Mooners and Shakers: Move over Home and Away… crypto’s got its own soap opera today

Admit it... it's kinda fun watching the drama unfold. Pic via Getty Images.

Mornin’ Coinheads, and welcome to hump day! Crypto markets have been a bit busy overnight, but this time it’s good news – a quick look over the top 10 today is showing a sweeping field of lovely green.

BTC is up 1.1%, ETH is up 1.5% and even recent candidate for World’s Shakiest Asset, XRP, has had a decent run over the past 24 hours, adding 0.4%.

The wind appears to have come out of Solana’s recovery, however – it’s dropped 1.6% since this time yesterday, but remains 21.3% higher over the past 7 days.

The most alarming (or amusing, depending on your take on the situation) this morning is the performance of the long-awaited Flare Network’s token (FLR), after more than 4.28 billion FLR tokens were finally delivered to XRP holders who held at least one token during a snapshot in December 2020.

After waiting for more than 2 years for their FLR to arrive, users promptly dumped pretty much the lot of it on the market, and it’s plummeted. Badly.

Over the past 24 hours, FLR value has sunk more than 70% – not exactly the vote of confidence the blockchain protocol developer was hoping for.

Let’s take a deep-ish dive into some news before my morning coffee wears off.

Coinbase punts another 950 staff.

The world’s largest crypto exchange, Coinbase, has undergone yet another round of belt-tightening, which has put 950 more of its employees on the tech industry scrapheap – just seven months after it slashed 1,100 from the company head count as it tries desperately to stay afloat.

The move came after the company’s CEO Brian Armstrong said that he’s pushed to reduce operating expenses by 25 percent quarter on quarter, after the Crypto Winter and rampant inflationary issues piled bruise upon bruise for investors.

The latest round of cuts equates to around 25% of the Coinbase headcount, as per the figures on the company’s website – despite Armstrong’s claims that the company remains “well capitalised”, and his belief that “crypto isn’t going anywhere”.

I’m sure he meant that last bit in a positive way.

In a statement, Armstrong also said that Coinbase must “make sure we have the appropriate operational efficiency to weather downturns in the crypto market and capture opportunities that may emerge”.

And that, naturally, means stripping out employees to reduce operating costs – with the company promising to help those affected by the job losses to transition into new roles somewhere else, and comply with all local laws… but whether that is going to be much more than a “here’s your hat, what’s your hurry” for staff being ushered out the door remains to be seen.

It’s Gemeni v Genesis as spat gets a public airing. Again.

50% of the Winklevoss twins are back in the headlines again, this time after CEO and co-founder of Gemini Cameron “The One on the Left” Winklevoss went public with some pretty serious allegations against crypto broker Genesis and its parent firm Digital Currency Group (DCG).

Some backstory here: DCG platform Genesis served as Gemini’s primary lending partner – but it now owes users of Winklevoss’s high-yield savings product Gemini Earn $900 million… the same users that were promised up to 8% annual yield by Gemini.

According to a public statement by WInklevoss, DCG has been up to no good, alleging that “Genesis and DCG, including CEO Barry Sibert and other “key personnel,” conspired to make false statements and misrepresentations to Gemini, investors, and the general public about Genesis’ financial health”, according to Decrypt.

Earn Update: An Open Letter to the Board of @DCGco pic.twitter.com/eakuFjDZR2

— Cameron Winklevoss (@cameron) January 10, 2023

You can read the whole letter at that link, but in a nutshell, it says that Genesis loaned now-defunct hedge fund Three Arrows Capital (3AC) a hefty $2.36 billion worth of assets, which 3AC used to go spectacularly broke in June 2022.

The 3AC collapse left Genesis / GCD exposed to a $1.2 billion hole on its loan book, and – Winklevoss claims – Sibert and his crew lied about what they’d done to fix it.

There’s a bunch of other very complicated Crypto Soap Opera drama in there as well, something about a $1.2 billion promissory note that DCG (allegedly) claimed was an asset when it couldn’t possibly one… it goes on and on.

But the gist of it all is that Gemini reckons that everything at Genesis and DCG stinks, and to prove how much they think it stinks, Winklevoss wrote his scathing letter and put it Twitter for the world to see. Just like a proper grown-up would.

Episode 2: Sibert Fires Back

Annnnd, predictably enough, DCG boss Barry Sibert has responded to Gemini, calling the open letter from Cameron Winklevoss a “desperate and unconstructive publicity stunt … to deflect blame from himself and Gemini”.

This is another desperate and unconstructive publicity stunt from @cameron to deflect blame from himself and Gemini, who are solely responsible for operating Gemini Earn and marketing the program to its customers.

— Digital Currency Group (@DCGco) January 10, 2023

Sibert, via a standalone website, also penned his own open letter, outlining his version of events as to how the whole Genesis / 3AC / DCG thing went down, and his own take on the role that the $1 billion promissory note was, and continues to play on the books and in the debt that Gemini says DCG still has to cough up.

Predictably enough, the public back’n’forth has drawn some deep divisions among the wider crypto community, with supporters of each side of this debacle shouting into the swill bucket of Twitter with their own opinions on who’s right, who’s wrong and why everyone who doesn’t agree with them is a massive diaper-baby.

Which seems to be the way of the crypto world at the moment – so much drama, so little time to sit and process it all, as it just gets murkier and more confusing the deeper anyone seems to dig into it.

If only there was some weirdly apt piece of music that would act as a soundtrack to the whole tawdry drama…

Oh wait… There is!

Here’s Genesis, with Land of Confusion.

Enjoy the tune, here’s today’s crypto charts – and I’m going for a lie down.

Top 10 overview

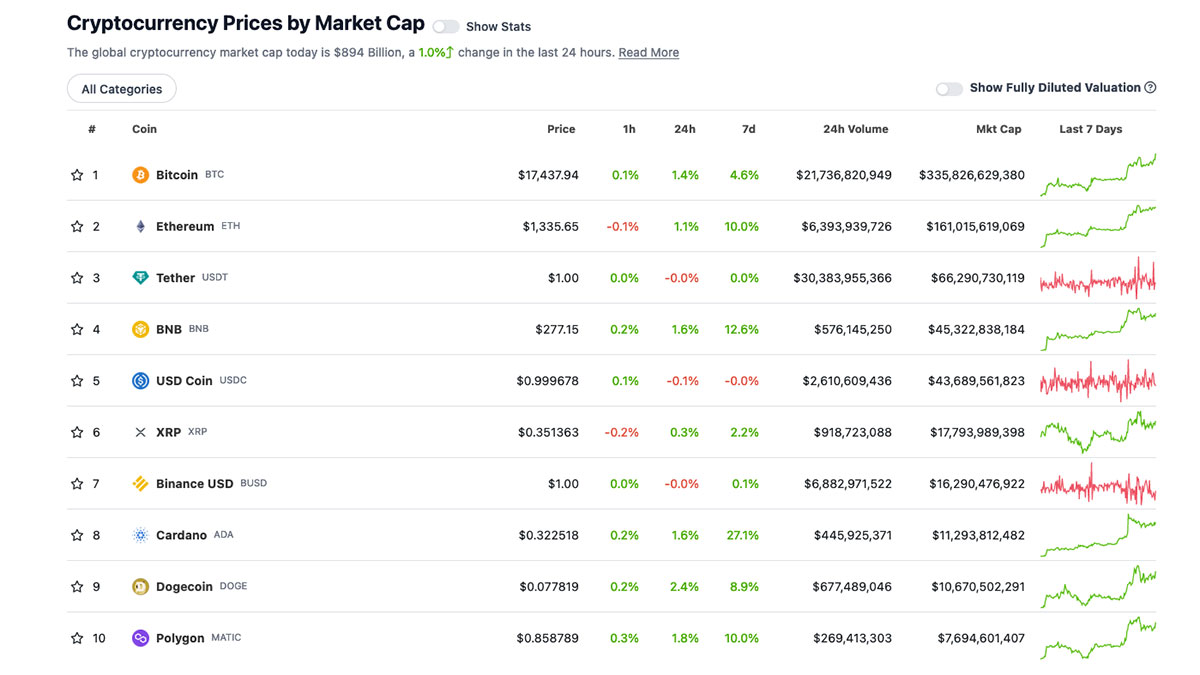

With the overall crypto market cap at US$894 Billion, up 1.0% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

DAILY PUMPERS

- Shiba Inu (SHIB), (mc: US$5.48 billion) +5.8%

- Apecoin (APE), (mc: US$1.79 billion) +5.0%

- Aptos (APT), (mc: US$717 million) +5.6%

- GMX (GMX), (mc: US$373 million) +4.6%

- Chiliz (CHZ), (mc: US$643 million) +4.0%

DAILY SLUMPERS

- Flare Network (FLR), (market cap: US$496 million) -71.7%

- Toncoin (TON), (mc: US$3.14 billion) -4.2%

- XDC Network (XDC), (market cap: US$357 million) -2.1%

- Frax Share (FXS), (mc: US$395 million) -1.8%

- Solana (SOL), (mc: US$6.00 billion) -0.8%

(Stats accurate at time of publishing, based on CoinGecko.com data.)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.