Crypto news: Bitcoin spot ETF denied by SEC; market still cooling off a bit

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

The VanEck “spot” Bitcoin exchange-traded fund has been rejected by the US Securities and Exchange Commission today. Meanwhile, it’s another market-dipping day.

Hopes have been, if not high, at least existent for the approval of investment firm VanEck’s Bitcoin ETF application.

It’s an ETF that would directly track the price of Bitcoin and allow the asset to be “physically” held in custody, as opposed to the currently approved futures-backed BTC ETFs in the US.

A spot ETF approval has been widely regarded as a further potential Bitcoin and crypto price-pumping catalyst. Alas, for now, it’s not to be. But it always felt like a long shot, given the rhetoric from SEC boss Gary Gensler over the past several months.

We are disappointed in today’s update from the SEC declining approval of our physical bitcoin ETF. We believe that investors should be able to gain #BTC exposure through a regulated fund and that a non-futures ETF structure is the superior approach. @tyler @gaborgurbacs

— Jan van Eck (@JanvanEck3) November 12, 2021

Spot ETF on #Bitcoin rejected, which might be fueling a potential negative sentiment on the markets.

A rejection isn't a bad cause, it's standard. Just delay until we get it.

And prices that are correcting -> just a chance to start buying cheaper assets.

Positivity.

— Michaël van de Poppe (@CryptoMichNL) November 12, 2021

In its ruling, the SEC once again expressed its concerns that the Bitcoin spot market is subject to “fraud and manipulation”.

For the moment then, American-based institutional investors will have to suffice with Bitcoin ETFs linked to futures – contracts that bet on the future price of BTC.

Mooners and shakers

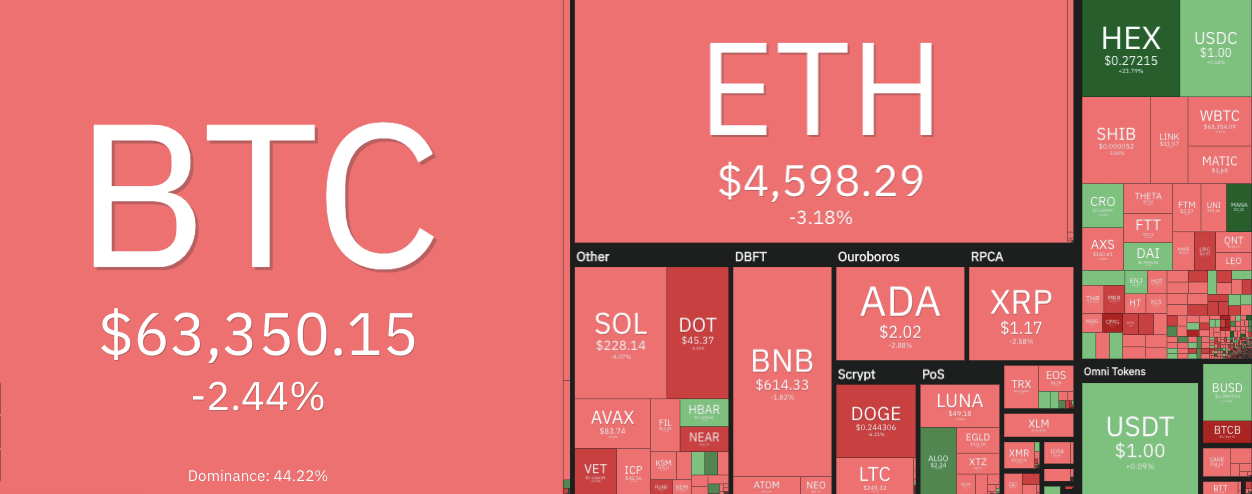

At the time of writing, the overall crypto market cap, according to CoinGecko, is down about another three per cent since this time yesterday. It’s zoning in around the US$2.91 trillion level.

The dippage is nothing to freak out about – at least that’s the overwhelming consensus of the numerous crypto technical analysts we’re following on social media.

Sure, many are pointing to a “rising wedge” pattern in the charts for Bitcoin, which is a bearish signal for a further break down…

Important region for #Bitcoin to hold here, but still a rising wedge structure.

For bullish perspectives I'd want to see it break $65.5-66K. pic.twitter.com/tZVRQNsHfQ

— Michaël van de Poppe (@CryptoMichNL) November 12, 2021

#Bitcoin at rising wedge support.

If we breakdown here orange support looks likely.#BTC spot ETF was rejected too – could lead to some potential downside pic.twitter.com/Z13A9VBGbG

— CryptoTee (@Cryptoteeee) November 12, 2021

Rising wedges aside, analytical thought is still strong among many, however, that the Bitcoin/crypto bull market remains completely intact, even if things were to take a sizeable dip in the next day or so.

After all, experienced crypto traders and HODLers are well used to swift, temporary retracements of 30 per cent or more, even in bull markets. In fact, especially in bull markets – whales need to take their profits.

Is #BTC in a new Bear Market?

We can either follow emotion or follow reason when it comes to answering that question

Most data science models that have been reliable predictors for years suggest $BTC is still in a Bull Market

I'll stick to the data science models#Bitcoin

— Rekt Capital (@rektcapital) November 12, 2021

In the meantime, let’s look for a positive note or three to finish on in the top 100 by market cap… At press time, the layer 1 smart-contract platform Algorand (ALGO), founded by MIT professor Silvio Micali, is up a pretty decent 13 per cent in the past 24 hours.

Can’t see any particular catalysts for that, but it does have a rapidly expanding ecosystem…

The @Algorand ecosystem is also expanding recently.

Let’s take a look into it.$ALGO #ALGO #Algorand pic.twitter.com/9xLbeS1nHI— Coin98 Analytics (@Coin98Analytics) November 12, 2021

A selection of other notables going against the grain and faring pretty well today include: OG crypto metaverse Decentraland (MANA) +26%; fellow gaming metaverse The Sandbox (SAND) +9%; and Helium (HNT) +8%, a project Stockhead took a good look at back in July.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.