Crypto wrap: Terra’s Luna token keeps on mooning; BTC, Eth dip; Apollo CIO bullish

Getty Images

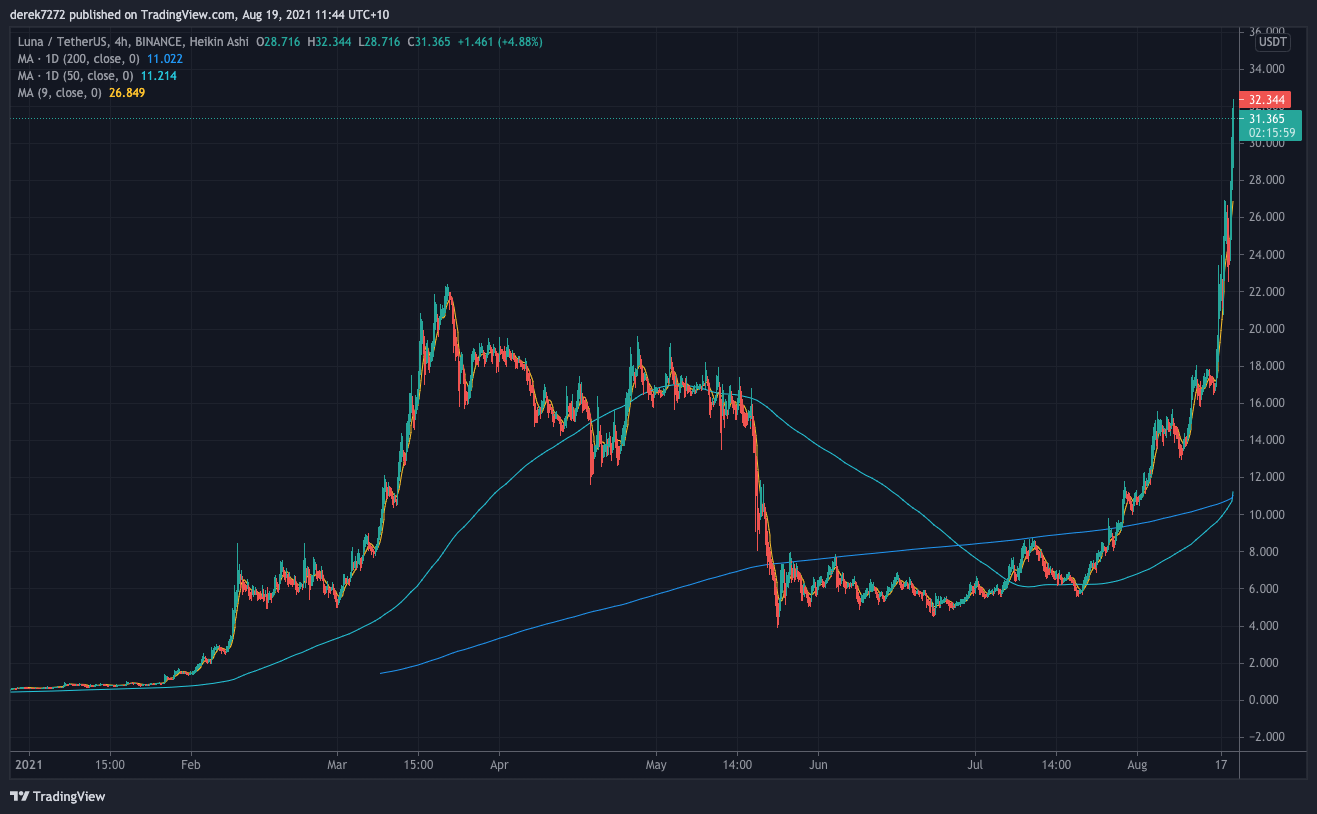

Terra’s Luna token just keeps on mooning — and is now knocking on the door of the crypto top 10.

The coin powering the South Korea-based, payments-focused project hit an all-time high of US$32 earlier this morning, and at 11.39am AEST had retreated only slightly. It was trading at US$31.84, up 33.7 per cent from yesterday, and up 88 per cent in a week.

It’s now the No. 12 coin on Coinmarketcap, up from No. 51 back on May 23. It’s up 49-fold since the start of the year, when Luna coins were trading for US65c.

The Luna token serves to stabilise decentralised stablecoins like TerraUSD (UST) in the Terra ecosystem with a conversion mechanism. If UST ever trades above US$1, Luna holders can convert $1 of Luna to UST and sell at a profit. And if UST ever drops below US$1, UST holders can convert their holdings to Luna tokens for US$1 and sell.

#LUNA for beginnars (Thread 1)#Luna is the native staking token for the #Terra protocol. Through its role in collateralizing the mechanisms that secure price-stability of stablecoins & modulate incentives of validators, it serves as a foundational asset for entire Terra network

— WSB Crypto Mod (@traderrocko) August 18, 2021

Luna is soaring after Terra USD, which has gained the most traction in South Korea, last week launched on leading US exchange Coinbase Pro.

Also, Terra’s Columbus 5 upgrade is now scheduled to go into effect on September 9. The upgrade will make the Luna somewhat deflationary, as well as enable cross-chain swaps through the Cosmos Inter Blockchain Communication protocol (IBC).

Users expect that’ll lead to increased adoption of Terra USD, which would boost the value of Luna coins, since they’re needed to mint UST.

Among other things, users can stake their UST coins on the Anchor Protocol for a 20 per cent yield – among the best available for staking stablecoins.

Cross chain swaps will be a major play.$RUNE proves it.$LUNA is just now getting it priced in with what you are seeing, the reason is Columbus -5 upgrade, specifically Stargate, which enabeles cross chain interoperability on Luna, allowing UST to be accessible on other chains

— bitcoinmanbearbull (@bitcoinmanbear1) August 18, 2021

$UST is still only at 2.2 billion market cap.

The parabolic $LUNA run hasn’t even started.

Columbus-5 is in 20 days!

Get ready for some fireworks

— Alpha Staker.UST (@AlphaSeeker21) August 18, 2021

BTC, Eth dip

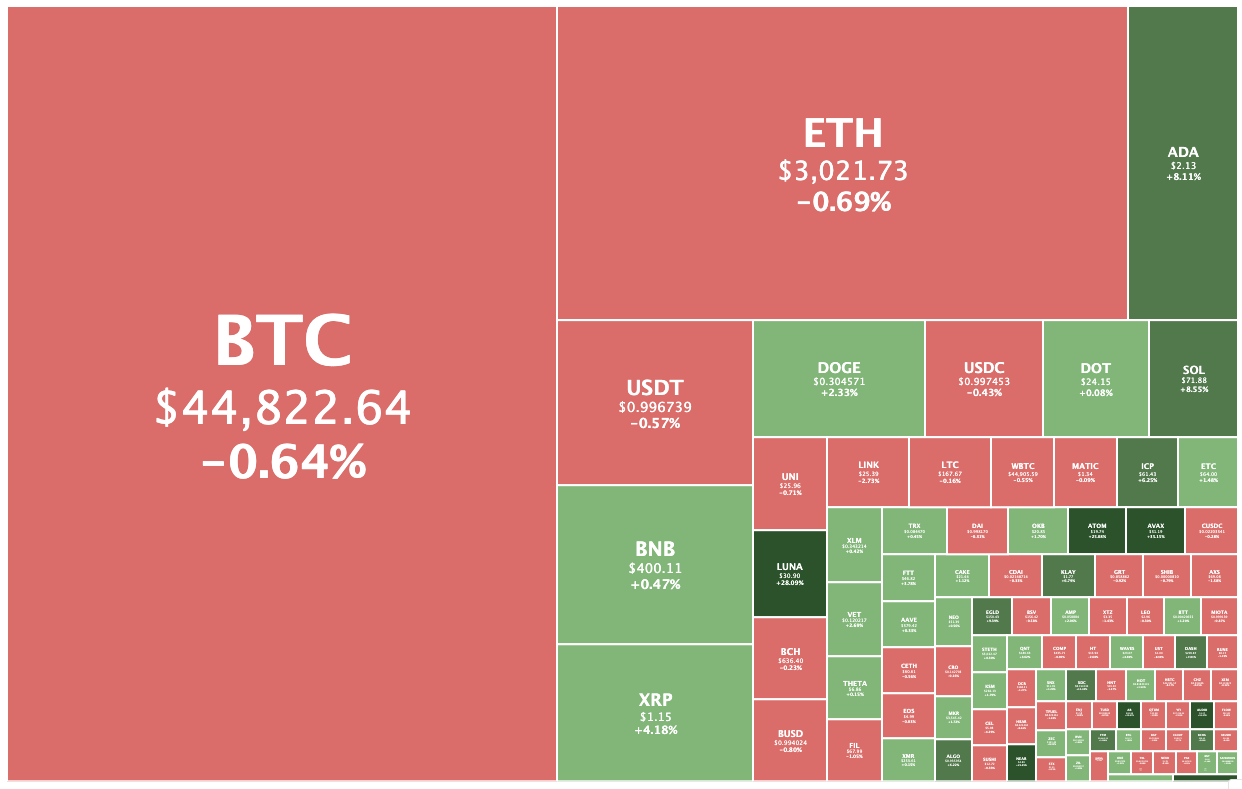

Overall the crypto market was up 1.1 per cent to $US1.99 trillion at lunchtime, even as Bitcoin and Ethereum edged lower.

BTC was trading at US$44,843, down 0.7 per cent from 24 hours ago, while Ether was changing hands for US$3,021, down 0.8 per cent.

Arweave was the biggest gainer among top 100 coins, rising 31.5 per cent to US$31.42. As Stockhead highlighted this morning, the decentralised file storage platform has seen strong pickup for use by Solana NFT projects.

Avalanche was up 30 per cent while Cosmos, Voyager Token, Near, Audius, Fantom, XDC Network, Solana and Cardano had all posted gains of between 28 and eight per cent.

On the flip side, lending and borrowing protocol Celsius Network was the biggest loser among the top 100 coins, falling 4.5 per cent.

Apollo CIO ‘quite bullish’

Leading Melbourne-based crypto investment fund Apollo Capital gave its second-quarter update this morning and chief investment officer Henrik Anderson told investors he was “personally quite bullish for the rest of the year”.

“Our sense is that there’s a lot of money on the sidelines, looking to get exposure to the market, so I think it’s fairly positive for the remainder of 2021.”

Anderson said there was a lot of excitement around alternatives to Ethereum, such as Solana, Avalanche and Terra. And later in the year will be the launch of “another big L1 (layer one), Polkadot,” which Apollo has invested in.

Ethereum co-founder Gavin Wood’s project is currently the No. 9 crypto with a market cap of US$24 billion.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.