Crypto roundup: ‘Bitcoin car’ places eighth; Arbitrum now in beta; crypto recovers from crash

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

More than 250 crypto teams have requested access to an Ethereum scaling solution that launched in beta over the weekend, the project says.

“The developer interest and enthusiasm for Arbitrum has exceeded our wildest expectations,” Offchain Labs, the team behind Arbitrum, said in a Medium post.

Offchain Labs plans to onboard those projects onto Aribtrum One for the next fortnight before opening the rollup chain to end users.

Uniswap, Sushiswap, Bancor, Chainlink, Curve Finance are among the projects that will be building on the platform.

Arbitrum reduces Ethereum fees by more than 50 times for most workloads, Offchain Labs said.

Ethereum gas fees were averaging 0.0024 Ether, or A$7.37, over the last 24 hours, according to Etherscan, and during periods of volatility this year have reached a one-day average of A$90.

Arbitrum works by moving smart contract transactions off of layer 1 Ethereum and onto its native layer 2 environment, only publishing fraud proofs onto the base layer.

Unfortunately for investors, there doesn’t appear to be any way to invest in Arbitrum, which has no native token.

There’s a number of other Ethereum scaling solutions being developed, including Polygon, which has a native token — MATIC — and Optimistic, which doesn’t at present.

Cryptos recovering

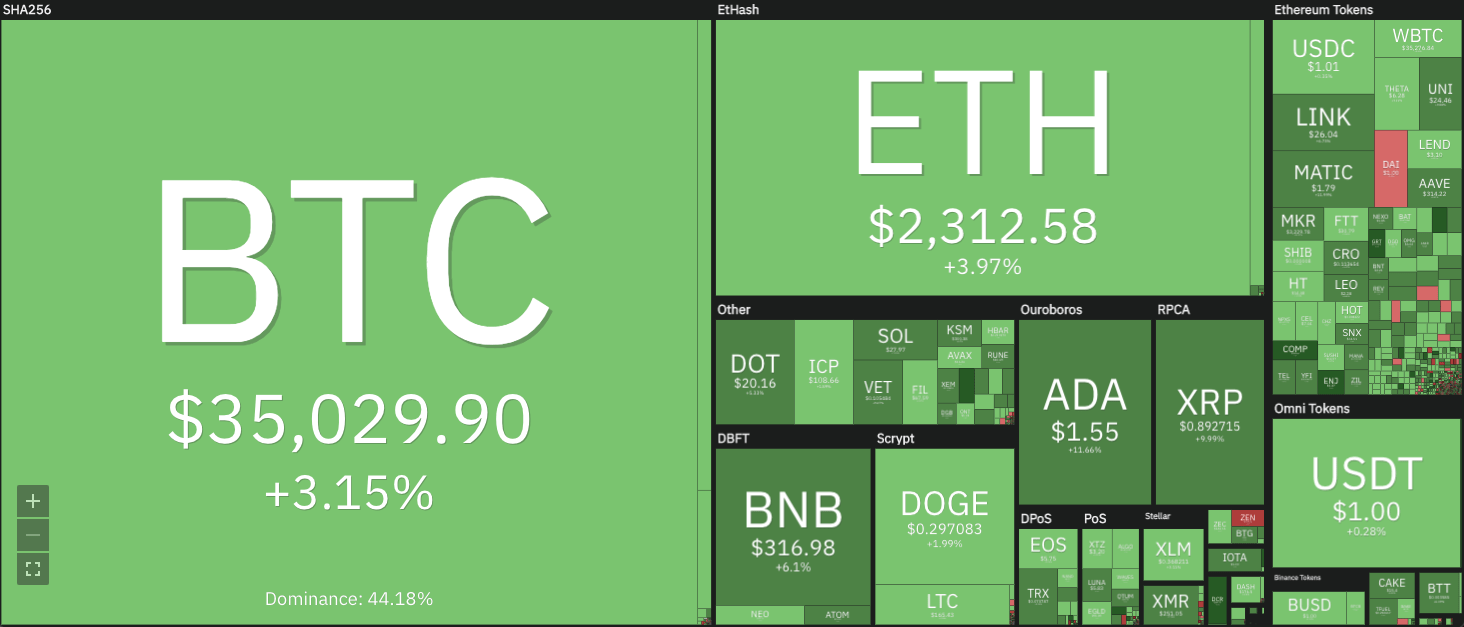

Nearly every top 100 token was up this morning, compared to the past 24 hours, bouncing back after another weekend selloff.

Memorial day weekend dump, sweet! #bitcoin #crypto

— Lark Davis (@TheCryptoLark) May 30, 2021

Bitcoin was trading at US$35,220 ($45,630) at 11.40am, up 4.2 per cent from the same time Sunday, and up 2.1 per cent from a week ago.

Ethereum was changing hands at US$2,338 ($3,030), up 5.7 per cent for the day and 12.6 per cent for the week.

Every non-stablecoin in the top 100 was in the green, save for Horizen (REN), which was down 7.9 per cent after rallying earlier in the week.

The Graph was the top performer, up 22.3 per cent, followed by Near, which had gained 19.1 per cent.

Helium, the No. 71 token, on Saturday became the first top 100 coin to hit an all-time high since the May 19 crash, trading for US$22.31, according to Coingolive.

On Monday it was down nearly 30 per cent from that level, however, at US$16.

The token is used to power a wireless infrastructure network that Helium says costs a fraction of traditional cellular networks.

Most other tokens still have a long way to go to recover from the crash, however.

Bitcoin, which tends to drive the market, twice last week traded for over US$40,000 – but only briefly. But dips to around US$33,000 to $US34,000 have been snapped up pretty quickly.

#Bitcoin continues to develop an intraday trading range on the 4 hour timeframe. Could potentially be making a Last Point fo Support (LPS) in Phase C. But needs further confirmation still with a Sign of Strength rally, otherwise could see a further test of the lows of the range. pic.twitter.com/ZQZsYKfnJr

— Stage Analysis (@stageanalysis) May 30, 2021

‘Bitcoin car’ places eighth

Meanwhile, a “Bitcoin Chevrolet” raced this morning (Australian time) in America’s most famous IndyCar motor race and led for much of the first-half — ultimately its rookie driver was unable to capitalise on his front-row start.

Still, 20-year-old Rinus VeeKay finished a respectable eighth out of 33 drivers in the Indianapolis 500, a 200-lap, 500-mile (805km) race.

P8 in my second #Indy500. Led 32 laps and was right in contention to win the race. A few unfortunate moments on the last pit cycle sent us back down the field. After all, awesome month of May and really proud at everyone @ecrindy, the #Bitcoin car was insanely fast! pic.twitter.com/L9uzIx9XfU

— Rinus VeeKay (@rinusveekay) May 30, 2021

He also managed to avoid a result that would have really given wags something to write about.

as far as im concerned the bitcoin car has one job: don’t crash

— Neeraj K. Agrawal (@NeerajKA) May 30, 2021

VeeKay competes for Ed Carpenter Racing, which has also begun offering Bitcoin as a payment option for all of its employees.

“I could not be more excited that this project is becoming a reality. To bring my personal interest and immersion in Bitcoin to our industry is historic,” owner/driver Carpenter (who placed fifth) said earlier this month.

“Just as Bitcoin is revolutionizing our financial system, I see it as an opportunity to transform how we operate within our own motorsport industry.”

For the first time in my career, one of my cars isn’t funded by a corporation, but rather by the people. By you.

This race is bigger than racing.

For the first time, the Indy 500 is about a community of individuals and all we’re trying to accomplish in building #Bitcoin

— Ed Carpenter (@edcarpenter20) May 30, 2021

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.