Cryptos rise on Powell speech, ahead of US inflation report

Getty Images

Bitcoin has hit a five-day high, rising along with equities, after US Federal Reserve chairman Jerome Powell’s testimony before Congress contained no major surprises.

The Fed chair told a US Senate committee that the American economy was ready for higher monetary policy and rate hikes, which the market has been expecting.

The Dow Jones closed up 0.5 per cent, the tech-heavy NASDAQ climbed 1.4 per cent and at lunchtime (Sydney) BTC was trading for US$42,792, up 2.5 per cent from yesterday.

Jurrien Timmer, director of global macro strategy at Fidelity, tweeted that Bitcoin was technically oversold and had found strong support at US$40,000.

All in all, these charts tell me that Bitcoin should have both technical and fundamental support at $40k. It doesn’t mean it can’t go lower, but it looks like $40k is the new $30k. /END

— Jurrien Timmer (@TimmerFidelity) January 11, 2022

All eyes tonight will be on the US Consumer Price Index data readout for December, to be released at 8.30am EST on Wednesday (12.30pm on Thursday, AEDT), which is expected to come in at a red-hot seven per cent – a 40-year high.

Inflation is expected to have hit 7.1% in December, will be confirmed on Wednesday.

Yeah, I guess the runaway inflation means it is time to sell off your inflation hedge… lol #bitcoin

— Lark Davis (@TheCryptoLark) January 10, 2022

When the US Bureau of Labor Statistics reported in November that consumer prices had surged by an annualised 6.2 per cent the month before, Bitcoin briefly spiked to an all-time high before correcting. The December 10 announcement that consumer prices had rose 6.9 per cent in November also led Bitcoin quickly soaring by US$1,000.

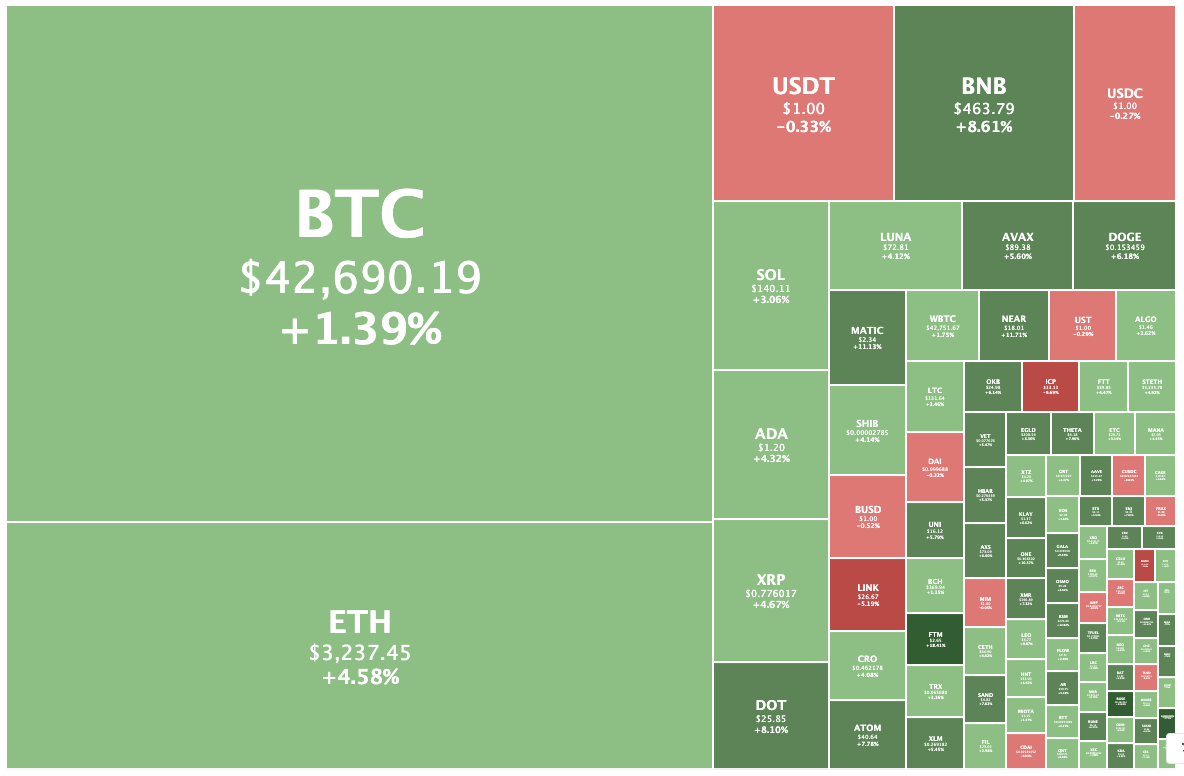

Crypto market up 3.8%

Overall the crypto market was at US$2.12 trillion, up 3.8 per cent from yesterday.

Ethereum was up 4.6 per cent to $3,240.

Oasis Network was the biggest gainer in the top 100, rising 23.6 per cent to 46.3c.

Fantom and Safemoon were both up around 18 per cent.

Near Protocol was up 11.7 per cent to $18.01, after hitting another all-time high yesterday, of $18.19.

Internet Computer was the biggest loser, down 9.7 per cent to US$33.13.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.