Crypto roundup: Bitcoin rangebound; AVAX surges; India allows crypto assets

Pic: DKosig / iStock / Getty Images Plus via Getty Images

Bitcoin might be settling into a tight-ish range for the moment, but Avalanche has hit an all-time high and positive crypto news keeps pumping. Including from India.

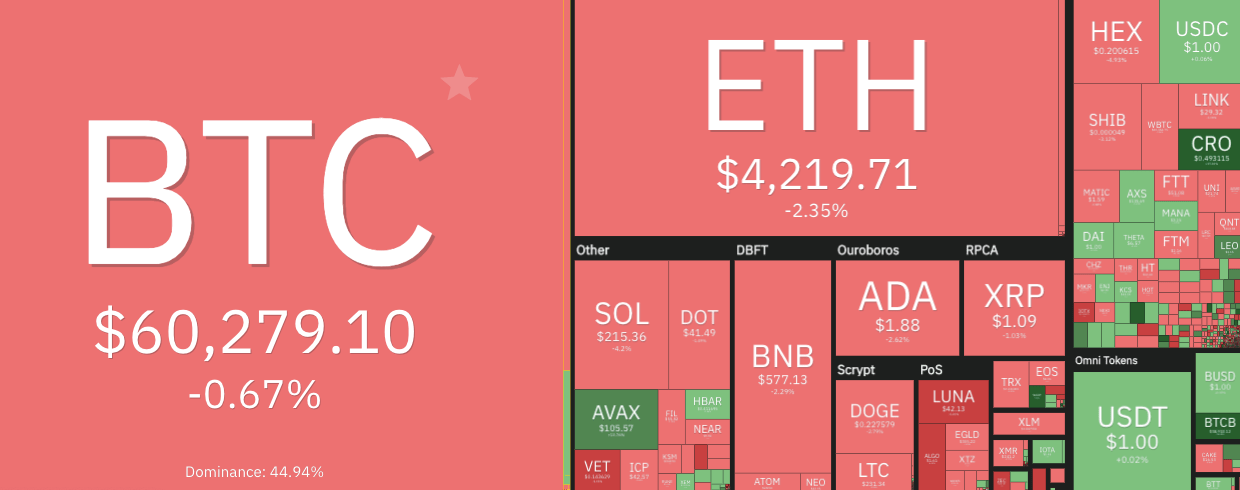

At the time of writing, we’re looking at a US$2.73 trillion market cap for crypto as a whole, according to CoinGecko data. It’s down a bit since yesterday – about two per cent.

Pack leaders and unofficial price-directional navigators for the entire market, Bitcoin (BTC) and Ethereum (ETH) are still figuring out a plan of action. That’s fine, you do your thing, top two crypto assets… we’ve got all the time in the world…

Well, sort of. This is crypto, after all, and its investors tend to live in a frothy world of impatience. But at least the subdued and potentially suppressed prices for much of the market are making for some discounted crypto Christmas gifts… if that’s your bag.

Pseudonymous analyst Rekt Capital, meanwhile, is still pointing towards a crucial monthly close for Bitcoin, which he believes needs to stay above about US$58,700 for bullish tendencies to remain.

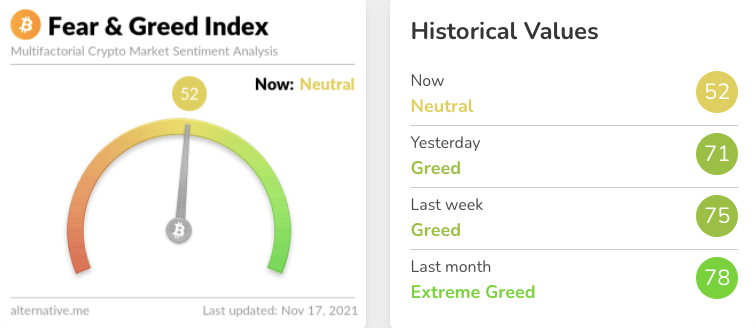

There are still a couple of weeks to go before the end of, er, “Moonvember”, however, and he’s not ruling out lower levels in the meantime to push the market into extreme fear on the crypto Fear & Greed Index.

#BTC is successfully retesting its Monthly level as support (green)

Still many weeks left until the 1M Close though

All good as long as $BTC 1M Closes above green

But that doesn't rule out downside volatility below the green level to make sentiment Extremely Fearful#Bitcoin pic.twitter.com/6JnDqM6oYp

— Rekt Capital (@rektcapital) November 17, 2021

The last time Bitcoin saw extremely fearful levels on the popular sentiment indicator was September 21. And, as the analyst points out in a separate tweet, “this is when BTC actually bottomed before enjoying a run to its new all time highs. Currently, sentiment is Neutral (52) but Fear is what precedes reversals.”

Mooners and shakers: AVAX and CRO defy market gravity

Avalanche (AVAX) has hit another all-time high today, surging past US$106 a short time ago. It’s up about 20 per cent in the past 24 hours.

The layer 1 smart-contract platform has been having a hell of a run in general over the past few months, and is up about 90 per cent across the past 30 days or so.

Is AVAX in “price discovery” mode, meaning short-term higher price action? Possibly. Various tweeting analysts seem to think so. But that does all depend a bit on the wider market sentiment, too, even if the coin is bucking the trend right now.

A possible catalyst for the platform’s surge could be its latest big partnership announcement.

2/ Ava Labs and @Deloitte are launching the Close As You Go platform that leverages the Avalanche blockchain to improve security, speed and accuracy of FEMA funding.https://t.co/vHK0U3UpUk

— egs9000🔺⚔️ (@el33th4xor) November 16, 2021

Avalanche and Ava Labs founder CEO Emin Gün Sirer revealed on Twitter today that the crypto company will be partnering with “Big Four” accounting firm Deloitte “to build more efficient disaster relief platforms using the Avalanche blockchain”.

Crypto.com Coin (CRO) meanwhile, has also made a 24-hour 20 per cent surge on the back of a huge announcement.

As we reported earlier, the Singapore-based crypto wallet and services provider, now ranked 18 on the market-cap charts with a valuation just under US$13 billion, has just pulled off one of the biggest naming-rights deals in sporting history.

We're extremely proud to announce that Staples Center, Los Angeles' most iconic arena is getting a new name:

https://t.co/vCNztATkNg Arena

As part of this 20 year partnership, we're also excited to welcome the @Lakers & @LAKings as our newest partners! pic.twitter.com/KCfYKySDRt

— Crypto.com (@cryptocom) November 17, 2021

The Staples Center arena in Los Angeles, which is home to the LA Lakers and LA Clippers NBA teams as well as the NHL’s LA Kings, will be renamed Crypto.com Arena on Christmas Day.

And, according to a press release, the deal is worth US$700 million over 20 years. It’s another slam dunk for Crypto.com and, by proxy, crypto in general.

It’s these sort of price-pumping partnerships and deals that might, just might… tell us the bull market has plenty left in the tank.

A few other notables in the top 100 today also travelling particularly well include: JP Morgan-backed PoW layer 1 platform Kadena (KDA) +12%; Avalanche-based DeFi protocol Wonderland (TIME) +10%; gaming ecosystem token WAX (WAXP) +20%; and another crypto-gaming play Gala (GALA) +62%.

Oh, and a Coinbase-listing alert, which certainly explains the GALA pump…

https://twitter.com/TheLINKPill/status/1460974406000381959

And in other news: India regulates; ConsenSys raises

Also making headlines today…

• India’s government has made a big announcement in the past 24 hours. It’s both good and bad (mostly positive, though).

The densely populated, tech-loving country has finally ruled that it will allow and regulate the trading of crypto assets, as reported by Indian media outlet the Economic Times.

And the bad news? It’s placing a ban on the use of cryptocurrencies as a means of payment in the country. Oh well, never mind – savvy Indian investors will just have to HODL their Bitcoin instead.

Day 1112

Regulations before meant trying to suppress or kill the crypto industry

Regulations today are directed at growing & winning the crypto industry

We’ve gone from negative to positive outlook towards crypto

It’s on us now to make India a crypto leader#IndiaWantsCrypto

— Nischal (Shardeum) 🔼 (@NischalShetty) November 17, 2021

• Ethereum’s blockchain infrastructure provider ConsenSys has reached a valuation of US$3.2 billion after sealing a US$200 million funding round. Triple unicorn-ing it – impressive.

The round’s investors included some big names: global bank behemoth HSBC; US hedge fund Third Point; Dragonfly Capital; Coinbase Ventures; Animoca Brands… just to name a handful.

And if you needed further proof that crypto is thriving… ConsenSys founder (co-founder of Ethereum, too) Joe Lubin also announced that the Ethereum-based wallet and browser extension MetaMask has reached about 21 million monthly active users. It’s more than doubled over the past four months.

We’ll end this roundup with a magnanimous touch here from Charles Hoskinson – the founder of Ethereum rival Cardano. (He also happens to be one of Ethereum’s co-founders, in case you didn’t know.)

Congratulations @ConsenSys https://t.co/kNWlJFout5

— Charles Hoskinson (@IOHK_Charles) November 17, 2021

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.