Crypto Espresso: Imagine the shame of making an NFT using right-clicked images

Back in my day, we had to leave the house to steal other people's art. Pic via Getty Images.

Morning Coinheads…

It’s post-World Cup Monday, and we’re feelin’ the pinch a little at this end, so this morning’s just a quick round-up – Crypto Espresso-esque style – for you while we chug industrial quantities of coffee and energy drinks and brain pills and whatnot, and wonder why the whole Earth is shaking.

Or is it just our eyes?

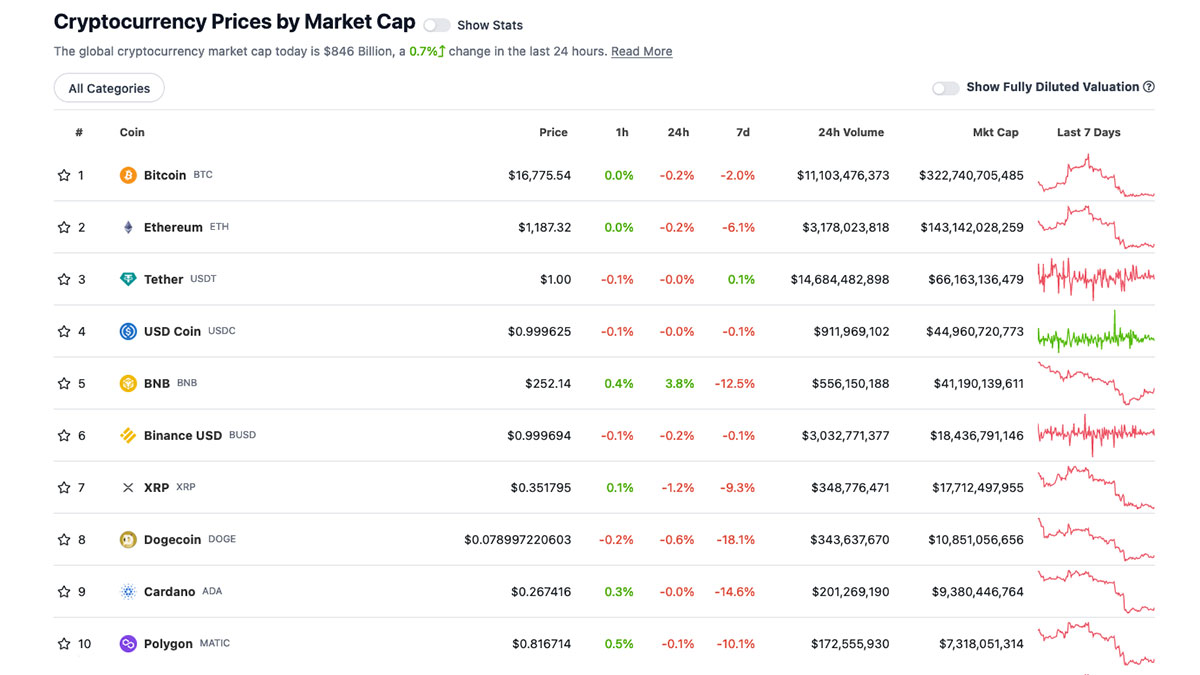

One thing that seems to be pretty stable this morning are the majors. BTC and ETH are both nudging into the black this morning, but not by much for the past 24 hours.

BTC is at US$16,763 – up 0.12% for the past 24 hour period, ETH is similarly up 0.15% to US$1183.5 and BNB has enjoyed a solid 3.9% bump since this time yesterday, and is moving around the US$250 mark at the time of writing… but it’s been falling steadily over the course of the morning.

Now, here’s some news…

Trump NFTs sink, then soar-ish

Everyone (well… nearly everyone) had a good laugh when former US President Donald Trump launched his weary attempt to cash in the crypto fad, launching a range of NFTs that sees him cosplaying as an astronaut, a cowboy, a member of the military and the rest of the Village People.

BUT it would seem that now that the dust has settled, Trump’s NFTs have managed to increase in value over the weekend, and that’s despite eagle-eyed NFT-watchers noticing that a bunch of the Trump Trading cards appear to have used images taken off the internet.

The evidence in many cases is pretty damning – and, obviously, not exactly Trump’s fault because the odds of him knowing how to use Photoshop to make his own NFTs are very, very slim.

At the time of writing, Trump Collector Superhero Magic Moneymaking Cards™ are on Opensea with a floor price of 0.23ETH, about triple what they were selling for at launch.

Everything’s comin’ up Tulips for DCG

Over at Decrypt, there are rumblings among the Dutch this morning after cryptocurrency exchange Bitvavo says it has 280 million euros (US$297 million) “stuck with Digital Currency Group (DCG), or 17.5% of the $1.6 billion Euros Bitvavo says it manages in deposits and other assets”.

This is, clearly, not great news – the current state of the entire market is obviously in Quiet Chaos mode, and it’s that “current turbulence in the cryptomarket” which Bitvavo is blaming for the SNAFU.

In a blog post, Bitvavo says DCG has “has suspended repayments until this liquidity issue has been resolved. DCG indicated that the outstanding deposits will be reimbursed and that it will present a plan in the coming weeks.”

In the meantime, naturally, Bitvavo says it will “continue to offer the services that our customers expect from us” – and will continue to manage the 1.6 billion euros in deposits and digital assets it has on its books.

Except for the 280 million euros-worth it can’t withdraw from DCG – which has possibly been invested in some kind of digital Tulip Bulb scheme… the kind that has been all the rage among the Dutch since the 1630s.

Top 10 overview

With the overall crypto market cap at US$846 billion, up 0/7% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

DAILY PUMPERS

- Toncoin (TON), (market cap: US$3.94 billion) +5.7%

- Rocket Pool (RPL), (mc: US$367 million) +3.4%

- BNB (BNB), (mc: US$11 million) +3.9%

- Pancake Swap (CAKE), (mc: US$563 million) +3.4%

- Shiba Inu (SHIB), (mc: US$5.06 billion) +3.3%

DAILY SLUMPERS

- Filecoin (FIL), (market cap: US$1.05 billion) -4.2%

- BTSE Token (BTSE), (market cap: US$342,000) -4.0%

- GMX (GMX), (mc: US$386 million) -3.7%

- Algorand (ALGO), (mc: US$1.35 billion) -3.1%

- Ethereum PoW (ETHW), (mc: US$320 million) -2.9%

(Stats accurate at time of publishing, based on CoinGecko.com data.)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.