Crypto news: USDC flips Solana; Near on the rise as cryptos dip again; Fed blamed for selloff

US Fed Chair Jerome Powell (Pic: Getty)

USDC Coin has moved past Solana to become the No. 5 crypto, as the once red-hot high-speed layer 1 blockchain struggles to deal with denial of service attacks.

As recently as December 26, USDC was ranked eighth by Coinmarketcap, also behind Cardano and XRP. But those coins have suffered double-digit losses since, while USDC’s supply has increased slightly.

Its market cap of US$42.3 billion still puts it well behind the leading stablecoin Tether, which also dominates the entire crypto market by trading volume.

But USDC is coming on strong. Its circulating supply is up more than ninefold from a year ago, while Tether’s market cap has roughly tripled.

Near pumps again

Near Protocol has been the biggest gainer in the past 24 hours, rising 15.2 per cent to US$15.47. It hit an all-time high of $17.60 back on January 4.

There is a consensus between everyone I know who is smarter than myself and have hit massive homeruns in the past with evaluating protocols.$NEAR is grossly undervalued.

— Ryan Cantering Clark (@CanteringClark) January 9, 2022

Cosmos (ATOM) had advanced 8.6 per cent to $38, making it the second-biggest gainer. Oasis Network followed with a 6.6 per cent gains.

Gnosis was the biggest loser, dropping 15.4 per cent to $403, followed by THORChain, down 8.6 per cent.

Crypto market down 1.7%

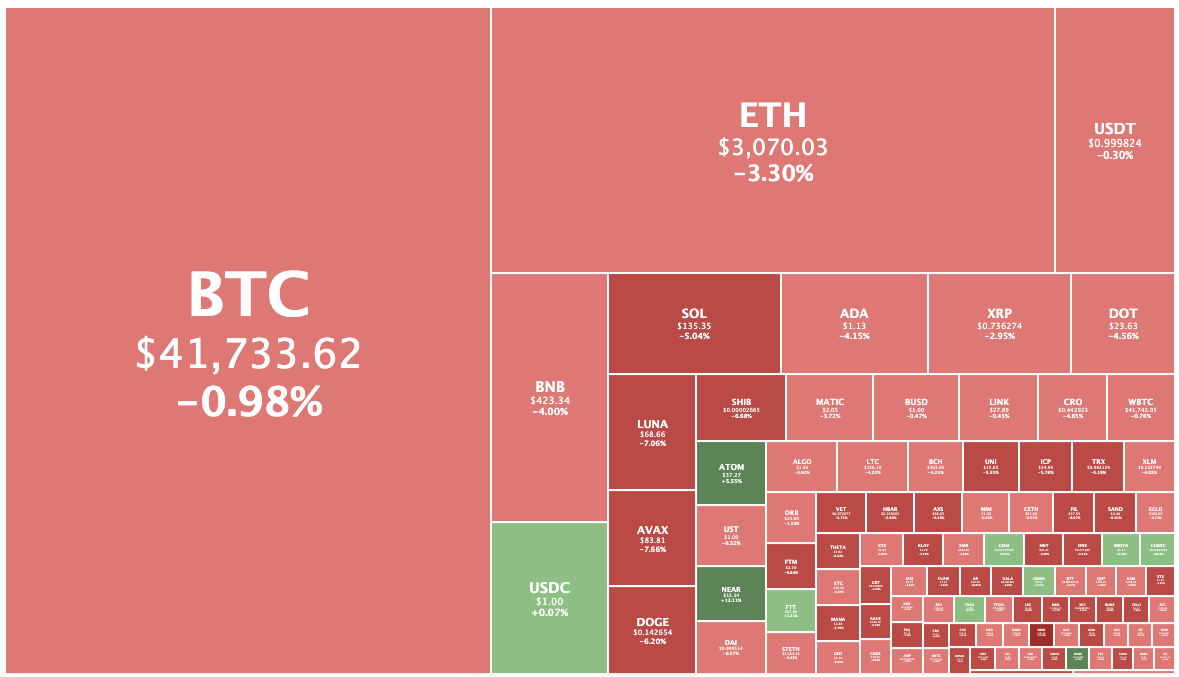

Overall the crypto market was at US$1.94 trillion, down 1.71 per cent from yesterday.

Bitcoin was down 0.5 per cent to US$41,747, while Ethereum was down 2.9 per cent to $3,070.

‘Momentum works both ways’

Pepperstone head of research Chris Weston offered his perspective on the crypto sell-off this morning on Ausbiz, telling the streaming TV service that while there were interesting and innovative things going on in the sector, Bitcoin had been a major beneficiary of the monetary stimulus measures put in place during the coronavirus crisis.

“This was a liquidity beneficiary – and you know, you buy everything under a world of QE (quantitative easing); you buy everything under zero interest rates and negative interest rates,” Weston said.

“The opposite is true now.

“Quantitative tightening, which we’re front-running, is designed specifically to take people back out of the risk curve, is designed to reduce asset prices and tighten financial conditions.

“And Bitcoin is caught up in that — you don’t fight the Fed. You’re basically short at the moment. … it’s a momentum vehicle, and momentum works both ways.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.