Fear and Greed: Bitcoin bulls and bears appear to be at a junction – big moves brewing?

Getty Images

Bitcoin and the broader crypto market are navigating fairly flat, calm waters at this moment in time. But there’s a something brewing, according to various analysts and blockchain analytics firms.

The question is, will it be a hard rain that falls upon the bulls or the bears in the market right now?

BTC is still up about 65% so far this year, making it one of the very best-performing major assets among any market in 2023. Is that the creation of a launch pad in progress for another multi-month moon mission? Or is it due another massive capitulation?

Let’s look at a few eye-catching theses and statistical nods from both camps…

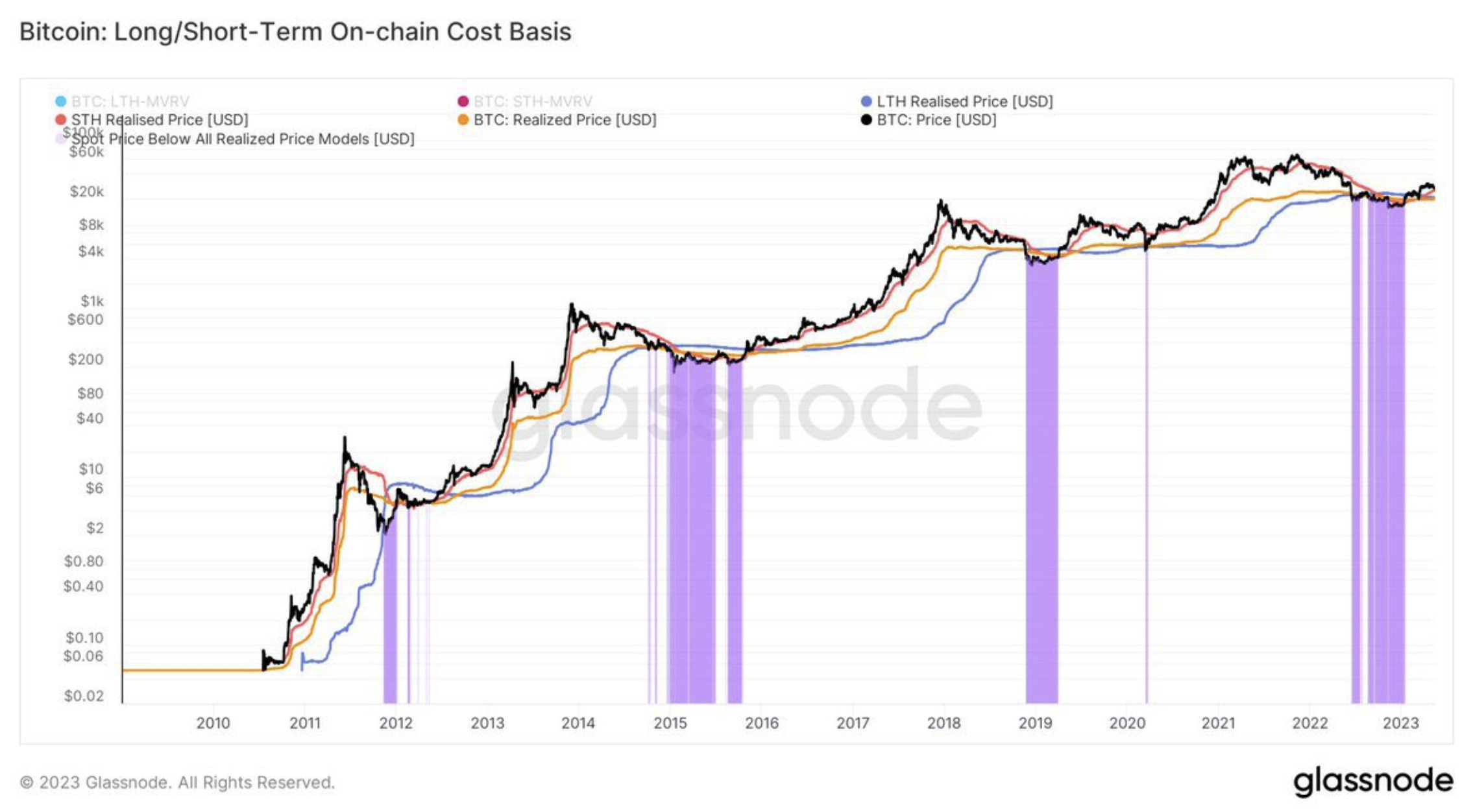

Bitcoin’s realised price – flashing bullish?

So here’s something of note, from the blockchain analytics gurus Glassnode and Blockware Solutions – as pointed out in this CoinDesk article earlier today.

The article and the two analytics firms reference the Bitcoin (BTC) “realised price” metric, which appears to be on the cusp of flashing a, historically, major bullish signal.

Bitcoin’s realised price refers to the the average value of all bitcoins at the price they were bought, divided by the number of bitcoins in circulation.

The firms are showing the metric up against the Bitcoin long-term holder realised price, which reflects the average price of the long-term holder (at least 155 days) BTC supply, valued at the day each coin last transacted on chain.

Confusing? You can dig into it more on various blockchain analytics firms’ sites (most are paid subscription sites, however), but the main takeaway for now is that the convergence of these two metrics, or the lines representing them on the chart below, is potentially very positive for the chances of a bull-market formation.

As this observer, @kat_brend notes, the thing that will give Bitcoin data bulls true hopium is if the realised price (orange line) moves above the LTH line (blue).

The next bullish #Bitcoin catalyst is for the realized price to get above Long Term Holder RP, less than an $800 difference now.

Interestingly enough, each time this flipping has occurred has happened mainly in June. pic.twitter.com/RiHJNhrxzR

— Kathleen Brendon (@kat_brend) May 16, 2023

This movement, which is rare, has preceded mega crypto bull-market activity in the past. Previous crossovers have occurred in September 2012, May 2016 and June 2019.

Bitfinex zooms out and sees a bull market forming

The influential crypto exchange Bitfinex (owned by Hong Kong firm iFinex, which also owns the largest stablecoin, Tether – USDT) has released its latest report on the market and it’s also seeing positive longer-term metrics.

“Long-term Bitcoin metrics suggest we could be on the cusp of an early bull market,” reads the exchange’s report, adding:

“Glassnode’s ‘Recovering from a Bitcoin Bear’ dashboard displays all eight indicators flashing green, historically a potent bullish signal for the Bitcoin market. Despite some short-term metrics suggesting a retracement, Bitcoin is trading comfortably above key pricing models.

Meanwhile, @glassnode’s "Recovering from a Bitcoin Bear" dashboard displays all 8 indicators flashing green, historically a potent bullish signal for the Bitcoin market 🟢

Do you think the #Bitcoin bull market is coming?https://t.co/1aVV2SbRkY

— Bitfinex (@bitfinex) May 15, 2023

Bitfinex also observed that Bitcoin is comfortably trading above its 200-Day Moving Average as well as its Realised Price level – further potent signs of the asset’s strength right now.

Furthermore, the exchange notes, the Bitcoin Realised HODL Multiple is on the up over the past 90 days. This apparently suggests that “USD-denominated wealth is moving back towards new demand inflows; indicating that even when profits are being realised, the market is capable of absorbing them”.

One more from the Bitfinex report… Smart Money movements.

Smart-money investors have apparently been primarily exchanging into stablecoins and Ethereum derivatives over the past week or so.

Smart money refers to highly experienced and institutional investors. Is that you? If not, hello Mr or Mrs Retail “Dumb Money” – get slightly uncomfortable and join the club.

The report does, however, give a nod to the short-term bears regarding this metric…

“Smart money allocating more of their portfolio into stables has historically occurred before pullbacks in BTC price. Thus, long-term on-chain indicators remain bullish and resemble early stages from the previous bull markets but short-term metrics suggest an upcoming pull-back.”

Which leads us to the following…

Did Pepe frenzy mark a local top?

In another update from widely followed (511k YouTube followers) crypto analyst Nicholas Merten, aka DataDash, he predicts an imminent altcoin plummet, pointing to the recent overheated state of the memecoin sector as a short-term market-cycle top.

“There is not much development going on right now. Nowhere near what we need for another bull market,” says Merten, who appears to have been fairly bearish on the market for a good month or two, judging by a quick sweep of his video thumbnails. “A brutal awakening is coming”, “The cold truth”, “The reality we need to face” – it all makes for fairly gloomy viewing.

In any case, gleaning further from his latest takes, he notes:

“And if Pepe wasn’t the sign here for you guys… I don’t know what is…

“If the only thing that is getting people excited in this period of time is a memecoin, which has been dumping here over the past couple of days… this is just abysmal for the industry… Speculation does not do well in contractionary environments.”

‘A fairly dull year?’

In the spirit of some further counter-balance, here’s another Crypto Twittering bull-run doubter for good measure…

By the way, we do acknowledge that it’s probably not completely fair or accurate to describe most analysts we reference as “bulls” or “bears”, but the very clever Benjamin “Into the Cryptoverse” Cowen, has certainly been down-playing expectations of late.

Here he is, predicting a “fairly dull year” in terms of Bitcoin and crypto’s price action for the rest of 2023 as the market moves towards the Bitcoin halving event around this time next year.

“I would expect a fairly dull year.”

📺https://t.co/vcrIMmHh4N pic.twitter.com/iOibiEZM0M— Into The Cryptoverse (@ITC_Crypto) May 16, 2023

Another savvy analyst is US crypto and forex trader Justin Bennett, who has also recently been on the more bearish side of the ledger. However, is he starting to swing the other way?

Some of these Tweets this week might suggest so… in which he sees the possibility of a BTC rally to somewhere near US$33k, before a potential pull-back from there…

Remember that USDT.D moves inversely to the crypto market.

— Justin Bennett (@JustinBennettFX) May 15, 2023

Haha yeah, that's the other thing… most of CT seems to have flipped bearish. That alone makes me hesitant to short.

— Justin Bennett (@JustinBennettFX) May 15, 2023

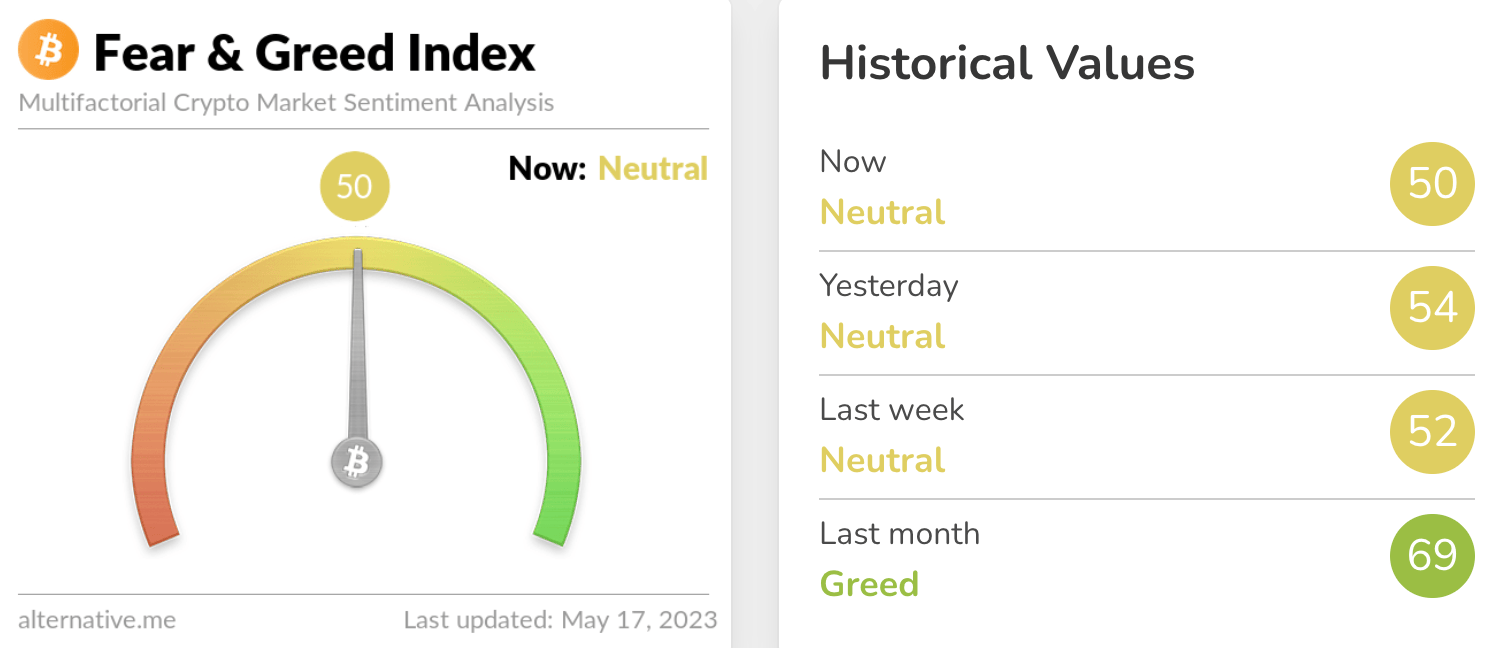

Fear & Greed

Finally, just what is the Bitcoin/Crypto Fear & Greed Index showing? Can it give an indication at the moment as to which camp might be winning the market sentiment battle?

Hmm… nope!

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.