Crypto: STEPN keeps on moving, as move-to-earn heats up, while Bitcoin loses steam

Getty Images

STEPN keeps on stepping up, even as the rest of the crypto market experiences its first significant pullback in over two weeks.

The Aussie-founded “move-to-earn” token, used to govern a platform that rewards users for being active, has again been the biggest gainer among top 100 cryptos this morning after FTX said it would list it.

STEPN’s Green Metaverse Token (GMT) was up 19.8 per cent to US$2.43 at noon Sydney time, and hours earlier hit a fresh all-time high of US$2.62. It’s up 243 per cent in the past seven days, and was sold on Binance Launchpad a month ago for just 1c.

GMT is currently listed as No. 85 crypto on Coingecko and No. 74 on Coinmarketcap, with a total value of $1.4 billion – about the same as Synthetix, another Aussie-founded project.

People trying to SHORT $gmt zoom out !

Zil ,LRC are pumping cuz of hype .

Gmt got no hype . It carries value .

It will be $5 soon . Just wait and watch— sick (@ewwwshhh) March 31, 2022

⚡ Lots of people really made money off $GMT … Amazing

— CryptoZard (@compzard) March 31, 2022

$GMT just hit $2.46 and it’s ranked #74

Absolutely insane work from the @Stepnofficial team

— Lady of Crypto (@LadyofCrypto1) March 31, 2022

Two other tokens that claim to be fitness-related, the tiny YetiCoin (YETIC) and dotmoovs (MOOV), were also surging – YetiCoin nearly doubling and MOOV up 76 per cent. Dotmoov has a sports app that rewards people for exercising in their home, as verified by an artificial intelligence algorithm, while YetiCoin says it is working on a Move2Earn app.

Crypto market down 3.2%

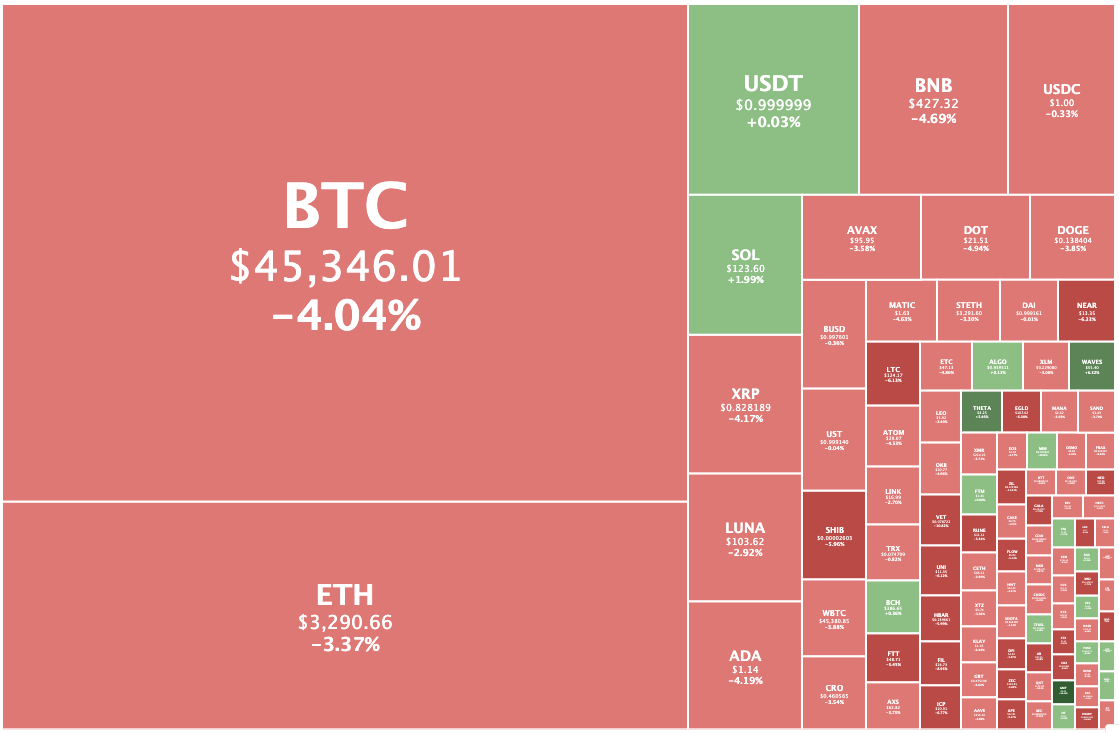

Overall, though, the crypto market is down this morning, by 3.2 per cent to US$2.18 trillion, although only two tokens had fallen by double digits.

Humans.ai (HEART) and VeChain were both down around 11 per cent.

Theta Network, Theta Fuel and Waves were all up by about five or six per cent, with Waves having set a fresh all-time high of $61 overnight. At lunchtime it was trading at $55.

Bitcoin was trading at US$45,350, down 4.0 per cent, and Ethereum was changing hands for US$3,290, down 3.4 per cent.

Solana was the only token in the top 25, except for stablecoins, not in the red. SOL was up 2.4 per cent to $124.

The crypto market had been more or less steadily rising since March 15, printing green candles on 15 out of the past 16 days.

Two analysts’ views

Sydney-based City Index analyst Tony Sycamore wrote in his morning brief that Bitcoin was “once again following the lead of stock markets. Bitcoin remains a risk asset, so when stocks do well so does Bitcoin and vice versa.”

Bitcoin’s 200-day moving average at $48,300 had been the resistance point, Sycamore wrote. But if it can hold support at US$45,000 and eventually break that 200-day moving average, then that would clear the way for a move to US$51,000 to US$52,000 from its December high.

But a loss of US$45,000 level on a closing basis (i.e., at 11am AEDT/midnight UTC) would be a warning that the rally was finished and a retest of the range lows at US$36,000 to US$33,000 was likely, Sycamore indicated.

Meanwhile, Perth-based Think Markets analyst Carl Capolingua told Ausbiz TV this morning that he was waiting to see how Bitcoin responded to the drop and if it could flip its previous resistance at around US$45,000 into support.

“I’m prepared to give it to about US$42,500, because nothing is exact with Bitcoin. It overshoots almost every time.”

Capolingua said he’d be buying there to give him the position he is looking for in anticipation of Bitcoin’s next move higher into the 50s and 60s.

After doing a good job calling the bottom on Cardano a fortnight ago – it’s up 35 per cent since then – Capolingua said he liked the chart on Terra and would be a buyer on pullbacks.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.