Crypto market cracks $3 trillion, Bitcoin soars, ETH hits new high; Zimbabwe making BTC legal-tender move?

Getty Images

“Moonvember” or Pumpvember… whatever you want to call it (maybe just November), it seems to be real and happening with the week in crypto off to a flyer so far.

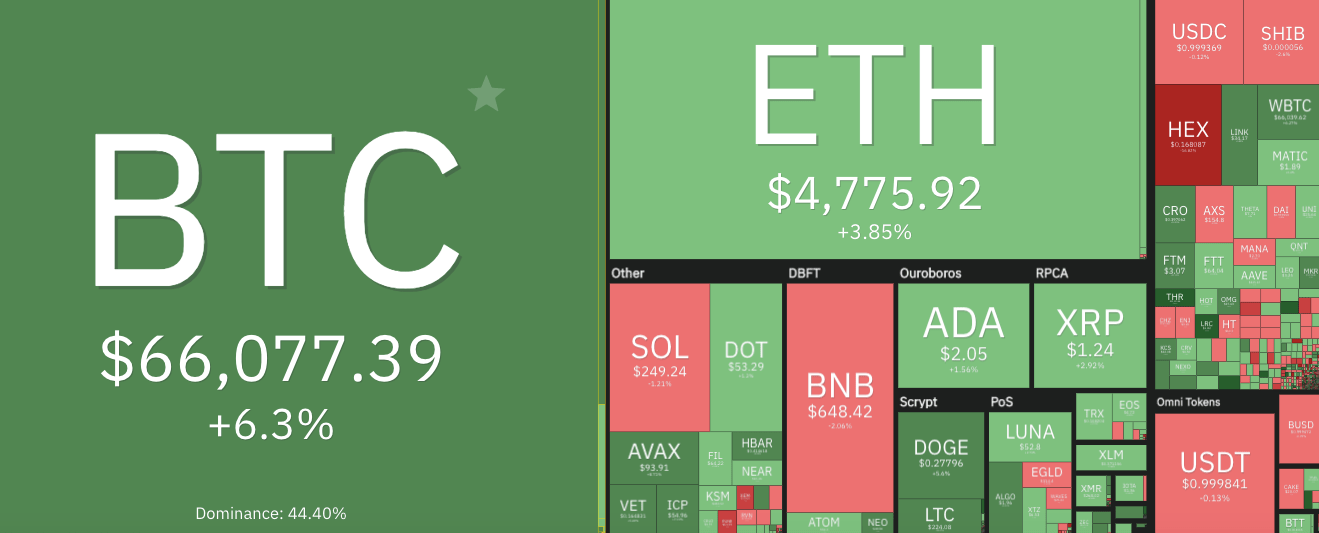

At the time of writing, the entire market is sitting about $23 billion above the US$3 trillion mark, having cracked it for the first time ever earlier today.

Bitcoin (BTC), having successfully bounced off the 21-day exponential moving average (a chart indicator commonly referred to by technical analysts as a bullish line to stay above), is currently changing hands for US$66,077, up about six per cent since this time yesterday.

Long-time no.2 on the market cap charts, Ethereum (ETH), meanwhile, smashed a personal best about an hour ago, reaching US$4,803. It’s currently up about four per cent in the past 24 hours.

Ethereum is now in “price discovery” mode, as the analysts say, and eyeing off US$5K next.

$ETH has broken its final major resistance and has made yet another new All Time High

In Price Discovery right now#Crypto #Ethereum https://t.co/6TrFnn8PSl pic.twitter.com/v1Alv49Z1H

— Rekt Capital (@rektcapital) November 8, 2021

And as for the OG crypto, the market is frothing with bullish rumours today about two further things that could act as catalysts for further positive price action in the near future.

The first rumour is that a spot-traded Bitcoin exchange-traded fund (the one the crypto market really wants) could be on the way for approval from the US Securities and Exchange Commission (SEC). Some industry figures and influencers seem to be suggesting it might even happen this week…

Are we getting a spot #bitcoin ETF this week? If GBTC gets converted then hold onto your butts!!!! https://t.co/YdvSToKW0n

— Lark Davis (@TheCryptoLark) November 8, 2021

Barry Silbert, as seen in the above initial tweet, is the founder and CEO of Digital Currency Group, which owns Grayscale – the largest institutional digital asset manager in the business, with US$50 billion worth of assets under management.

Bloomberg’s Senior ETF analyst Eric Balchunas, however, thinks a spot, “physically backed” BTC ETF is still unlikely to happen before the year’s out…

23 NFL teams have better odds to win the Super Bowl than a spot Bitcoin ETF does of getting approved in 2021 IMO. Of course we think they SHOULD approve we just don't think they WILL. Prob see some more futures ETF launches tho. pic.twitter.com/qlThbdiLyi

— Eric Balchunas (@EricBalchunas) November 8, 2021

Will Zimbabwe follow El Salvador’s Bitcoin lead?

The other potential catalyst for further moon-targeting price pumpage could be this…

Wow, massive news!

Another massive country is looking to adopt #Bitcoin as legal payment option.

It's Zimbabwe.

Massive.

Absolutely massive! pic.twitter.com/zWdaCTvxfw— Michaël van de Poppe (@CryptoMichNL) November 8, 2021

According to a Cointelegraph article and local Zimbabwean news today, Zimbabwe’s government is currently “engaged in consultations” regarding increasing interest in crypto and its potential benefits and risks.

The government is said to be considering utilising Bitcoin as a legal payments option to meet growing interest and demand in its country, similar to how El Salvador officially adopted it as legal tender in September.

According to the news, retired Brigadier Colonel Charles Wekwete, the permanent secretary and head of the office of the president and cabinet’s e-government technology unit, said that discussions with businesses are already underway regarding Bitcoin and cryptocurrencies.

As mentioned, though, the government’s officials are currently weighing up pros and cons under consultation with a wide variety of sectors. It’s treading with caution for now and sees risk… but it also sees a “possible avenue for growth”.

For people living in countries that have recently felt or are currently feeling the impacts of intense currency debasement, #Bitcoin is an obvious solution once leaders within the country understand it can’t be shutdown by any outside authority. Some even argue it’s inevitable. https://t.co/f8XAlGd3ED

— Preston Pysh (@PrestonPysh) November 8, 2021

Mooners and shakers: ADA moves a bit, AVAX moves a lot

There’s plenty of green to be seen up and down the market cap lists today, so let’s go hunting for some standout performers. And maybe the odd thing that’s not doing so well, or might have cooled off a bit after recently pumping…

It’s not as dramatic as some, but in the top 10, where large market caps are harder to move, layer 1 smart-contract platform Cardano (ADA) seems to be getting a bit of love again. It’s changing hands back at US$2.10, up about four per cent since this time yesterday.

The upcoming decentralised exchange SundaeSwap is building out and increasing its interoperability within the Cardano network. Might be one to keep an eye on, as DEXs, such as UniSwap, SushiSwap, Trader Joe and many others have been strong movers in the past for other ecosystems.

Cardano's DEX @SundaeSwap now processes transactions through dApp Connector by @YoroiWallet: Details #Cardano $ADA https://t.co/W3zql9OXlI

— U.Today (@Utoday_en) November 8, 2021

More significantly today, though, one of Cardano’s upstart rivals, Avalanche (AVAX), has pounded through another all-time high today, reaching US$96.46 a few hours ago. It’s up about 6.5 per cent in the past 24 hours. We’ll just leave this tweet here…

As the digital asset ecosystem continues to grow, so too does our list of assets under consideration. This week, #Avalanche ( $AVAX) and #Terra ( $LUNA) joined that list.

Follow along for further updates: https://t.co/JHnVrYrbPI— Grayscale (@Grayscale) November 4, 2021

Other eye-catchers in the top 100 include, Litecoin (LTC) +14%; Algorand (ALGO) +11%; Crypto.com (CRO) +15%; Loopring (LRC) +37%; Basic Attention Token (BAT) +18.5%; Kucoin (KCS) +14%.

Meanwhile, possibly representing a potential opportunity or two further down the list, we have strong metaverse gaming project Wilder World (WILD) selling off a bit today and down about 10%; NFT platform Epik Prime (EPIK) -8.5%; and Polkadot decentralised exchange Polkadex (PDEX) -7%.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.