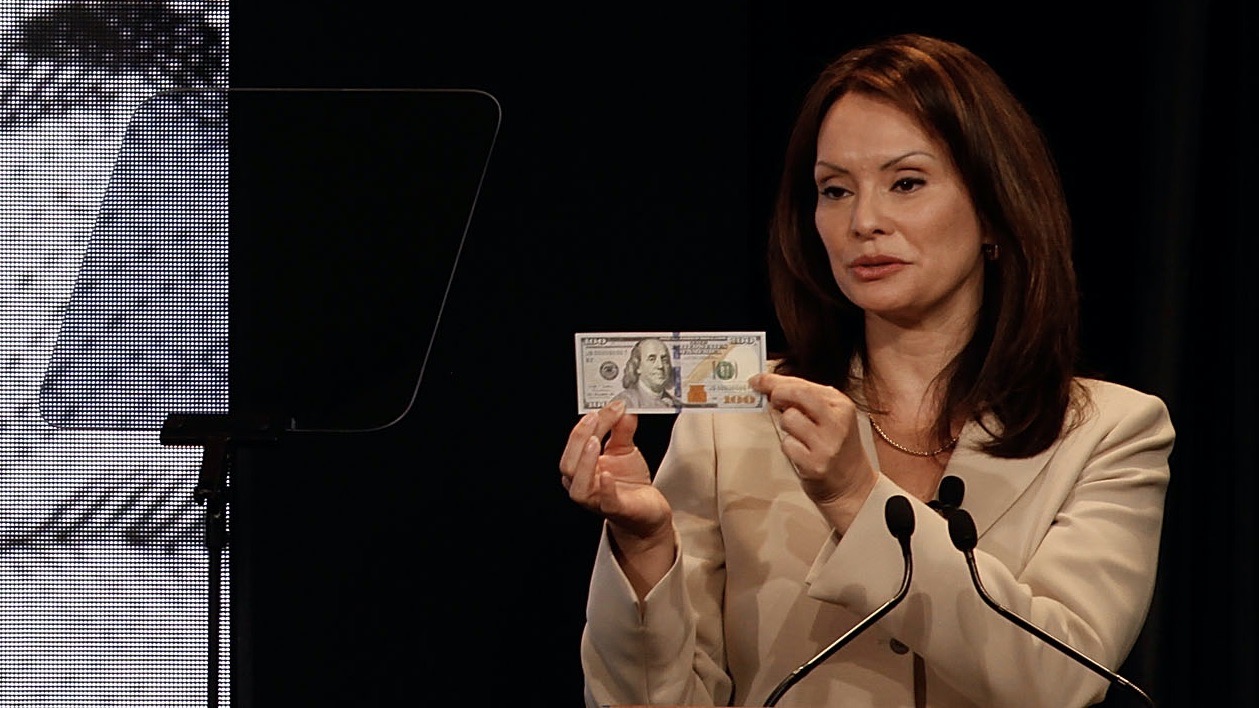

In the midst of Ripple Labs’ crucial lawsuit with the Securities and Exchange Commission (SEC), the founders of XRP have received words of support from a notable source – former US treasurer, Rosie Rios.

For the “XRP Army” (passionate XRP investors), this might not be surprising. The 43rd United States treasurer, who served in President Barack Obama’s administration for seven years until 2016, has been on the Ripple Labs board of directors since May.

That said, her latest comments have garnered some attention in the cryptoverse. While support for payments-solution crypto XRP is expected, some of her other comments have been polarising for the rest of the space.

Posting her thoughts on Twitter on September 26, Rios highlighted her belief that XRP has clear utility – facilitating cross-border payments – while taking a shot at “other cryptos”, which she said are purely speculative.

And that includes Bitcoin, judging by the hashtags on her tweet…

XRP’s primary purpose is facilitating cross border payments while other #Cryptos find their value in speculation. China’s latest move brings this point home. #Ripple #ripplenet #Bitcoin

— Rosie Rios (@RosieRios) September 26, 2021

Others have pointed out, however, the fact that Bitcoin, for instance, is now being used as a legal tender currency in El Salvador, and for lightning-fast cross-border payments to and from the US. (Although XRP proponents might be quick to remind that XRP has been able to do the latter for years.)

I watched a week ago, bitcoin doing cross border payment on the lighting network practically instantly at nearly free. If that is xrp’s primary purpose, why do we even still need it.

— Ghost Senshi 🌌📸 (@AbhLafiel) September 26, 2021

And further removing it from the realms of pure speculation, Bitcoin’s primary narrative as a store of value still holds true for many and gets stronger year on year… right, Michael Saylor?

While there’s no doubt most cryptos are indeed highly speculative assets, there’s an argument to be made that the tarring is being a little easily and loosely applied with a broad brush here. Top blockchains are brimming with utility, particularly Ethereum, with its broad ecosystem of decentralised finance and NFT transactions.

Rios received plenty of replies from those defending Bitcoin and Ethereum, in particular. To her credit, though, she backed up a day later acknowledging that other crypto developers are at least “pursuing” genuine use cases and utility.

Want to clarify that IMO. While Ripple is committed to the cross-border use case, developers globally everyday are pursuing other use cases, including store of value, medium of exchange, etc for multiple blockchains/cryptos.

— Rosie Rios (@RosieRios) September 27, 2021

A matter of security, and credibility

Just to recap, the SEC took Ripple Labs to court earlier this over its belief the firm has historically facilitated and profited from sales of an unregistered security. The commission claims XRP is most certainly a security.

Ripple, however, has always strongly denied that it has ever offered or sold XRP as an investment, and has stated in court that “XRP holders do not acquire any claim to the assets of Ripple, hold any ownership interest in Ripple, or have any entitlement to share in Ripple’s future profits.”

In the first of her two tweets, the former treasurer also referenced China’s latest crypto crackdown, which sent fear, uncertainty and doubt rippling through the crypto market late last week, from which it still seems to be attempting to recover.

Whether or not China’s reiterated crypto stance does somehow validate XRP’s cross-border payment utility and drive home the speculative nature of other cryptos, as per Rios’ tweet, is debatable.

But, from Ripple’s perspective, it’s a useful thing for someone with such clout, credibility and connections to highlight, as currency utility flies in the face of security classification.

The court case continues between the SEC and Ripple Labs. Its result, which we likely won’t get until well into next year, could have huge bearing on the crypto space and how cryptos are treated and regulated in the US.

The commission’s boss, Gary Gensler, is of the firm belief that the vast majority of cryptos are, in fact, securities and should fall under his regulatory body’s jurisdiction.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.