Mooners and Shakers: We don’t wanna jinx it, but 2023’s off to a pretty good start for crypto. Mostly.

Pleeeeeeeeeeze be good news. Pic via Getty Images.

Morning Coinheads… Rob “Now You See Me, (You Know The Rest)” Badman is currently out of the office, so you’re stuck with me again for a little while. Fret not – Rob’ll be back. Eventually. I hope.

In the meantime, let’s get down to brass tacks, because it’s been a relatively industrious weekend in crypto, following a really positive start to the year for most of the majors.

After the unrelenting horrorshow that was 2022 (and 2021…), this year is – touch wood – off to a good start for the top end of the market makers.

(As I write this, I have all of my fingers and all of my toes crossed that by being positive about how it’s all going, I’m not about to send it all into the sh-tter… I promise.)

The past 24 hours, though, things have been a little… slow. At the time of writing, BTC is flatter than a punctured Pirelli, as is Doge. ETH is up, but barely – running at +0.4% since this time yesterday.

But looking at the 7-day figures, there have been some impressive movements – BTC gained 2.5%, ETH piled on 6.2% and even beleaguered XRP added 0.5%.

The clear winner, however, has been Solana… after taking what was looking perilously like a one-way trip to Toilet Town, this past week has seen an enormous recovery. It’s currently up a neck-snapping 38.0% for the week, and 4.3% since yesterday.

It’s pretty safe to say that Solana can thank BONK for that – the Solana-based Doge defier has breathed new life into its blockchain token, and itself gone soaring some 43% since it was airdropped to creators, developers, and NFT holders.

And this morning, there are a couple of absolutely ludicrous 24-hour gainers – but you’ll have to read the whole thing (or just scroll down to the tables below…) to find out what’s gone screaming overnight.

In the meantime, here’s a quick look at the headlines…

I had a dream the other day that the FTX thing would stop being in the news

As with all fabulous dreams, I was shattered when I woke up to find out that my subconscious mind had been doing some serious wishful thinking… because I know I’m not alone in wishing that this entire FTX debacle would stop dominating the news cycle.

Yet, here we are, uttering the same horrid acronym that is no doubt still bringing shudders of despair and probably rage to a large number of people who took a bath when the whole thing went bang.

However, since posting 67-page manifestos on forums and message boards about how badly you got Liberace’d is highly likely to get you onto the kind of list that you really, really don’t want to be on – and reading those manifestos is the stuff of nightmares – there’s a new avenue for you to keep abreast of what’s the haps in terms of FTX and the US courts.

And it’s thanks to US authorities! That’s right… the US Feds have built a website for anyone who is among the approximately 100,000 creditors that are owed money by FTX to stay in the loop with what’s happening.

The number of people who are actually impacted is still up for debate – and that 100,000 creditors figure doesn’t include users of its crypto exchanges, FTX and FTX US.

With those people also included, the number swells to an estimate 1 million-ish – and, according to some very handy research by coingecko.com, Australians make up around 2% of the traffic to the exchange’s website… so we know at least some of you will want to know what’s going on.

As Decrypt reports it, “In criminal cases, prosecutors are required to notify victims ahead of plea or sentencing proceedings and allow them enough time to give testimony if they want to be heard.”

Prosecutors have, quite sensibly, argued that individually informing the 1 million or so people that are into FTX for some sizeable quantities of cash would be a ludicrous undertaking – and the judge overseeing the case, US District Judge Lewis Kaplan, agreed.

So – US authorities now have a website for everyone to visit to read about what’s happening and put their name (we assume) on a list of people who want to have their say about what’s happened.

You can find it here – we’d publish the URL visibly, but for some reason it’s a tediously long and imminently forgettable page on a very official-looking lawyery-justicey boring-boring website.

Yet another tech company has dumped a bunch of staff

Meanwhile, more folks that were happily employed and doing crypto / NFT related things in order to pay the rent have found themselves on the ever-growing list of people who used to have jobs doing crypto / NFT related things.

Coindesk is reporting that NFT marketplace SuperRare has gone on a firing spree, losing 30% of its workforce in a bid to stay afloat in what is turning out to be a very difficult pond to be swimming in.

A memo from SuperRare CEO John Crain did its very, very best to put something of a positive spin on it – including the utterly horrifying attempt to redefine the mass sacking as “rightsizing”, rather than “downsizing” – but the end result is that the start-up began to look like a wind-up after they hired too many people and tried to grow too fast.

You can read Crain’s memo here:

I have some tough news to share: pic.twitter.com/iLDKqgyhQa

— SuperRare John (@SuperRareJohn) January 6, 2023

… see? Horrible. Just horrible. At what point did the cool’n’funky start-up scene start sounding like gross’n’grotty corporate America? Did I miss a memo?

Anyway… it is super-unlikely that SuperRare will be the last big name to take an axe to the roster – and it’s joining a rapidly growing list of companies that are hitting the jettison button to get rid of pesky things like “workers” who “cost money” – but anyone who lived through the bursting of the dotcom bubble knows that this is just the way this sector works.

Those of you who weren’t around for the dotcom collapse… let’s just say it was hugely unpleasant and not worth revisiting, and leave it at that.

According to CoinDesk: “Beginning in April, several global crypto exchanges reduced their headcount, with Coinbase laying off 1,1000 employees in June. Shortly after, top NFT marketplace OpenSea laid off roughly 20% of its staff, followed by cuts from crypto brokerages, trading firms, payment processing companies and Web3 gaming studios.

“In November, Meta Platforms (META) slashed more than 11,000 jobs – an estimated 13% of its workforce – across its apps and Reality Labs segments,” Coindesk continues.

Top 10 overview

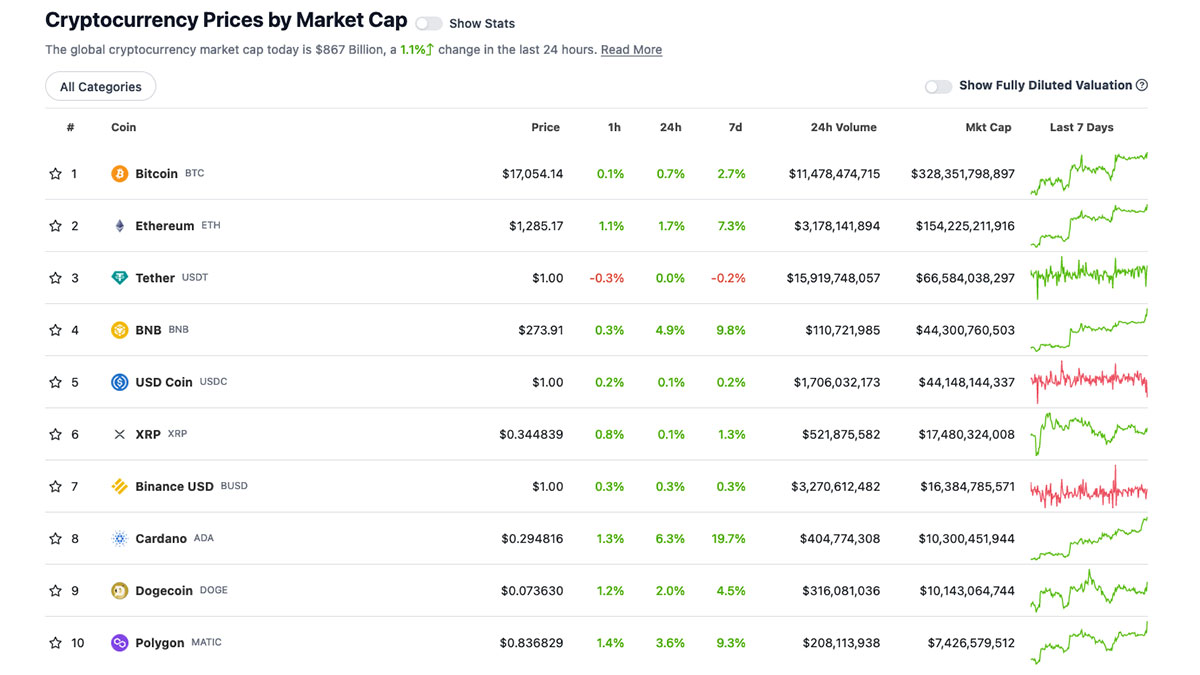

With the overall crypto market cap at US$867 Billion, up 1.1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

DAILY PUMPERS

- Lido DAO (LDO), (mc: US$1.66 billion) +34.6%

- Zilliqa (ZIL), (mc: US$371 million) +23.5%

- The Graph (GRT), (mc: US$524 million) +10.7%

- Frax Share (FXS), (mc: US$411 million) +10.6%

- The Sandbox (SAND), (mc: US$789 million) +8.9%

DAILY SLUMPERS

- GMX (GMX), (market cap: US$335 million) -2.4%

- OKC (OKT), (market cap: US$466 million) -1.5%

- OKB (OKB), (mc: US$6.65 billion) -0.7%

- Cronos (CRO), (mc: US$1.56 billion) -0.6%

- LEO Token (LEO), (mc: US$3.24 billion) -0.1%

(Stats accurate at time of publishing, based on CoinGecko.com data.)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.