Crypto wrap: Ethereum keeps rising ahead of London upgrade; Independent Reserve gets new licence

Getty Images

The Bitcoin rally seems to have stalled after a push above US$42,000 was rejected on Monday — but enthusiasm for Ethereum just keeps growing ahead of its London protocol upgrade on Thursday night (Australia time).

At 12.05pm AEST, Ether was changing hands for US$2,560, up 0.8 per cent from yesterday and close to a seven-week high.

BTC was trading for US$38,941, down 1.8 per cent from yesterday.

The crypto feed and greed index was reading a “neutral” 48, but the Ethereum fear and greed index was indicating a “greedy” 66 — and it showed on Crypto Twitter.

$ETH price has forgotten how to go down.

— Koroush AK (@KoroushAK) August 2, 2021

I feel good about being long $ETH this month, too.

— The Crypto Dog (@TheCryptoDog) August 2, 2021

I mean, it’s perfectly OK to be afraid this is a trap, and to have a plan in the event.

But don’t see where people get off saying this isn’t one hell of a seriously bullish looking chart. $ETH Weekly. pic.twitter.com/u4DTixzaWY

— Bob Loukas (@BobLoukas) August 2, 2021

The London hard fork for Ethereum is currently set to go into effect around 10pm on Thursday, when block 12,965,000 is mined. The upgrade includes EIP-1559 (Ethereum Improvement Protocol No. 1559), regarded as one of Ethereum’s most important upgrades ever.

It will make gas fees (fees paid by users to Ethereum miners to process their transactions) more predictable and burn (destroy) a fraction of them. That’s been described as making Ethereum “deflationary,” but analysts say that’s unlikely to be true until the network moves to a proof-of-stake model — probably early next year.

4)

Under the current proof-of-work (PoW) model ETH’s issuance is quite high (~4% of the total ETH supply annually). To offset this issuance rate by $ETH burn after EIP-1559, we would need ~150 gwei consistently. We have seen this before but it’s unlikely to sustain.— korpi (@korpi87) August 2, 2021

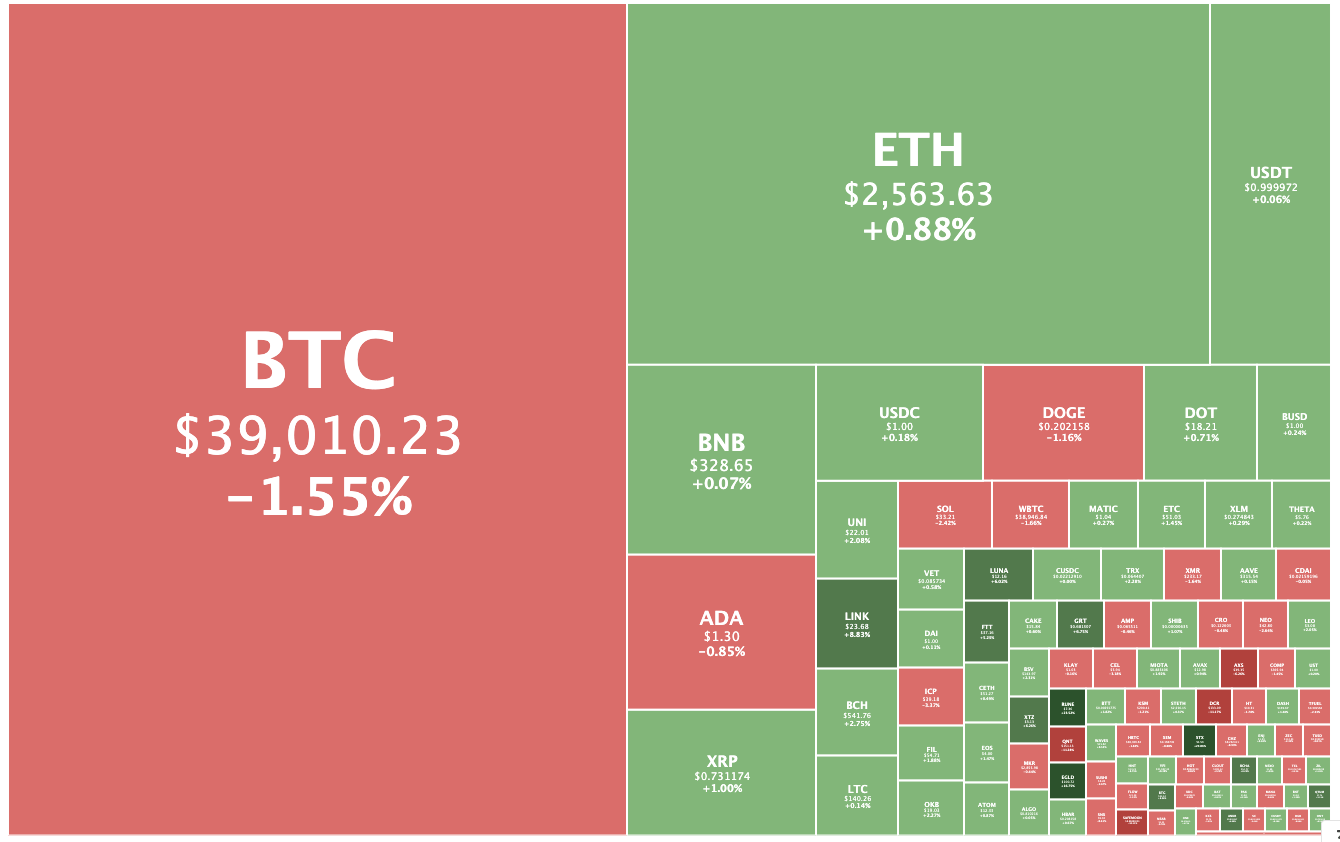

Crypto market down 0.5%

With Bitcoin weighing on the market, overall cryptos were down as a whole 0.49 per cent to US$1.59 trillion.

But only 25 of the top 100 cryptos had fallen by more than one per cent by lunchtime (Sydney time).

The worst laggard was Decred, down 11.7 per cent, followed by yesterday’s top gainer, Quant, which fell 8.9 per cent.

On the flip side, Voyager Token was the biggest top 100 gainer, rising 30.8 per cent, followed by double-digit gainers THORChain, Stacks and Elrond.

GO Markets analyst Lachlan Meakin told Ausbiz TV this morning that he thought Bitcoin was going to have a “tough uphill battle” to decisively move over US$40,000.

He said a lot of retail traders still seemed to be sitting on the sidelines, unlike in the first half.

“Every second phone call I got earlier in the year was about buying crypto,” he said.

Independent Reserve gets Singapore licence

Leading Australian crypto exchange the Independent Reserve has gained in-principle licensure approval from regulators in Singapore for its operations there.

The exchange received an “in-principle approval” letter for a major payment institutional licence from the Monetary Authority of Singapore to operate as a regulated provider for digital payment token services.

The Independent Reserve has already been operating a digital asset exchange and over-the-counter trading desk in Singapore since 2020, but now have become one of the first crypto exchanges to get a tick of approval from local authorities.

“It provides certainty for us as industry participants and security for our customers, knowing that their chosen platform has passed the scrutiny of a world-class regulator,” said Independent Reserve chief executive Adrian Przelozny.

The Monetary Authority of Singapore was particularly interested in customer protection mechanisms, transaction screening, the robustness of IT services, compliance structures, and anti-money laundering/counter-terrorism financing processes, the company said.

The licence also gives customers the same protection as if they were dealing with any other licensed financial services provider in Singapore. It further requires IR Singapore to be audited so all technical and physical safeguards are regularly tested to the standards required by the regulator, the company said.

“We were impressed by the thoroughness of the licensing process and the level of detail required to ensure our systems and processes are robust and up to strict regulatory standards,” said Raks Sondhi, managing director of Independent Reserve in Singapore.

Crypto enthusiasts fear inflation

Official inflation figures have remained relatively low in Australia during the pandemic, with the Australian Bureau of Statistics announcing last week that the Consumer Price Index rose 0.8 per cent in the June quarter, and 3.8 per cent in the 12 months to June 30.

But a survey of 1,010 Australian crypto enthusiasts commissioned by the Gemini exchange found that 79 per cent thought that inflation would become a real problem in the country in the next five years, and 51 per cent think it’s already here.

Respondents were also asked to choose the safest investment out of seven different types, if inflation were to continue.

Property was the most popular answer, chosen by 41 per cent of respondents. Cryptocurrencies and shares were tied for second — both chosen by 19 per cent of respondents — as the least likely to lose value over time during inflationary periods.

Just nine per cent of investors chose commodities such as gold and silver.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.