Crypto roundup: Market gets a boost; Fidelity and Nexo target institutional investors

(Getty Images)

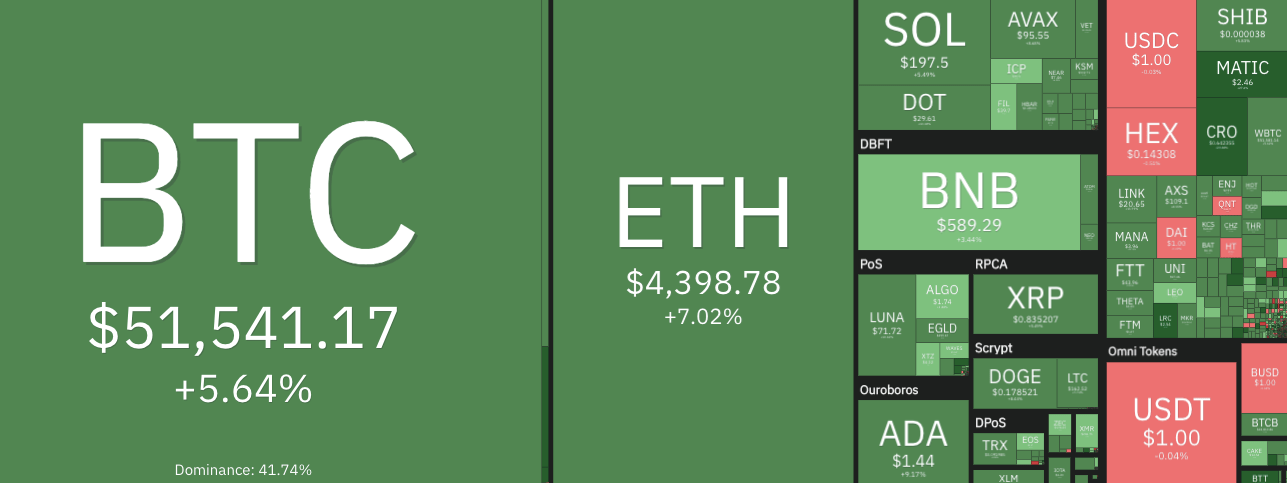

The crypto market appears to be attempting a recovery today, with Bitcoin reclaiming US$50k, and several altcoins making strong moves.

At the time of writing, the entire sector’s market-cap valuation is up an encouraging 8.7 per cent since this time yesterday and zoning in around the US$ 2.54 trillion level, according to CoinGeco data.

Having begun the past 24 hours down around US$48k, Bitcoin (BTC) has been making steady progress back up to its current level – about US$51.5k.

Second-in-command (although for how much longer, Flippening fans?), Ethereum (ETH) is faring even better, up about 7 per cent and moving back above US$4,400 again, about $400 below its all-time high.

Bitcoin dominance, on a relatively steady decline since late October when it was up around 48 per cent, is now about 41.7 per cent. It’s a measure of how much the total market cap of crypto is comprised of BTC and, very simply, if it keeps falling significantly it indicates altcoins are in a comparative uptrend.

With traditional markets rebounding today (the S&P 500 is currently up 2.5%), which has given crypto its cues, bullish sentiment certainly seems to be returning to much of Crypto Twitter right at this very moment. (Subject to extreme volatility and bearish flips by the time this has published, of course.)

And here’s just one of many examples we could find for you to demonstrate the point…

GM WAGMI

— Tyler Winklevoss (@tyler) December 7, 2021

… Although it’s easy to say “we’re all gonna make it” when you co-own a crypto exchange (Gemini) with your twin brother and have already made it – to the tune of several billion dollars. Nice sentiment, though.

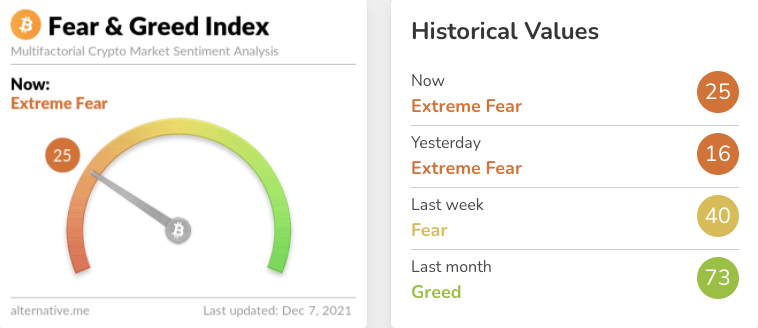

And speaking of sentiment, let’s check in with the crypto Fear & Greed Index. By this time tomorrow, will we have had enough of the Extreme Fear/extreme dip-buying opportunity? (Not financial advice.) The crypto bears probably won’t think so. Time will tell.

Mooners and shakers: Polygon, Spell and gaming coins pump

As for the altcoins, most are well up today. Layer 1 platforms Cardano (ADA) +10%; Polkadot (DOT) +13%; and Terra (LUNA) +11% are all presently posting double-digit percentage gains in the top 10 by market cap.

Some top 100 coins really making waves at the time of writing, though, include interoperable layer 2 scaling protocol Polygon (MATIC) +32%; Crypto.com (CRO) +21%; BitTorrent (BTT) +40%; Bitcoin SV (BSV) +44%; Loopring (LRC) +31%; and DeFi protocol Spell Token (SPELL) +79%.

There’s a lot of positive buzz about Polygon right now, as there has been for much of this year. It’s become one of the widest-reaching protocols in crypto in terms of industry partnerships providing genuine utility…

🗣️ @0xPolygon and #Wanchain are teaming up to launch a decentralised Layer 2-to-Layer 2 crosschain bridge connecting @arbitrum and Polygon PoS!

🚀 This bridge enhances Polygon’s growing suite of solutions including Hermez, SDK and Avail.

👇 Read more 👇https://t.co/sL1hpzWKur

— Wanchain (@wanchain_org) December 7, 2021

Meanwhile, further down the market-cap list, several gaming ecosystem tokens are crushing it once more, including SuperFarm (SUPER) +58%; UFO Gaming (UFO) +50%; Vulcan Forged (PYR) +48%; Atari (ATRI) +40%; Altura (ALU) +35%; and horse-racing simulation play-to-earn game DeRace (DERC) +35%.

And here’s some related news we’ve been meaning to cover…

One of the biggest blockchain ecosystems, Binance Smart Chain (BSC), is teaming up with one of the largest investors and publishers in the crypto-gaming sector, Animoca Brands, to create a US$200 million incubator fund for developing early-stage GameFi projects.

“With this co-investment, projects building on BSC will get the opportunity to gain insights and expertise from leading gaming giants, such as Animoca Brands, along with collaboration opportunities with blockchain experts from the BSC Community,” BSC investment director Gwendolyn Regina said.

We have set up a US$200M investment program for #blockchain gaming projects with Binance Smart Chain! The investment program will accelerate and incubate early crypto gaming #startups that are building on #BSC.https://t.co/fUo6MBopwG@BinanceChain #blockchaingaming

— Animoca Brands (@animocabrands) December 6, 2021

Fidelity and Nexo combine to empower institutional crypto investing

Nexo, one of the most prominent cryptocurrency lending companies, is partnering with one of the world’s biggest asset managers and financial services firms – Fidelity. Or, to be specific, Fidelity Digital Assets.

The collaboration aims to give Fidelity’s institutional investors another way to gain exposure to cryptocurrencies through custodial and lending services built specifically to suit their needs.

💥BREAKING: Fidelity + Nexo are launching #Bitcoin backed loans for instituons

— Bitcoin Archive (@BTC_Archive) December 7, 2021

As part of the agreement, Fidelity clients will have access to Nexo’s suite of products and crypto prime brokerage, while Nexo will be able to expand its ability to increase its assets under management.

Nexo’s custodial layer will also be upgraded to “military-grade security infrastructure”, for added investor protection, according to a press-release announcement about the partnership.

With almost US$5 trillion worth of assets under management, it’s fair to say, this is a big deal for Nexo and potentially for the continued growth of the crypto market as a whole.

Fidelity has shown before that it has big ambitions within the institutional cryptocurrency market, having made several strategic hires in the sector earlier this year.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.