DeFi projects post strong gains as Aave announces institutional lending platform

Picture: Getty Images

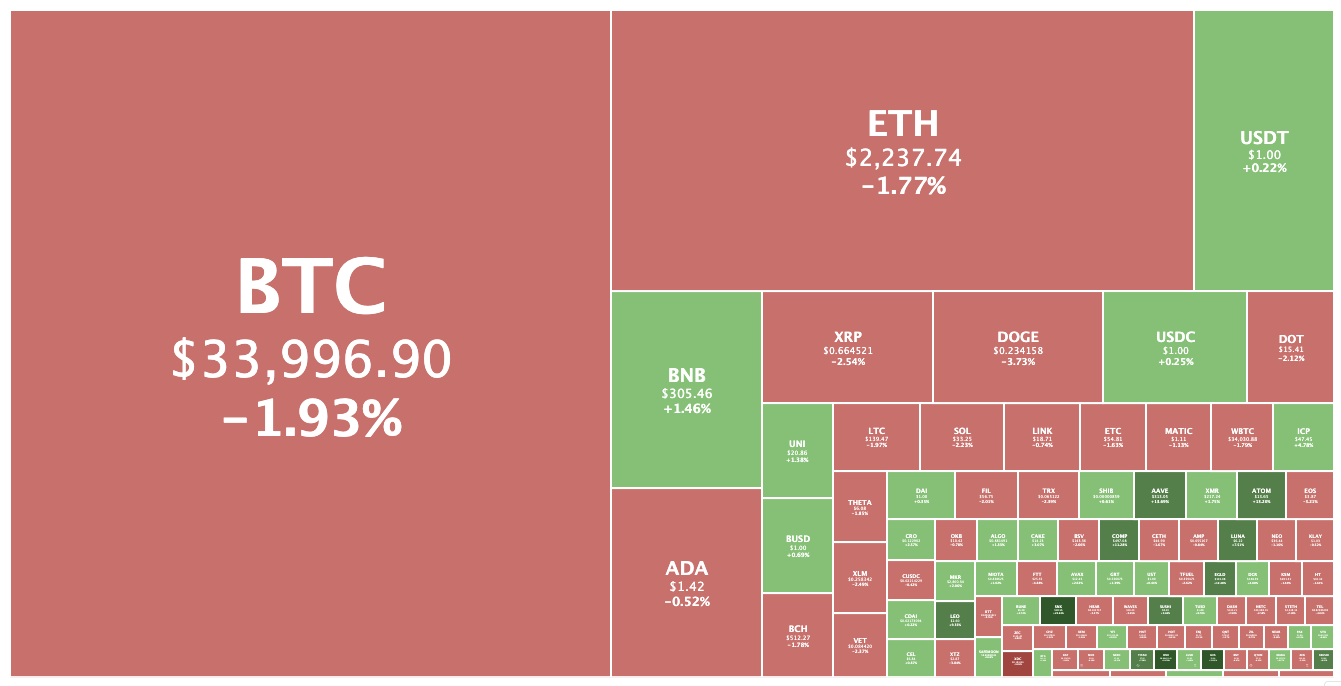

Defi tokens are gaining today even as the overall crypto market drops, with Synthetix, Aave and Compound all racking up double-digit gains, perhaps boosted by institutional lending coming to Aaave.

Synthetix, an Australian-founded derivatives liquidity protocol, was the third-biggest top 100 gainer this morning after being the top performer yesterday.

At 11am AEST, SNX tokens were trading at a one-month high of US$10.51, up 20.6 per cent from yesterday and up 50 per cent from a week ago.

The platform allows the creation of “synthetic assets” such as stocks and commodities that can be traded on the Ethereum blockchain. More than US$1.1 billion of total value has been locked in Synthetix as collateral.

Aave was up by 12.4 per cent to US$312 and competitor Compound up 10 per cent to US$496 after Aave said it would launch a permissioned version of its lending platform “due to extensive demand from various institutions”.

Aave Pro will launch this month with liquidity pools of Bitcoin, Ethereum, USDC and Aave, that only whitelisted Ethereum addresses that have conducted know-your-customer (KYC) protocols will be able to access.

Aave is the No. 27 token on Coingecko with a market cap of US$4 billion, and has US$16.5 billion in total value locked (TVL) on its platform.

The platform today was offering yields of 2.09 per cent on USD Coin deposits, while enabling simple collaterialised borrowing at a stable rate of 10.58 per cent or a variable rate of 3.17 per cent.

What people have yet to appreciate about Aave and Compound’s institutional products is that having doxxed institutional clients gives them an easy way to move into undercollateralized lending and credit markets.

— Noah Goldberg (@TraderNoah) July 4, 2021

Other defi projects Sushi, xSUSHI, Terra and TitanSwap were also all up, posting single-digit gains.

But overall the crypto market was down 2.1 per cent to US$1.47 trillion just before noon Sydney time, with both BTC and Ether edging lower.

Bitcoin was trading for US$33,970, down 2.1 per cent from yesterday, although up from a 24-hour low of US$33,329 at 3.50am AEST.

“Bitcoin is playing with everybody’s emotions,” wrote Bitcoin Charts. “We’re up then down, then down then up. But ultimately, we’ve remained range-bound from 30-42k. One thing that is definitely though is, there’s a move coming, and it’s going to be an explosive one.”

Overall the account was more bearish than bullish, and said their outlook would remain so as long as BTC remained below US$36,500 to $37,500.

Eth was changing hands for US$2,232, down 1.9 per cent from yesterday.

KuCoin Token was the biggest top 100 gainer, up 31.2 per cent, while XDC Network token was the worst loser, falling 9.1 per cent.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.