Crypto roundup: Bitcoin dips deeper amid short-squeeze hopes; US lawmakers push back on tax updates

Fancy a short squeeze? (Getty Images)

Bitcoin is chopping around below US$59k today and looking like it’s about to head lower at the time of writing. Hopes for a short-squeeze-fuelled rally in the not-too-distant are keeping bulls interested, though.

The US Dollar Index (DXY) is still riding high (95.78), the loftiest level it’s been in about 16 months, and this might be partly, or even mainly, the cause for some weakening Bitcoin and crypto price action just at the moment.

Like gold, Bitcoin (BTC) is an inflation hedge, or so the popular thesis goes. When the dollar strengthens on inflation-containment news such as interest-rate hikes, then BTC weakens. And vice versa. In simplistic, first-day-of-economics-class terms, that’s usually how things tend to play out. (Please forgive, if you’re more than aware.)

Will we get a corrective or consolidating move for the DXY in the next week or so? That’s what Bitcoin and crypto fans will be counting on.

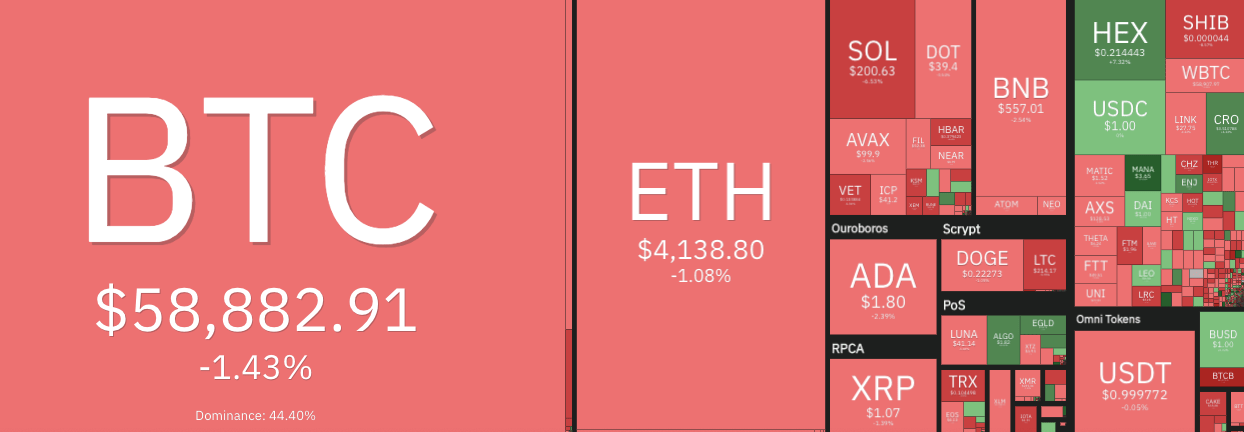

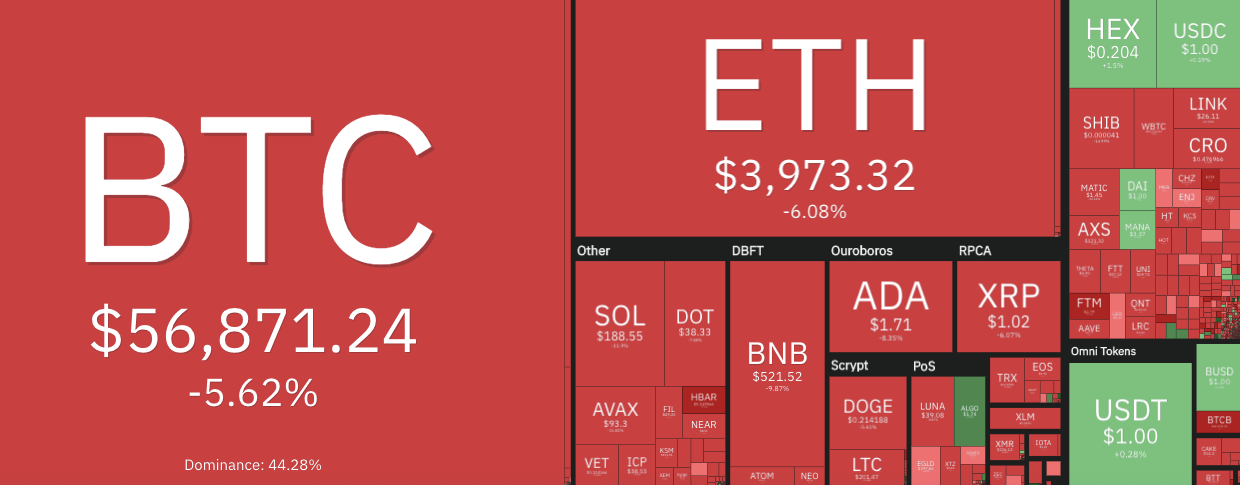

In the meantime, the entire crypto market cap has slid a bit further, down 2.6 per cent since yesterday and, according to CoinGecko data, trying to hang on to about US$2.68 trillion, give or take a few hundred billion.

The top 10 by market cap today is a 100 per cent red zone (excluding stablecoins USDT and USDC), and the same goes for the vast majority of the top 100.

There are, however, some interesting outliers, including: gaming/metaverse projects Decentraland (MANA) +15%; The Sandbox (SAND) +26%; Enjin (ENJ) +7%; and Gala (GALA) +31%… plus layer 1 smart-contract protocols Algorand (ALGO) +11% and Elrond (EGLD) +6%.

Bitcoin in search of a bottom

As for the Market Mover in Chief (that’d be Bitcoin), let’s take a look at how some analysts and traders are reading things…

Hold my hand

Im diving in pic.twitter.com/Fldgenz4jO

— TheoTrader 🏰 (@theo_crypto99) November 18, 2021

Amid all the choppy, generally blood-red price action this week for the OG crypto, there are quite a few observers predicting (and hoping) a short-squeeze pump will follow before too long.

https://twitter.com/LUNA_UST/status/1461270653752029187

A short squeeze is the resulting action that sometimes plays out when market leverage traders bet against the price performance of an asset (shorting) at the same time. It’s not overly common, but when it occurs, the price of the asset squeezes up dramatically as the short sellers quickly scramble to cut their losses.

Trading, eh? It’s a high-stakes, high-risk game – gotta know what you’re doing. (This author is more of an investor and a trading noob, by the way, which is why he doesn’t actually attempt to trade at this point. But it’s also why he’s taking a course to discover those dark arts. More on that, soon.)

History repeats? pic.twitter.com/zUdFAow4qI

— Ed_NL (@Crypto_Ed_NL) November 18, 2021

In the meantime, though, we simply can’t type this article fast enough – the BTC price is indeed dipping heavily, falling just under US$57k just now. Will we see it fall down to the US$52k-$53k levels some analysts are predicting? It’s a distinct possibility.

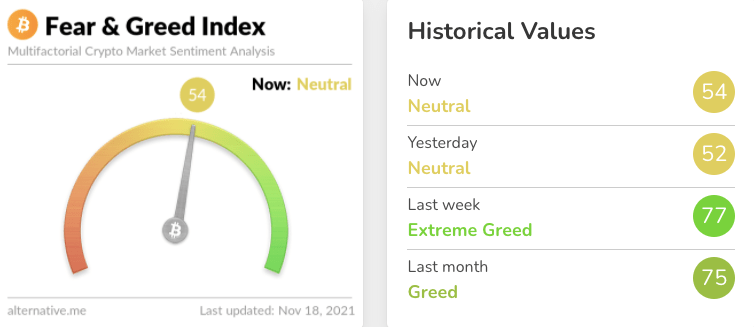

If that happens, keep an eye on the Fear and Greed Index. If it dips into Fear… even Extreme Fear… then “the bottom” might not be far away. Possibly.

If you FOMO on a green day…

You won't have enough ammo to FOMO on a red day

If you must FOMO – choose a red day#BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) November 18, 2021

News: US crypto-tax pushback; Acala wins parachain slot

Before we get out of here for the moment, let’s quickly catch up on just a few of the bigger stories from the past 24 hours that we haven’t yet covered…

• A bipartisan group of nine US Congress lawmakers have drafted a bill to amend the controversial crypto-tax-related provisions in the US$1 trillion infrastructure bill signed into law by President Joe Biden this week. The new bill is called the “Keep Innovation in America Act“.

This is the little bill I discussed a few days ago https://t.co/3qCRX0ApJC https://t.co/BhHZyCItsg

— Charles Hoskinson (@IOHK_Charles) November 18, 2021

• Acala, a DeFi hub project designed to help build out the Polkadot ecosystem, has won the blockchain’s first-ever parachain auction, with more than 32 million DOT (about US$1.3 billion worth at the time of victory) contributed by over 81,000 community members.

The project only just edged out Moonbeam, an Ethereum-compatability bridging project, which is an extremely high chance of securing the next auction. The winner of the second parachain slot will be announced on November 25.

Congratulations to @AcalaNetwork for winning Polkadot's first parachain auction!

Acala will be onboarded at block #8179200 [Dec. 18] at the beginning of lease 6 with the other first 5 auction winners. Over 81K network stakeholders locked up DOT in favor!https://t.co/ZFSzezZAFX pic.twitter.com/Xn0hItfHrm

— Polkadot (@Polkadot) November 18, 2021

• Time Magazine is set to hold Ethereum (ETH) on its balance sheet, as part of a deal with Mike Novogratz’s Galaxy Digital. The partnership will see the long-running American magazine and media outlet produce a weekly newsletter focused on… buzzword alert… the metaverse, with an educational and newsy bent.

• Oh… and breaking news. Was just about to go make dinner and then this little nugget happened (see below). As for BTC, at a bit beyond press time it’s pumped back up by about US$1,000 (US$57.8k).

💥BREAKING: PayPal has enabled #Bitcoin payments at checkout with millions of merchants!

— Bitcoin Archive (@BTC_Archive) November 18, 2021

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.