Crypto roundup: Bitcoin runs out of puff; Celsius raises $400 million

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

The Bitcoin solo act appears to be winding down for the moment, pulling back along with the entire crypto market.

Ethereum (ETH), the no.2 crypto by market-cap valuation, meanwhile, has lost a key level of support and is in a downtrend right now when priced in BTC.

According to Cointelegraph, ETH/BTC has currently dipped below its 200-day exponential moving average, and may have some further short-term downside to come.

Dutch trader Michaël van de Poppe sees it similarly, and yesterday forecasted an altcoin run only likely happening once Bitcoin manages to break its all-time high.

If that occurs, maybe the OG crypto will be kind enough to put down its double-necked guitar and let the rest of the band take over for a little while.

Scenario I'm looking at with $ETH. pic.twitter.com/y02e5ZoYpL

— Michaël van de Poppe (@CryptoMichNL) October 12, 2021

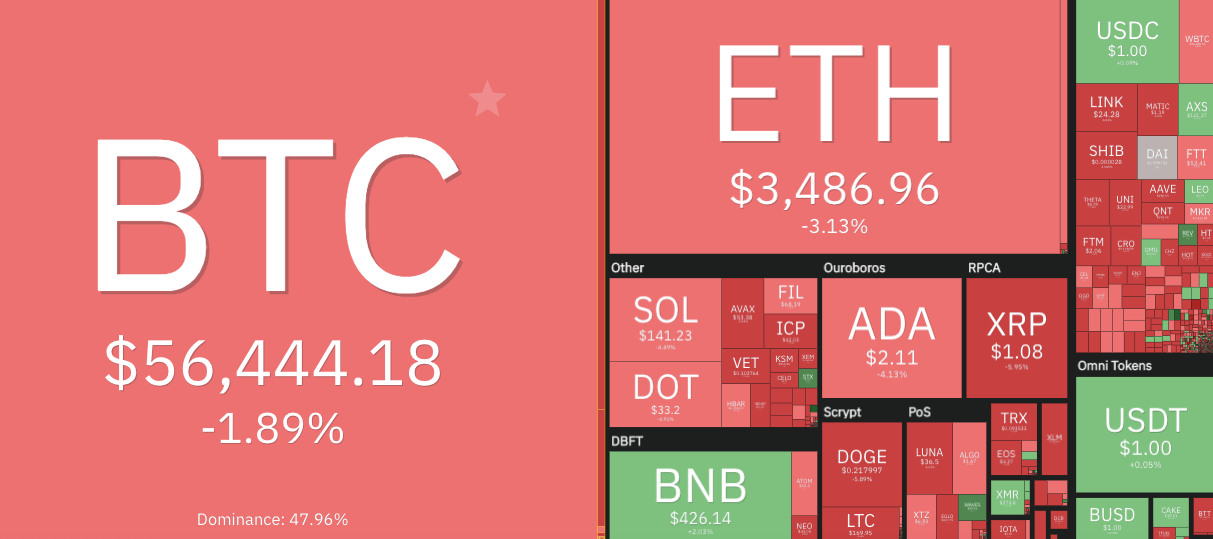

At the time of writing, the entire crypto market is down by 2.3 per cent in the past 24 hours, sitting at US$2.37 trillion, give or take a few billion dollars.

Bitcoin’s upstaging act over the past few days looks like it might be faltering somewhat, with the market-moving digital asset pulling back under US$57K again, changing hands for US$56,444 and down 1.89 per cent since this time yesterday.

A further BTC pullback to retest previous levels of resistance around US$52K and US$50K might not be shocking to those near the front of the crowd who have a decent view of what’s happening on stage.

Guess we’ll have to wait and see if this set winds up, or if we get an encore. But, as many a longterm crypto investor would advise (but in non-financial advisory capacity)… “when in doubt, zoom out”.

Trading #Bitcoin is like trading Apple, Amazon, Google, or Facebook a decade ago. The more you obsess over timing the market, the more mistakes you make. They were all technology networks that were dominant & destined to grow. The best strategy is to buy bitcoin and wait. https://t.co/D3XiQ2B71R

— Michael Saylor⚡️ (@saylor) October 12, 2021

Celsius raises US$400 million in funding round

Meanwhile, never mind the murky regulatory landscape in the US regarding DeFi and lending platforms right now… Celsius has raised an impressive US$400 million in a new equity funding round.

The popular crypto lending platform made the announcement today via a press release and revealed the funding was led by Canada’s second-largest pension fund, Caisse de dépôt et placement du Québec (CDPQ), and WestCap, an equity firm that counts Airbnb among its previous investments.

Celsius, led by its prominent founder Alex Mashinsky, says it plans to use the proceeds from the investment to expand its offering and products, with particular emphasis on institutional grade products. The firm also intends to double its team from 486 employees to nearly 1,000 and expand globally through strategic acquisitions.

Celsius Network raises $400m. @FT

"The funding round was led by WestCap… and Caisse de dépôt et placement du Québec (CDPQ)." More:https://t.co/L5wpMxCvcR

— Celsius (@CelsiusNetwork) October 12, 2021

Crypto-lending firms, including Celsius and BlockFi, have come under increasing regulatory scrutiny in the US in recent months, with Coinbase, too, abandoning its plans to launch a crypto-lending service after a stern warning and discouragement from the US Securities and Exchange Commission.

“While the current regulatory attention is new,” commented Laurence A. Tosi, managing partner at WestCap, “Alex Mashinsky and Celsius’ ethos has long echoed the sentiment regulators are trying to put forth in terms of consumer protections.”

The new funding round give Celsius a valuation of more than US$3 billion. The company recently reported that, as of October 8, 2021, its total assets had crossed the US$25 billion threshold – including more than one million customers registered with the platform.

As the release mentions, Celsius has now paid more than US$850 million in interest to its users through its Earn product in just over three years.

Also in the news: Crypto czar, ConsenSys, Binance, Facebook

• The US government is considering an “executive order” on unified crypto oversight, under the watch of a specially appointed “Crypto czar”. Catchy title.

• ConsenSys, a US company that helps develop Ethereum projects, is in talks about a funding round that would value it at US$3 billion, according to reports.

• Two top Facebook engineers from its digital currency unit have quit to join VC firm Andreessen Horowitz’s crypto team. Later, Zuck.

• A Swiss non-profit think tank, 2B4CH, has initiated a vote to include Bitcoin in Switzerland’s federal constitution and add the asset to the nation’s reserves.

🇨🇭We are planning to start a Federal Popular Initiative. Can we reach 100k Bitcoin-friendly Swiss nationals?

If you vote in Switzerland & you like #Bitcoin, please reply below and @ 1 or more friends who also are BTC enthusiasts.

RT for exposure also appreciated. Thank you.

— 2B4CH🇨🇭 (@2B4CH) October 8, 2021

• Binance has announced it’s launched a whopping US$1 billion fund to support growth on the Binance Smart Chain with a focus on gaming, VR and DeFi.

It's time to accelerate #BinanceSmartChain's journey towards scaling and mass adoption 🚀

We're announcing the biggest growth fund in the history of crypto – the $1 billion fund to push the adoption of not only BSC but the whole blockchain industry.

👇https://t.co/lkTHmp8fRm— BNB Chain (@BNBCHAIN) October 12, 2021

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.