Fear and Greed: SEC chair thinks Proof-of-Stake coins are securities; CFTC boss labels The Merge a positive step

Getty Images

You’ve got no choice but to take the good with the bad as a crypto investor. And there’s often plenty of both on an hourly basis. US regulatory big dogs the SEC and the CFTC are bringing both sides of the coin today.

It’s a shared coin that has two heads – a forwards-looking bull on one side, and a snarling bear that looks weirdly like Gary Gensler on the other.

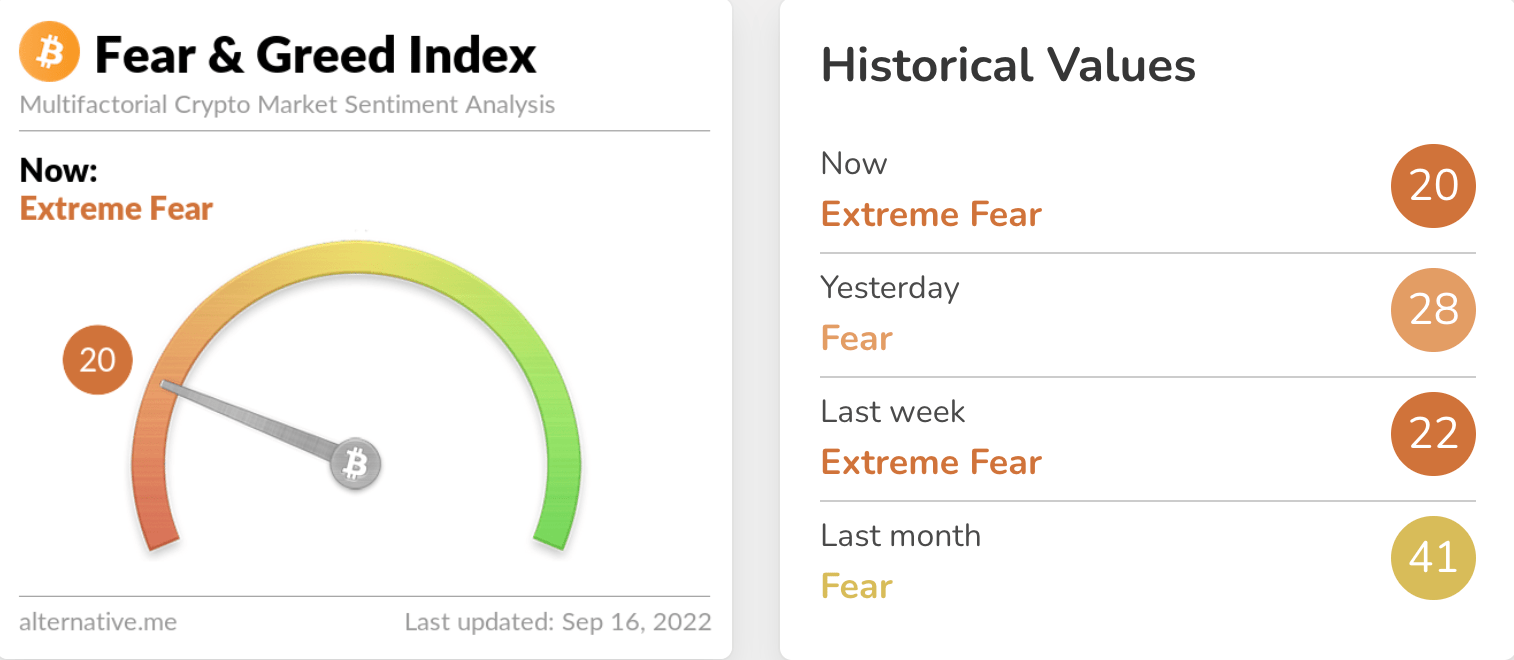

Before we get into that, let’s check in with the popular crypto-market sentiment tracker – the Fear & Greed Index.

Yep, and as suspected by probably many, post Merge hype, we’re back in Extreme Fear territory once again. We can’t blame it all on Gensler, but let’s talk about him and his SEC for a few minutes…

The US Securities and Exchange Commission chair (that’d be Gary Gensler) had the good grace to save his latest comments till fractionally after the Merge Day festivities. (Festivities that, as far as we can tell, pretty much consisted of sitting in front of computers waiting for the price of ETH to go down, and meme creation of dubious quality.)

Gensler, who looks a bit like a cross between Mr Burns, Voldermort and the undertaker character from an old Belgian comic book called Lucky Luke, has yet again rolled out his favourite topic when it comes to crypto. The topic possibly has a thick dossier labelled: If it Looks, Sounds, and Smells Like a Security, Then It’s Probably a Security.

Well, suppose it is his job to flag these things.

“Of these 10,000 crypto tokens … I believe that the vast majority are securities,” @SECGov Chair @GaryGensler told a U.S. Senate panel on Thursday, repeating a pro-oversight stance in the wake of @Ethereum’s transition to just such a method.https://t.co/eHzkFmh8Y6 pic.twitter.com/76x3E5GidR

— CoinDesk (@CoinDesk) September 15, 2022

This time, GG was specifically referring to Proof-of-Stake coins. The man is nothing if not extremely, topically, on point.

Speaking to reporters after the Senate Banking Committee on September 15, Gensler said that staked cryptocurrencies may be subject to federal securities regulations.

According to the Wall Street Journal, he reportedly said that cryptocurrencies and intermediaries that allow holders to stake (earn yield from) may see them defined as a security under what’s known as the Howey Test. And that’s a piece of long-faded red tape first dreamt up and employed about 80 years ago. Which is about how long it took The Merge to merge.

“From the coin’s perspective […] that’s another indicia that under the Howey Test, the investing public is anticipating profits based on the efforts of others,” Gensler reportedly said.

Nice use of the word “indicia”.

Gensler also said that intermediaries offering staking services to its customers “looks very similar — with some changes of labelling — to lending”.

The implications of Gensler’s comments are a little unclear at this point, although it would definitely seem like Ethereum and others of its PoS ilk (Solana, Cardano, Polkadot, for example) are well and truly back in the SEC’s crosshairs.

And the annoying and troubling thing about that for Ethereum is that the SEC has previously indicated that it views ETH more like a commodity, the way it sees Bitcoin (BTC) – according to a Cointelegraph article referencing the largely crypto positive US senators Cynthia Lummis and Kirsten Gillibrand.

Perhaps Gensler has never personally seen things that way about ETH. He’s been gunning for everything other than Bitcoin to be under the SEC’s purview for a little while now.

Why would this be bad? Gensler has a reputation for striking a particularly hard line of rhetoric on cryptos that aren’t Bitcoin – particularly DeFi. And the idea of a crypto-innovation-friendly America just seems in constant jeopardy while Gary Gensler is in the big regulator’s chair.

Why? Well, partly because the SEC has developed a penchant for suing (e.g. XRP) and threatening to sue (e.g. Coinbase) the crap out of crypto companies – some of which have have actually tried to settle with or comply with the agency regarding potential breaches of its strict security-law boundaries.

Gensler’s open invitation to crypto firms to “come in and talk” sounds about as inviting as a trap-door-standing audience with Jabba the Hutt.

The Merge is ‘a step in the right direction’: CFTC boss

Meanwhile on the same day, another US regulatory gaffer had a somewhat different take on Ethereum, The Merge, and crypto more broadly.

The CFTC is hoping to become the primary watchdog for the crypto industry in the US. Its chair, Rostin Behnam, who was speaking at a not-very-crypto-sounding hearing of the Senate Agriculture Committee, indicated that his agency is the right one to oversee the trading of digital assets.

“The volatility in the market, and its impact on retail customers – which may only worsen under current macroeconomic conditions – emphasises the immediate need for regulatory clarity and market protections,” said Behnam.

A US Senate bill is currently being pushed to create new rules for the crypto industry, and it would have the CFTC as the leading regulator of oversight. The bill apparently recognises “the CFTC’s expertise and experience” according to Behnam, making it “the right regulator for the digital asset commodity market.”

2/ What is the DCCPA?

The heart of the bill is a grant of exclusive jurisdiction over crypto spot markets to the CFTC.

This reflects a bipartisan, bicameral consensus that the CFTC is the right regulator for crypto. @CFTCBehnam made clear today that the CFTC is up to the task.

— Jake Chervinsky (@jchervinsky) September 15, 2022

“[The bill] would provide the authority to the CFTC to regulate markets. This volatility, the fraud, the manipulation — much of it would probably go away because we now have a regulator, a cop on the beat, and this would deter activity by bad actors,” added the CFTC boss.

As reported by CoinDesk, an aspect of the bill would see the agency examine the issue of high energy usage in crypto mining, though Behnam conceded the Ethereum Merge is a positive move.

“An event occurred last night with Ethereum that which is going to reduce energy consumption – a step in the right direction but certainly not resolving the problem,” said Behnam.

While that might not be an out-and-out ringing endorsement, at least it sounds quite a bit more open to potential flexibility than what the industry’s been getting from the SEC boss so far this year.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.