Crypto roundup: market stabilises after wobble; Cream Finance spills $130m in DeFi hack

The crypto market looks like it’s trying to find support around current levels after its big daily dip. Meanwhile, DeFi project Cream Finance has copped a hefty flash-loan hack.

Quite a day in crypto, this one. A day that’s seen more than US$850 million worth of crypto liquidations, over US$210 billion lost to the overall crypto market cap, and dog-meme coin Shiba Inu (SHIB) hit an all-time high and mark its territory in the top 10 by market cap.

Imagine if #Bitcoin and top altcoins DO NOT reach their potential targets this year because of:

Doggycoins

We will deserve the pain#dogecoin popping off in Summer 2021 marked the short term top#SHIB doing so well is activating my PTSD response

— Tyler Strejilevich (@TylerSCrypto) October 27, 2021

At the time of writing, the overall cryptocurrency market cap is sitting at US$2.59 trillion, according to CoinGecko, and down about five per cent since this time yesterday.

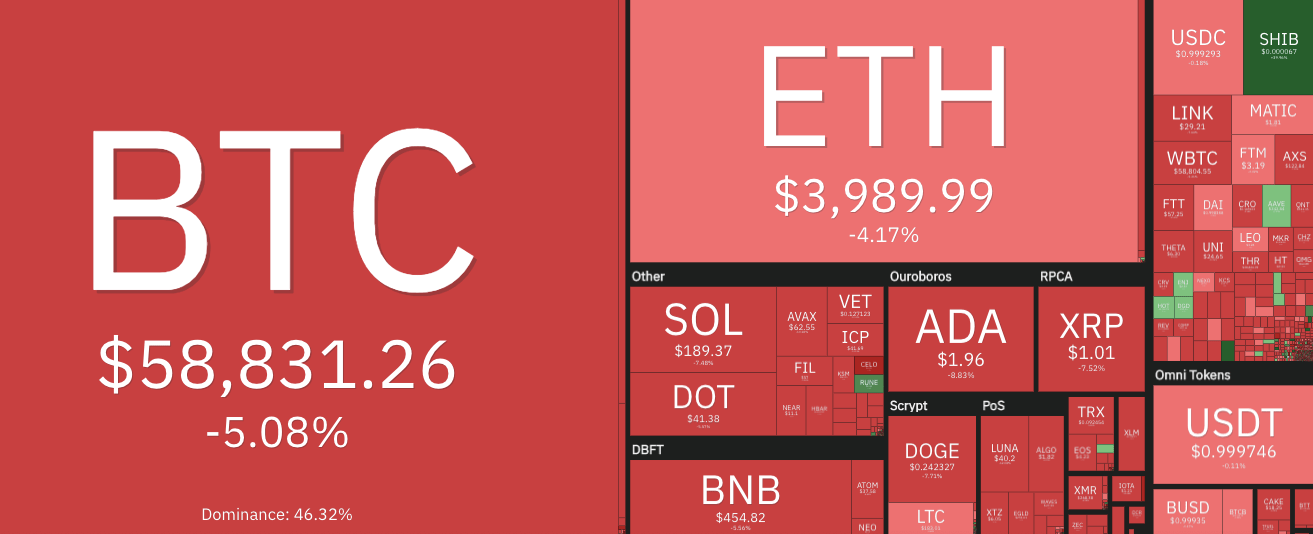

Check out this top-coin grid overview, below. Reflecting the broader crypto market, it’s a sea of red, with the odd notable green outlier – e.g. top right…

Since losing the US$60K zone about eight hours ago, Bitcoin (BTC) has largely been chopping around sideways in the high 58K to low 59K areas. Its market-moving buddy Ethereum (ETH) has been doing similar stuff, trading either just under or just above US$4K for several hours.

Cause for alarm? Many an analyst believes the “bull market” could remain intact even if Bitcoin drops all the way down to levels around US$50K. Just as a reminder, Bitcoin was sitting at about US$43K only one month ago.

And here’s one respected tweet-happy chart watcher we follow, who’s been half expecting today’s move…

https://twitter.com/VailshireCap/status/1453376145018081280

Veteran trader Peter Brandt, meanwhile, is famed for correctly calling the 2018 Bitcoin top. He’s not playing that card just here, just yet, even if he is getting a bit uncomfortable on the fence…

Head and shoulders tops need not always produce a bear market to the implied target or beyond. This pattern can also fail (bullish) or morph into a larger congestion (exhausting). $BTCUSD pic.twitter.com/8f0E0HqXn2

— Peter Brandt (@PeterLBrandt) October 27, 2021

Another DeFi project creamed in big exploit

Cream Finance is the latest protocol to give decentralised finance a bad look and provide more ammunition for the likes of Securities and Exchange Commission boss Gary Gensler and US Senator Elizabeth Warren.

The DeFi lending protocol has been hit by another* “flash loan” attack, with the hacker making off with more than US$130 million in Ethereum-based tokens.

*(It was also hacked for US$34 million in August.)

Cream Finance, the Ethereum DeFi protocol has been hacked for more than $130M!

This is why I barely touch DeFi rn… We're TOO early. 😅

— Layah Heilpern (@LayahHeilpern) October 27, 2021

Smart-contract auditing firm PeckShield broke the news of the exploit on Twitter a few hours ago and has specific details about the flash-loan hack, what that actually is, and how it was caused.

Cream Finance, meanwhile, has announced it’s “investigating an exploit on C.R.E.A.M. v1 on Ethereum”.

DeFi and smart-contract insurance specialists such as Nexus Mutual (who spoke with Stockhead in August) and Bridge Mutual, are well across the exploit…

https://twitter.com/Bridge_Mutual/status/1453384539229888524

This Right right here is vital to Defi's Survival. https://t.co/4ZvJU0eSZ0

— Michael (@Mringz) October 27, 2021

Playing the DeFi game still carries enormous risk. Covering that risk with insurance just makes good sense.

That said, as crypto analyst Adam Cochran notes on Twitter, the funds in Cream’s staked ETH 2.0 service are custodial, meaning that those particular Cream liquidity pool tokens are “likely saveable”.

And this is because the Cream team and their validators probably still have the underlying ETH, writes Cochran, “and can snapshot balances at the time of the hack”.

1/3

Looking into the $CREAM hack, it looks like $40M of the hackers funds are in Cream's Staked ETH2 which according to their docs is a custodial service.

CRETH2/weth has small Uniswap and Sushiswap pools, but for the most part is illiquid. pic.twitter.com/2qfyo20kjf

— Adam Cochran (adamscochran.eth) (@adamscochran) October 27, 2021

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.