Crypto lobbying expenditure in the US doubled last year, with Ripple Labs leading the way

Getty Images

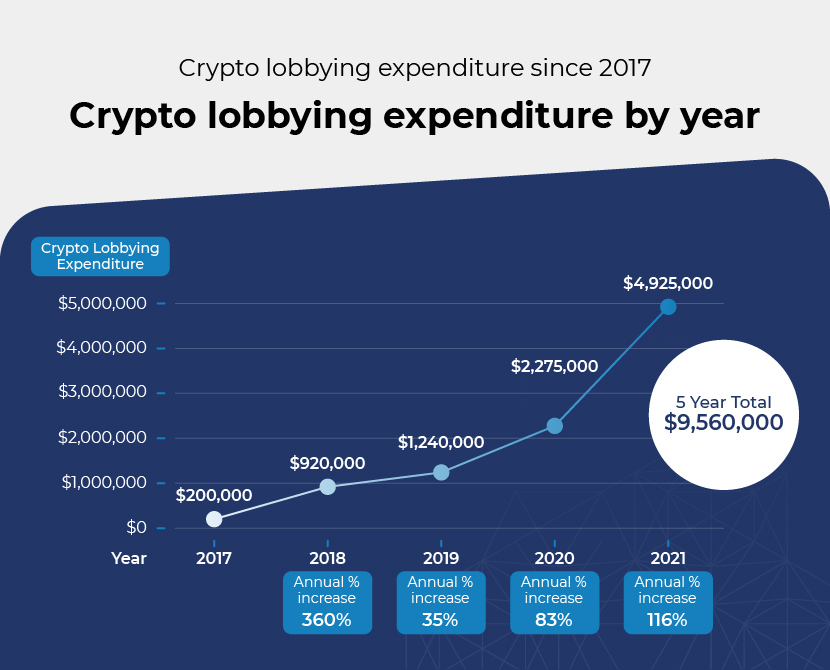

A new study has revealed that spending on crypto lobbying in the US increased by 116 per cent in 2021, bringing the total lobbying expenditure to US$9.56 million.

The 2021 figure totalled US4.9 million – more than twice as much as 2020’s US$2.3 million expenditure.

This shows that the crypto and blockchain industry, which is obviously global but certainly spearheaded in America, is taking concerns about the legislation of cryptocurrencies in the US extremely seriously.

There are lingering concerns that the Biden administration could yet regulate crypto into a pretty tight and difficult corner this year, as well as worries about how those in power perceive crypto mining’s affect on the environment and decentralised finance’s power to disrupt traditional financial models.

Nevertheless, for all the crypto-negativity emanating from certain US Senators and Treasury officials, there are also strong voices in the halls of American power supportive of the industry. Perhaps the lobbying has actually been having an effect.

some good news.

we are on track for newly minted crypto (from things like mining or staking) to be taxed at sale rather than creation

— Neeraj K. Agrawal (@NeerajKA) February 3, 2022

The research, conducted by crypto analytics startup Crypto Head, analysed data obtained from the research and government transparency group Open Secrets and reveals how much crypto companies have spent on lobbying in the US and which ones spent the most money.

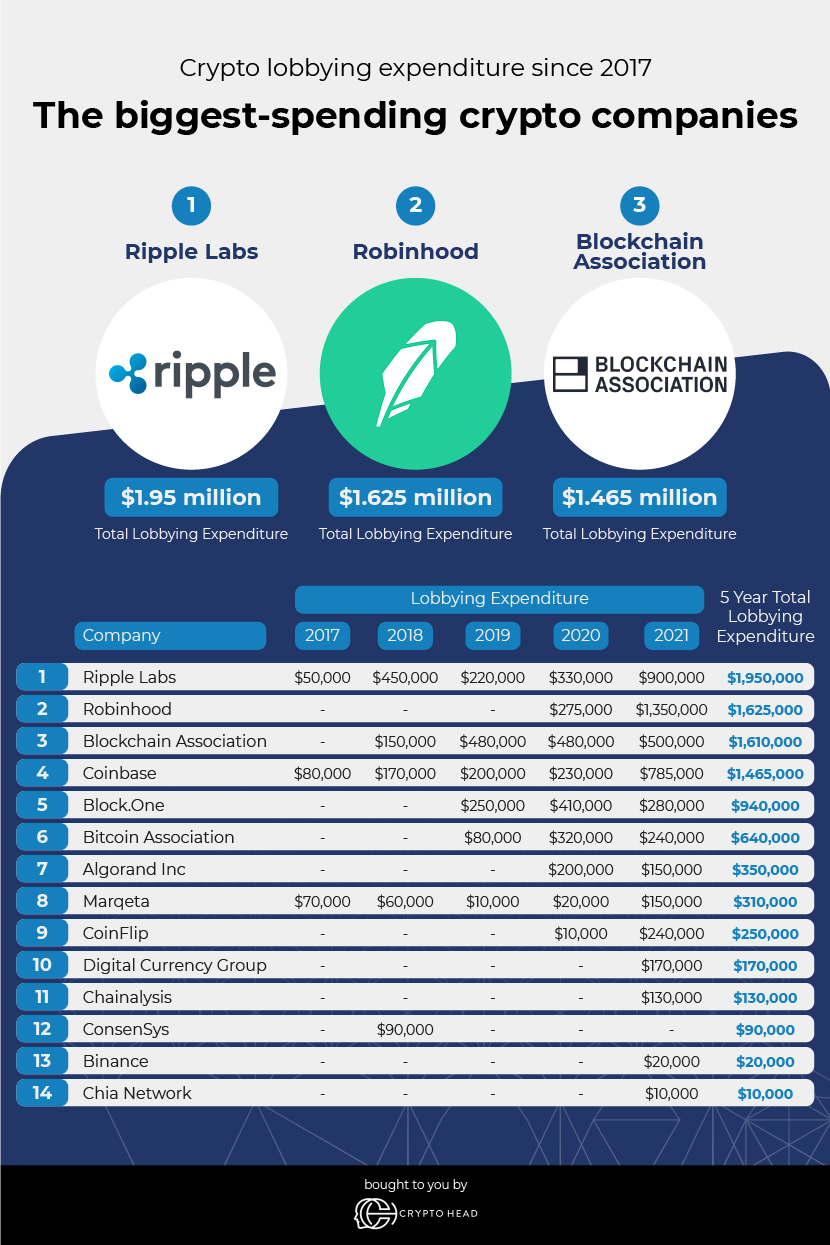

According to the report, Ripple Labs, the developer of permissionless payments protocol and cryptocurrency XRP, is the biggest-spending crypto company in the US over the past five years, with lobbying expenses totalling nearly US$2 million.

Ripple Labs is “possibly the most influential crypto company in the USA when it comes to affecting government policy and regulation,” claims the study, which was shared with Stockhead.

This takes on added significance, given the fact Ripple Labs has been involved in an excruciating lawsuit for more than a year, filed by the US Securities and Exchange Commission in late 2020. The regulators allege that the firm was involved in a US$1.3 billion unregistered securities offering of XRP.

Other lobbyists include the crypto-enabling stock-trading app Robinhood; the industry’s advocates group Blockchain Association; the crypto-exchange giant Coinbase, and Block.One – the developer of the EOSIO blockchain and EOS cryptocurrency.

According to the data, Coinbase was the biggest-spending lobbying blockchain company in 2021, with expenses totaling more than US$1.3 million.

Both Coinbase and Robinhood have been the subject of SEC scrutiny in the past 12 months. Last September, the regulator pressured Coinbase to ditch its crypto-yield program “Lend“, under the threat of a security-classifying lawsuit similar to the one it slapped into Ripple’s chest.

Robinhood, meanwhile, was ordered to pay about US$70 million in fines for “widespread and significant harm” to its users and “systemic supervisory failures”, as reported by Cointelegraph.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.