Fear and Greed: ‘That sucking sound’… crypto liquidity concerns analyst, but is BlackRock buying Bitcoin?

'Dude, Bitcoin sucks right now, sell everything,' said BlackRock. (Possibly.) Pic: Getty Images

The crypto market sentiment has officially turned fearful again, in case you weren’t already aware of that from the tumbling value of your crypto portfolio – if you have one*, that is.

(*Hopefully mainly BTC and ETH if you’re being the least “degen” you can about matters. Not financial advi… yada yada.)

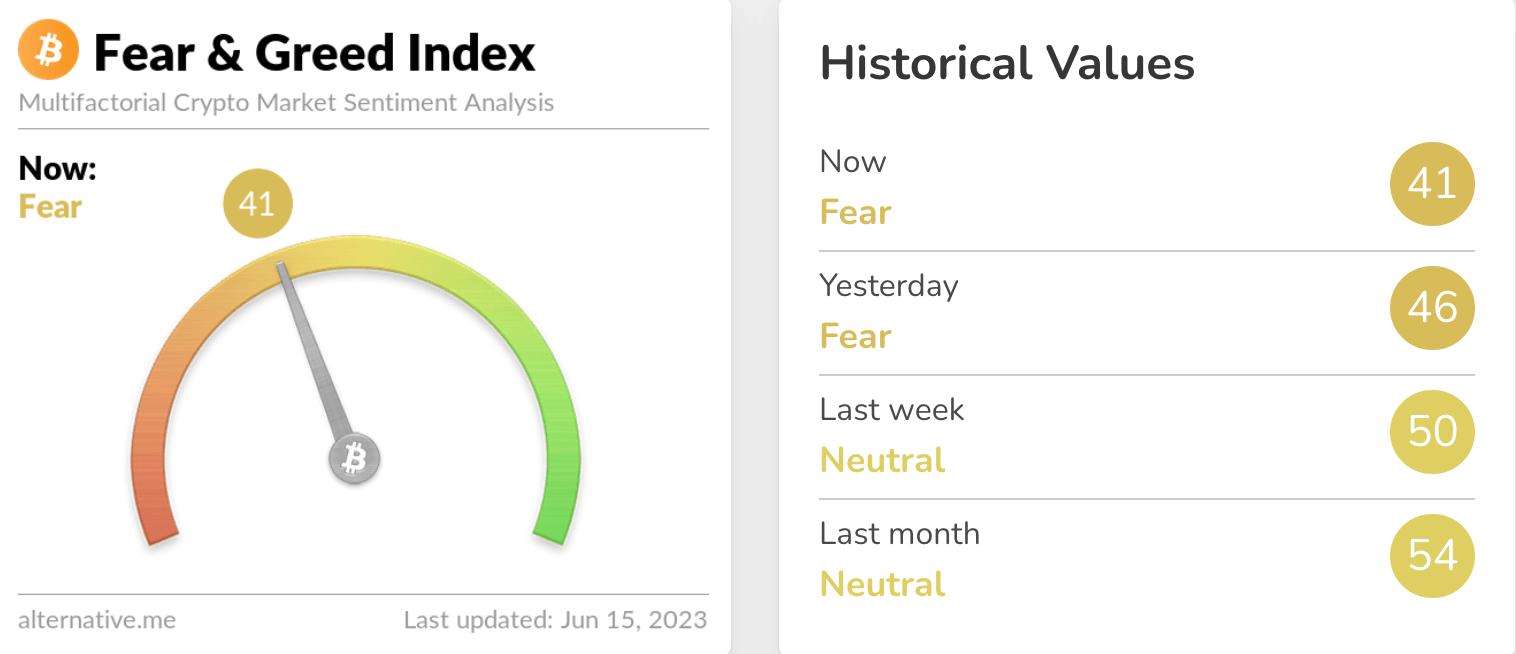

And when we say “officially”, we’re just really talking about the leading sentiment tracker for the industry – the Crypto Fear & Greed Index, compiled by alternative.me.

This indicator, which gathers its data from several different sources based on metrics including volatility, market momentum and volume, social media, Bitcoin dominance and trends, has tipped into Fear territory once again. That’s after sitting bang on the middle of the dial at about “Meh” level for a good few weeks.

For those who believe in loading up on risk assets when things are looking decidedly more blood orange than lime, then they’ll be hoping for further cracks in the market.

For the rest of us, we’re probably a little sick of “cracks in the market”, but the Fed seems set on making it thus as part of its grand, master plan before eventually opening the floodgates of liquidity once again. In the meantime, a little more pain, perhaps.

Here, by the way, is the index compilers’ thesis behind measuring fear and greed sentiment in the crypto market. As it notes… “crypto market behaviour is very emotional”. Truer words were never uttered.

‘It’s that sucking sound’: bearish Bloomberg analyst

We’ve referenced Bloomberg Intelligence’s senior macro strategist Mike McGlone’s Bitcoin and Ethereum analysis a number of times in the past in Coinhead. He’s largely stated a fairly bullish long-term case for the assets.

That hasn’t necessarily changed, but he’s certainly been pushing a shorter-timeframe bearish angle on the crypto market as a whole just lately.

And the main reason for that, he told crypto commentator Scott “Wolf of All Streets” Melker this week is that the high levels of interest offered on US Treasury Bills (T-Bills) is sucking liquidity away from crypto.

Referring to the common argument from crypto heads that fiat money is debasing and decreasing in value, McGlone noted:

“People always need to be reminded of when they point out that fiat currencies decline over time. Yes, they do. But they do pay you interest.

“Right now… you’re getting contracting liquidity and 5% guaranteed on a T-bill, a one-year bill, is hard to pass up. And it’s just that sucking sound of money… and also it’s the US government reissuing a lot of the debt it didn’t in the last few months.

“That’s just a giant sucking sound for liquid assets, risk assets, and what are the most risky? Crypto. So I just see this is a bear market tilting back down.”

Jeez, okay… what does “McGloom” think might do okay in the meantime, then? Gold. Which, of course, carries the safe-haven, store-of-value narrative that many a crypto investor believes in for Bitcoin, too.

Hey McGloom, something bullish? #Gold.

Gaining Momentum? #PreciousMetals Up, Base Versions Down – A long and variable lag from aggressive central bank easing is what it might take for industrial metals to stabilize lower and for precious ones to plateau higher. pic.twitter.com/WLJnQGGf0X— Mike McGlone (@mikemcglone11) June 11, 2023

McGlone also emphasised that the crypto market has never faced macro conditions like these in its short-ish history. He did concede to Melker, though, that he believes investors will look to reinvest in crypto after the market dips lower, amid recession, and once T-bill interest pays off.

“The key thing is there is that sucking sound. It’s what crypto has never had before. It never had a recession, a real recession,” said McGlone. “Never had the Fed tightening into deflating commodities and never had major competition from T-bills. Now they do.

“To me, it’s that sucking sound away from speculative digital assets in a bear market versus something where, ‘Hey, maybe I can lock up for a little while and be the one person to buy everything at a discount a couple years from now.’”

Just some food for thought on this… The curious whims and volatile trending of largely non-T-Bill-dabbling crypto market participants globally may prove to have very different ideas from McGlone’s outlook.

Continued US dominance on markets aside, developing crypto hubs in Asia and Europe (and even increasing Chinese-induced liquidity?) as well as regulatory clarity developing in those regions, could prove to be significant, market-moving wildcards.

BlackRock… quietly buying Bitcoin?

Meanwhile, we’re just going to leave this one here… BlackRock, which we know has been dipping it’s considerably large toes into crypto over the past year, has, according to these Twitter-based observers, been making some heavy Bitcoin-related moves very recently – in Q1 this year and possibly beyond…

https://twitter.com/Travis_in_Flint/status/1669019324621651968

Looking at the largest holders of MicroStrategy(MSTR) stock, we can see some big banks have been buying HUGE amounts of MSTR in Q1 2023!

Yes, that's the same MSTR that is the largest institutional holder of Bitcoin, owning 140K BTC, worth over $3B!

This makes us wonder…

— Sunny River (@sunnyriverr) June 14, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.