Mooners and Shakers: It’s bailouts and Alameda zombie wallets as far as the eye can see

We're gonna need a few more buckets, Mr Novogratz. Pic via Getty Images.

Gooood morning Coinheads!

Rob “Two Tickets to the Bahamas Please” Badman is still enjoying his well-earned Christmas break, so you’re stuck with me again for this morning’s wrap-up.

It’s not been an ideal 24 hours for most of the majors. Both BTC and ETH have been in a bit of a post-Christmas funk, and overnight both of them dipped a little too sharply for my liking.

They really need to have a long, hard think about what they’ve been doing, and lift their game – or it’s no Xbox for a week… Because I said so, that’s why.

Arguably the most alarming news this morning is that while the rest of the market appears to be holding steady, Solana – once a market darling – looks like it’s sustained a cut to a vital piece of arterial infrastructure, because the bleeding just doesn’t seem to be stopping.

Solana’s trading at less than US$10 for the first time in about 2 years – at one point as low as US$9.54 – and it’s down 12% over the past 24 hours and more than 20% lower over the past 7 days, well beyond the movements of the rest of the majors in the market.

And on that not-bright note, let’s find out what the crypto world is gossiping about this morning together, shall we?

Oh goody. We’re still talking about FTX.

The “mysterious” hack that took place on the FTX exchange shortly after the company filed for Chapter 11 Bankruptcy in the US has caught the eye of Department of Justice investigators.

For those not quite in the know, this is the part of the FTX shitshow where “someone” helped themselves to about US$650 million worth of crypto from the exchange, at a time when withdrawals were frozen and everyone was losing their minds

The stolen coins were moved to other wallets, changed into other coins, yada yada yada – the usual moves for someone trying to hide stolen money. But the Feds say they’ve been able to track, and freeze, some of the money.

And by “some of the money”, we mean “a minute fraction of it”, because it’s crypto and all super-anonymous and decentralised and all that magic-magic stuff.

Curiously, though, Decrypt is reporting that against the backdrop of that investigation – and we’re (mostly) not saying that the stolen money and what’s happening at the moment are linked – a few wallets associated with Alameda Research, FTX CEO and all-round massive boofhead Sam Bankman-Fried’s trading firm, have “sprung to life”.

Th reason that’s weird is that everyone who’s meant to have access to those wallets isn’t meant to be touching them, because they’re all a little bit busy trying desperately to avoid being sent to PMITA Money Jail for whatever role they might have played in SBF’s Great FTX Train Robbery.

According to Martin Lee, a data journalist at Nansen, various Ethereum-based tokens have been consolidated into two main wallets, which were later swapped for Ethereum (ETH) and Tether (USDT).

1/ Lots of activity going on among Alameda wallets in the past 6-7 hours

Various tokens on ETH being consolidated into 2 main wallets

Swapped to ETH/USDT (USDC to USDT too)

USDT thn swapped to ETH

Sent to multiple wallets and thn to FixedFloat/Changenow

Source: @nansen_ai pic.twitter.com/NfTe9CoY9K

— Martin Lee | Nansen (@themlpx) December 28, 2022

It’s not a huge amount of funds – probs around US$100,000 or so – but the fact that it’s being moved at all is likely to raise the hackles, if not the ire, of investigators as they wade through the numbers and try to decide exactly how badly boned SBF is going to be when his case turns up in court again.

Argo avoids bankruptcy after Galaxy Digital Bailout

Meanwhile, Bitcoin miner Argo Blockchain has managed to put a halt to its ominous circling of the drain, thanks to a Hot Cash Injection in the form of a US$100m Bailout From Novogratz’s Galaxy Digital.

Coindesk is reporting that the bailout is a two-parter: Argo will sell off its Helios mining facility in Dickens Country, Texas, to Galaxy Digital for $65 million, and get access to a US$35 million the Michael Novogratz-driven financial company to sweeten the pot – and keep the literal wolves from the door.

It’s a bold move from Novogratz, apeing into a facility in Texas, where the power supply is iffy at best, and the guy responsible for it – Texas Governor Greg Abbott – is far too busy committing what amounts to gross and pathetic federal human trafficking violations to bother with making sure the lights stay on in the Lone Star State.

The deal also includes an arrangement that will allow Argo to lease back space at the Helios facility to allow it to keep mining at the site, which has up to 180 megawatts worth of power capacity.

There’s no word on whether Galaxy, which will now be using Helios as its flagship mining facility, will continue with Argo’s original plans for expansion at the site, which would have seen Helios reach 800 megawatts of energy consumption and 20 exahash/second of computing power.

Helios will, however, be the second major mining operation under the Galaxy umbrella – and another step in Novogratz’s well-timed spending spree, after the investor has successfully swooped like a seagull on the bucket of dropped hot chips that crypto has become.

Galaxy recently snapped up crypto self-custody platform GK8 from bankrupt crypto lender Celsius Network at a price that is “materially less” than what Celsius paid for GK8 a year ago – and as more and more start-ups and others simply run out of funds as the market gets squeezed ever-harder, it’s the guys like Novogratz who are most likely to make out like bandits as the bargains start to pile up around them.

Top 10 overview

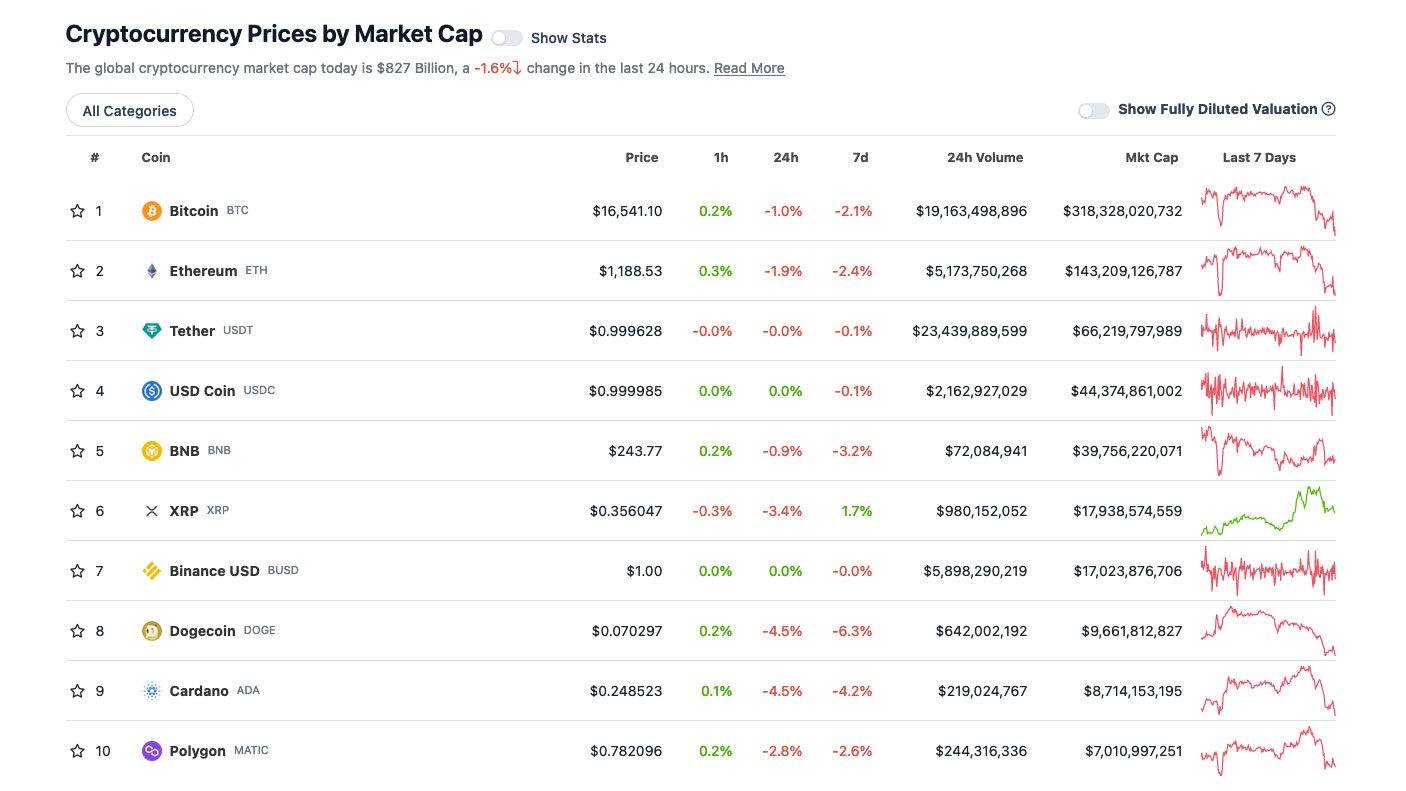

With the overall crypto market cap at US$827 Billion, down 1.6% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

DAILY PUMPERS

- Internet Computer (ICP) , (market cap: US$1.11 billion) +3.5%

- Tether Gold (XAUT), (mc: US$442 million) +2.7%

- Monero (XMR), (mc: US$2.66 billion) +0.9%

- Gemini Dollar (GUSD), (mc: US$580 million) +0.1%

- Pax Dollar (USDP), (mc: US$874 million) +0.1%

DAILY SLUMPERS

- Terra Luna Classic (LUNC), (market cap: US$879 million) -14.0%

- Solana (SOL), (market cap: US$3.59 billion) -12.1%

- Aptos (APT), (mc: US$419 million) -10.4%

- Toncoin (TON), (mc: US$2.87 billion) -9.6%

- Tokenize Exchange (TKX), (mc: US$504 million) -6.8%

(Stats accurate at time of publishing, based on CoinGecko.com data.)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.