Crypto roundup: Bitcoin hangs by thread; Vee Finance hacked; PayPal launches ‘super app’

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Bitcoin is still on shaky ground amid China’s Evergrande uncertainty, but has been trading relatively sideways and above US$42K for the past 12 hours or so.

Meanwhile, as usual, a mix of good and bad news is colouring the market today.

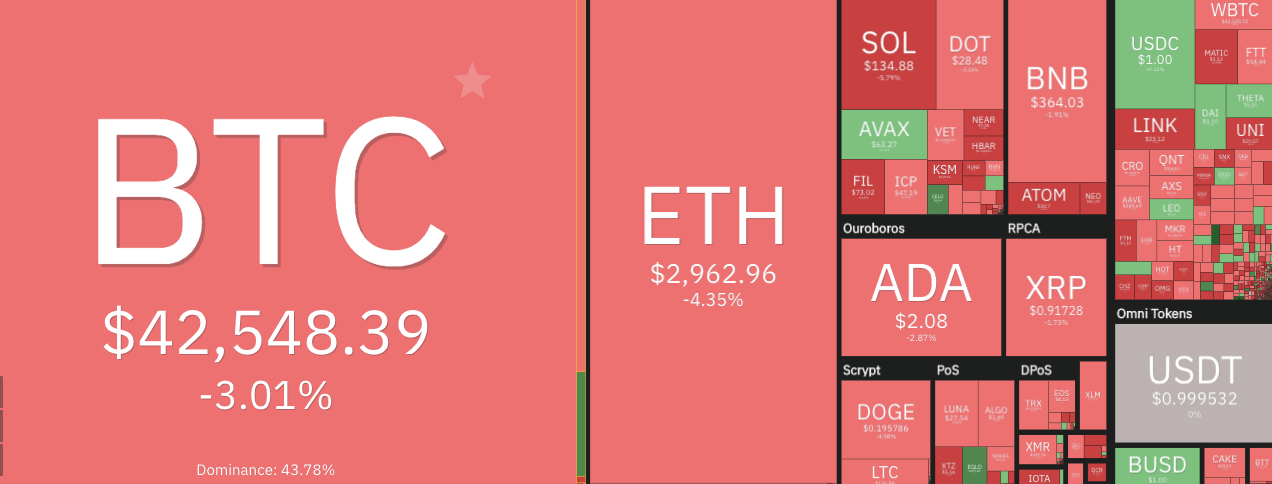

Bitcoin (BTC) is currently changing hands for US$42,548, down 3.01% since this time yesterday. And the entire crypto market cap is sitting at US$1.979 trillion, down 2.1%.

Here are a few of today’s takes on the market-barometer OG crypto, from popular crypto analysts and luminaries…

Dutch trader Michaël van de Poppe believes the critical level for Bitcoin to hold is a price band between about US$37.5K and $US40K. So far, so good on that front today, then.

If it loses this area, he expects little support, however, until a possible retest of US$28K. That said, Van de Poppe still leans towards the idea that the crypto market bull cycle has “one more leg” to go before any financial crisis or crypto bear market truly kicks in.

The trader is calling this current dip “a beautiful, corrective move” and is one of many analysts looking at historical data suggesting September is frequently a particularly bad month for crypto.

September is bad.

October is great.

November is great.

December is great.Buy the f*cking dip. pic.twitter.com/eyv75BkgC4

— Michaël van de Poppe (@CryptoMichNL) September 21, 2021

CEO of Galaxy Digital, Mike Novogratz, meanwhile, has told US media outlet CNBC that he thinks Bitcoin is “in good shape” as long as its price stays above US$40K.

And the level he’s eyeing for essential Ethereum support is US$2,800.

“I think the market got itself a little too long – the China news scared people,” said the former Goldman Sachs hedge fund manager, turned crypto bull.

“I see nothing but engagement and activity from our investing clients and corporate clients,” Novogratz added, confirming that he isn’t nervous about the crypto market at the moment.

Then there’s the CEO of hedge fund Three Arrows Capital, Zhu Su, dishing out a classic crypto-style “probably nothing”, while providing at least one perspective from Asia at the moment…

One of the largest hedge fund managers in Asia said the only stores of value he owns are GCBs (good-class bungalows) and BTC ( #bitcoin).

Setup Brinks gold holding account recently and they eagerly mentioned they support BTC cold storage also.

Probably nothing.

— 朱溯 (3/AC) (@zhusu) September 21, 2021

As for the no.2 crypto on the market cap charts, Ethereum (ETH), it’s just dropped below US$3K again, trading at US$2,962 (-4.35%) at press time.

Earlier today, “veteran trader” Peter Brandt tweeted out a fairly recognisable “head and shoulders” bearish chart signal forming in relation to the highly regarded smart-contract platform…

I am NOT saying I believe it and I am saying I am not shorting it — but like it or not if you own $ETH you will have to deal with it. This possible H&S exists, whether it is completed, fails or morphs, it exists. I am NOT a hater. pic.twitter.com/PG50GwaZkI

— Peter Brandt (@PeterLBrandt) September 20, 2021

Known for calling the Bitcoin and crypto-market-cycle top that preceded the 2018/19 “crypto winter” bear market, Brandt was at pains to point out his crypto-charting neutrality to the more emotionally driven members of his audience.

But, several hours later, he had a somewhat more positive update for them, highlighting a possible ETH “bear trap”, which is a “false reversal of a declining price trend”, according to Investopedia.

#Bear_Trap I have a strong suspicion that recent weakness, especially overnight, successfully washed out weak longs and might have trapped some bears. Of course subsequent price action would need to confirm this. $ETH pic.twitter.com/3begBYtHcu

— Peter Brandt (@PeterLBrandt) September 21, 2021

Vee Finance hacked

The Avalanche-based decentralised finance platform Vee Finance is off to a particularly rocky start, suffering an estimated US$35 million hack just a few days after launching.

Announcement: Our platform may have been exploited. All services have been paused. We are investigating the cause, please follow our official accounts for latest update.

Thanks!— vee.finance🔺 (@VeeFinance) September 20, 2021

The protocol confirmed via a blog post that a hacker was able to exploit a trade-contract address, making away with 8,804 ETH and about 214 BTC – roughly US$35 million.

At the time of writing, Vee Finance has not elaborated further on details of how the exploit occurred, but said in its blog that it would “continue to try to contact the attacker to recover the assets”.

As you would expect, the VEE token has been dipping sharply on the news. It’s currently down 42.9% since this time yesterday, and down 88.7% since its all-time high not long after its launch, almost a week ago.

PayPal launches all-in-one ‘super app’

Global payments giant PayPal has released a new version of its mobile app that aims to be an all-in-one solution for its customers’ digital payments, including crypto.

According to a press release today, the app provides support for a high-yield savings account through Synchrony Bank, in-app shopping tools, deals and rewards, bill management, direct deposits and, among other things, the management of crypto payments.

“The number of consumers using digital wallets is expected to double to 4.4 billion globally by 2025,” reads the PayPal statement, “and nearly half of consumers (48%) already cite simplicity as the top reason to use a digital wallet.”

The new-look app has rolled out just a few days after PayPal’s official crypto-payments expansion into the UK took place. Along with US citizens, Brits can now, too, use PayPal to buy, hold and sell Bitcoin, Ethereum, Litecoin and Bitcoin Cash.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.