Crypto roundup: Bollinger Bands creator cautious as Bitcoin guns for support

Photo: Getty Images

Bitcoin (BTC) seems to be fighting a move lower than $US47K today, but is in decidedly undecided territory. Meanwhile, the creator of the Bollinger Bands technical indicator has sent out a bearish warning on Twitter.

The OG crypto is moving faster than we can type at present. About 30 seconds ago it was at US$47.5K. One hit of the refresh button, however, and it’s teleported back up to US$48.2K. Let’s hit it again… US$48.7K. Hmm, that’s it, we’re calling a “Bitcoin supercycle”. (We’re not.)

Bitcoin is generally down by about 1% from this time yesterday, though, while the entire crypto market cap is currently about 3% in the red, taking time out, sniffing the roses around US$2.108 trillion.

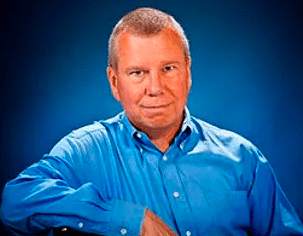

John Bollinger, the famed US technical analyst who created the “Bollinger Bands” – a well-known and widely used chart indicator – sent out the tweet below several hours ago, suggesting market participants should tread cautiously right now.

You can go and read some of the panicky-sounding “WTF do I do now?!” responses to Bollinger’s tweet if you like. But this is the best response we’ve seen, which then got a “What he said” reply from the man himself.

You lot need to chill out. He said keep an eye on the market. He didn't say shit yourselves and cry.

— Crypto Joe (@trader_joe89) August 24, 2021

According to analysis of the BTC Bollinger Bands today by Cointelegraph, Bitcoin is doing a good job for now of holding above the 20-day SMA (simple moving average) around US$46,750. However, a break below that risks a more dramatic move downwards.

If you’re a Bollinger Bands believer, that could see Bitcoin come down to about $42,670.

A pullback for BTC has certainly been predicted by more than a few chart watchers this week. The sentiment seems to be along the lines of the time-honoured “what goes up, must come down” price-gravity maxim.

Bitcoin had, after all, been closing daily green candles for at least a handful of days in a row leading into this week’s dipping action.

But, while the Bollinger stuff might well play out and is worth keeping an eye on, at the time of writing crypto no.1 might be changing gears yet again before accelerating into another corner. Just keep your eyes on the road ahead as best you can.

#BTC is showing some small signs of recovery

But if $BTC can't reclaim the red area/blue level soon then this recovery will have merely been a relief rally to turn previous support into new resistance#Crypto #Bitcoin https://t.co/ReHiZp5u9z pic.twitter.com/WlxzqsHWCi

— Rekt Capital (@rektcapital) August 25, 2021

Mooners and shakers

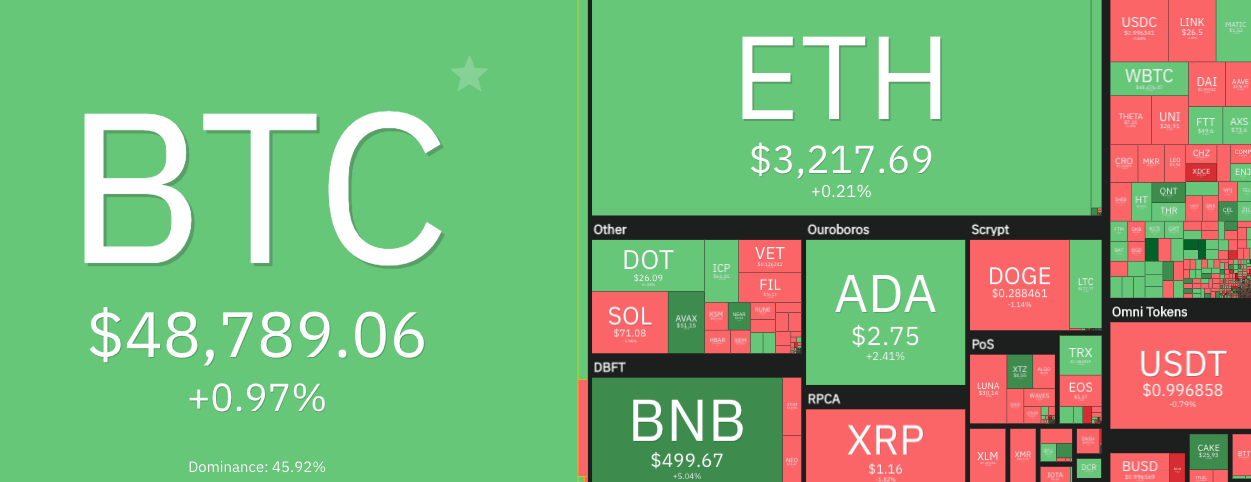

Moving down the CoinGecko and CoinMarketCap charts, Ethereum (ETH) and pals are still largely following Bitcoin’s lead. ETH is presently up 0.21% and changing hands for US$3,217.

Cardano (ADA) has levelled out pretty well after dipping 30c from US$2.95 to 2.65 yesterday. It’s back up at $2.75 at the time of writing, and in the green to the tune of +2.41%.

Regarding Cardano, the YouTuber “Hashoshi” has posted a great interview with the lead engineer at dcSpark, a Cardano ecosystem project that’s building an Ethereum-compatible sidechain. It’s a project getting some attention today for its potential to make good on Cardano’s interoperability ambitions.

Meanwhile, Binance Coin (BNB) is up 5% since this time yesterday and is presently the best performer in the top 10 over the past 24 hours.

In other movements of interest, low-cap NFT metaverse coin Wilder World (WILD) has been getting some influencer love lately on Twitter and YouTube. It’s up 21.36% at press time. It might be one to watch, as it seems to potentially fit the buzzy NFT and play-to-earn wave of hype. Its upcoming WilderWheels NFT game looks interesting…

#WilderWheels from $WILD built with @UnrealEngine 5. https://t.co/YVtrnRTS81

— JZ (@JohnnyZcash) August 23, 2021

Another micro-capper, at #587 on CoinGecko, Chain Guardians (CGG), +40.5%, has also been pumping this week. As well as being its own gaming play-to-earn universe, Chain Guardians doubles as a launch pad (Chain Boost) for other upcoming gaming-related projects.

Moving back into the top 100, though, Internet of Services Token (IOST) is +14.4% in the green; Tezos (XTZ) is having a good day, up 11%; and Near Protocol (NEAR) is nearly in double-digit gains territory: +9.26%.

Arwearve (AR), meanwhile, is down 7.13%; and at press time, Terra (LUNA) has taken a relatively mild dip, down 2.17%.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.