Crypto roundup: Bitcoin looks for support, while Ethereum celebrates its 6th birthday

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

As we head into the weekend, Bitcoin is looking for meaning and support – a base to figure out its next plan. Is US$40K it? That’d be nice. But there’s a chance it needs propping up a bit lower than that first, according to some analysts.

Bitcoin in search of a higher low

Even if you’re holding heavy bags of altcoins, Bitcoin (BTC) is always good to look at first to gauge what’s going on and what might happen next.

It’s still the asset in the digital driving seat that can dictate the direction of the entire market, although it’s widely hoped that Ethereum (ETH) can decouple from that narrative one day soon.

Dutch trader Michaël van de Poppe may still only have a modest subscriber base on YouTube compared with, say, BitBoy or Altcoin Daily, but he’s become one of the most quoted analysts in the cryptoverse, including this section.

Astute technical analysis is his bag, and in his latest video, the full-time chart reader was looking at a few scenarios for the no.1 crypto as we rounded out the working week.

One of which is the possibility of Bitcoin forming a “higher low” level of support, which Van de Poppe suggests could fall within the US$36.7K to US$34.5K zone.

This would represent a drop of as much as US$4,500 from Bitcoin’s present level of US$39,000, but that’s potentially not quite as bad as it sounds if support can form and hold there.

In fact, if it can, and then range sideways for a few days, it could represent a chance for a switch to some overall upwards altcoin price action, according to the crypto analyst.

#Bitcoin breaks south and lands on the next level of support around $38,600.

What's next? Most likely a breakdown, but how far will it go?

Check the recent update on YouTube:https://t.co/trPq5w7c7B pic.twitter.com/8CH9XcbMkz

— Michaël van de Poppe (@CryptoMichNL) July 30, 2021

There is a chance, too, however, that Bitcoin has already found some strong support, right about where it’s sitting on its 200-day EMA (exponential moving average), as another go-to analyst, Rekt Capital, points out below.

The retest of this level is still playing out at the time of writing, but , naturally, things may well have completely changed by the time you read this.

There’s also the small matter of $US1.5 billion worth of Bitcoin options contracts expiring today on unregulated derivatives exchange Deribit. Watch for some potential price volatility on Saturday morning, AEST (late Friday afternoon EDT).

#BTC retest attempt of the black 200-day EMA as support is now in progress$BTC #Crypto #Bitcoin pic.twitter.com/tSGeSDx3sC

— Rekt Capital (@rektcapital) July 30, 2021

Looking ahead to Sunday’s “weekly candle close”, a position traders and analysts watch to assess market strength heading into the new week, Rekt Capital was eyeing off US$39,000. Pretty much exactly where we’re sitting at press time.

A #BTC Weekly Candle Close above ~$39000 would be a fantastic contributing step towards further upside

All $BTC needs to do is continue to hold current price levels as it has been doing for most of this week already#Crypto #Bitcoin

— Rekt Capital (@rektcapital) July 30, 2021

Mooners and shakers: ETH parties on, FLOW gushes

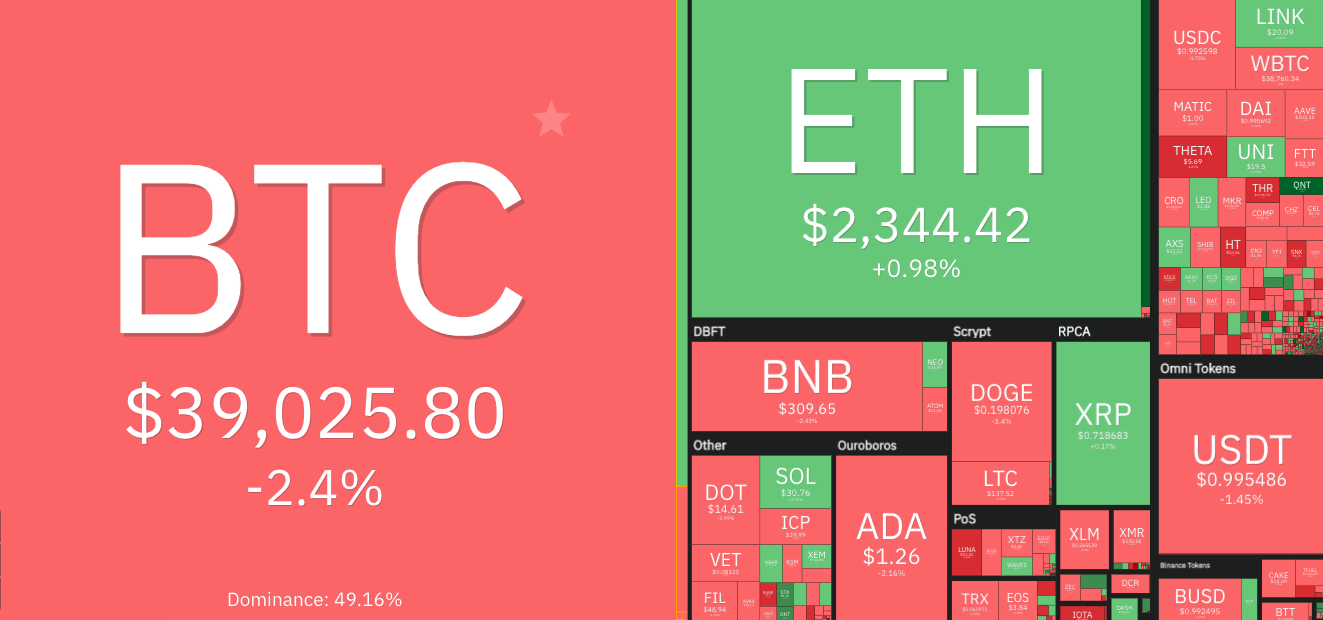

As you can see from this Coin360 overview, Ethereum (US$2,344) is keeping it green for the moment, along with a few other top 50 notables in XRP (US$0.718); Chainlink (LINK), US$20.09; Uniswap (UNI), US$19.50; and Solana (SOL), US$30.76.

Oh, and in case you didn’t know, Ethereum turned six today. There’s plenty of excitement building around the protocol at present, and for good reason considering its improvement upgrade – shipping next week if all goes according to plan.

Let’s hope Ethereum founder Vitalik Buterin is clapping with excitement and feeling “impress”. (See video of cult crypto classic hit below. It’s an ear worm for the ages.)

Hope @VitalikButerin is happy today!💚🎂https://t.co/frx5itt3aH

— CoinGecko (@coingecko) July 30, 2021

Meanwhile, one of the most hyped projects in the NFT sector of crypto, Flow (FLOW) by Dapper Labs, was gushing with activity today after it was added to the Binance exchange – an event that usually pumps newly listed coins, at least for a short time.

It started its day around the US$18.20 mark, soaring up to US$27.56. It’s presently pooling out around US$22.56 at the time of writing, still up 25.6% in the past 24 hours.

Two other notable cryptos doing well today: new kid on the gaming block, Yield Guild Games (YGG) – up 53.7% on the day; and free-VB-facilitator Power Ledger (POWR) with a +37.9% 24-hour gain.

Staking and passive income rewards in a trillion dollar industry probably.

— Crypto Prophet (@CryptoProfet) July 30, 2021

SafeMoon (SAFEMOON), a DeFi token with a pump-and-dump reputation, has been a reasonably significant loser in the top 100 by market cap today, down 17.3% at press time.

And lastly, something for holders of top-5 project and Ethereum rival Cardano (ADA) to either take heed of, take with a grain of salt, or take no notice of whatsoever.

“Veteran trader” Peter Brandt, as he’s nearly always described, correctly called the top of the 2017/2018 bull market. So his opinion here about ADA’s chart potentially forming a bearish head-and-shoulders pattern can’t be easily dismissed.

I feel compelled to remind you of your own tweet. https://t.co/NU5oE98tVn

— Card₳no Dan 🐂 ADA (@CardanoDan) July 30, 2021

Then again, maybe it can. Charts, eh?

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.