Balances of Bitcoin whales and shrimps ‘increasing meaningfully’: Glassnode

Bitcoin shrimp (okay, prawn) HODLers are increasing. (Getty Images)

Crypto just experienced its worst quarter in more than a decade, with a particularly brutal June and prolonged bear-market fears still dominating sentiment. Okay, Captain Obvious… any silver linings? Glassnode’s latest weekly report reveals some.

Titled “The Expulsion of Bitcoin Tourists”, the blockchain analytics firm’s July 4 Week Onchain report gives the overall gist that, yep, it’s a HODLers’ market alright.

“The Bitcoin bear is in full swing, and in its wake, the HODLers of last resort are the last ones standing,” wrote the pseudonymous Glassnode analyst UkuriaOC.

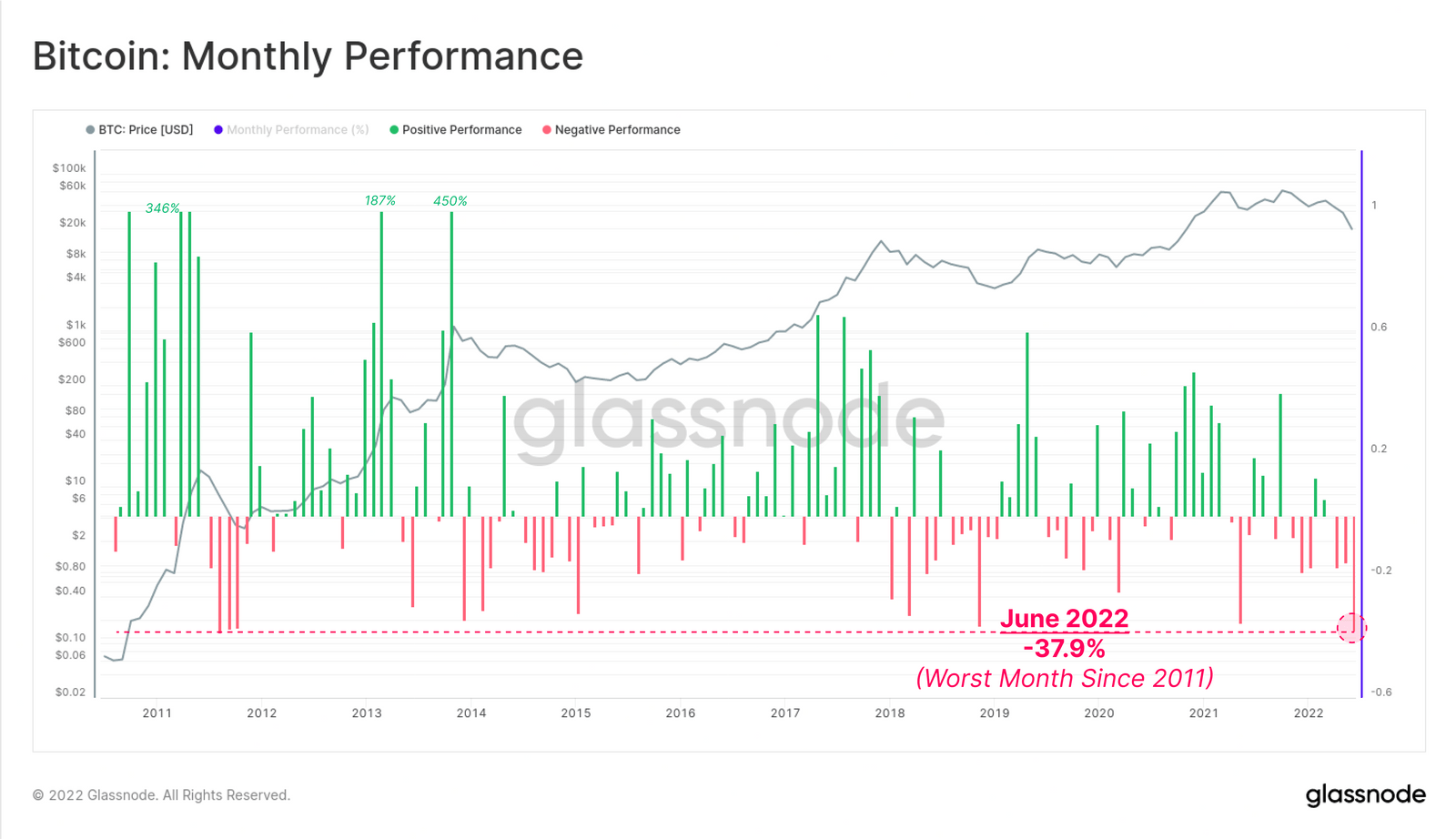

The report notes that June experienced Bitcoin prices trading down 37.9% – the worst monthly level in 11 years for the orange coin.

The analysis also indicates that fair-weather Bitcoin “tourists” have all but packed up and checked out of their hotels, which pretty much leaves the long-term investors holding and transacting in the leading crypto.

“The Bitcoin network is approaching a state where almost all speculative entities, and market tourists have been completely purged from the asset,” writes Glassnode.

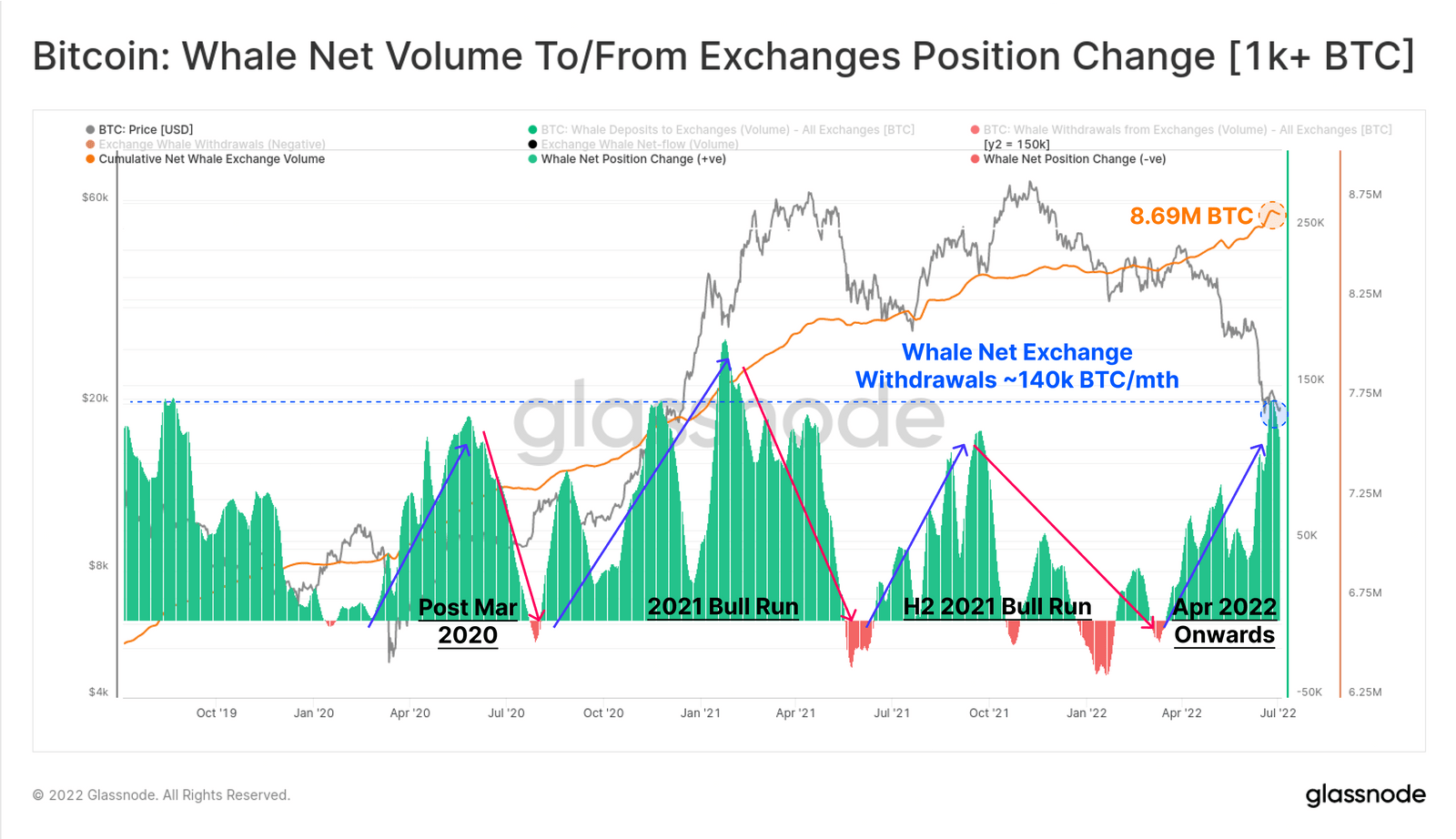

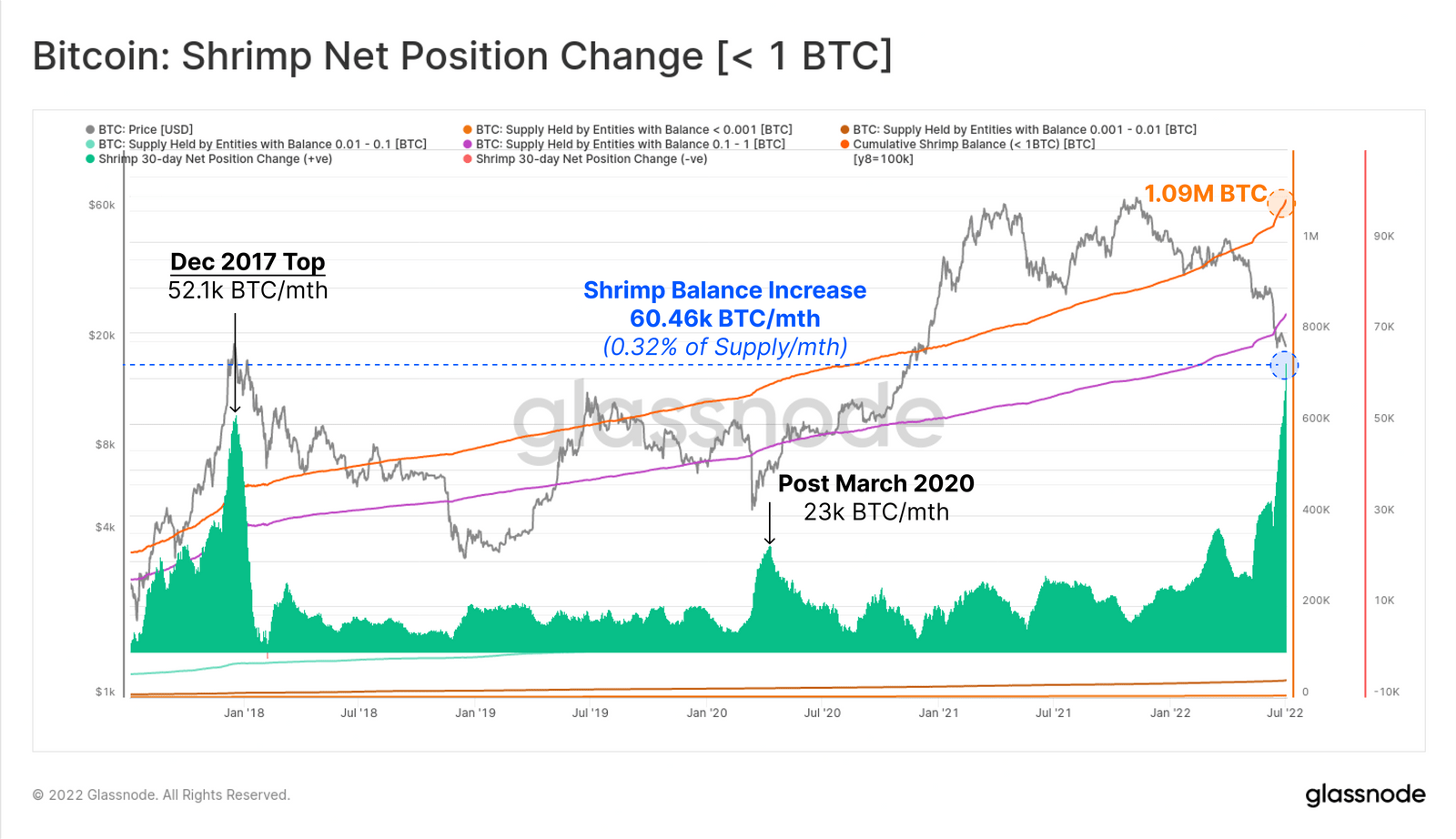

There’s a yin-yang element to this, though, because it appears there is some “meaningful accumulation” happening within significant sections of the HODLing faithful – the “shrimps” (those with less than one Bitcoin in their balance) and the “whales” (those holding 1,000-5,000 BTC, excluding miners and exchanges).

Further takeaways from Glassnode’s report

• Glassnode notes that since November 2021 the number of active addresses and entities has seen an overall downtrend, indicating less activity on the Bitcoin network in this time. And that would also explain the “purge” of the touristy investors, as the report puts it.

• However, cryptocurrency exchange reserves are draining – with the largest monthly outflow on record. This can be seen as a good thing for HODLer strength with more participants likely moving towards self custody of their crypto assets (eg. on cold-storage hardware wallets).

• And these coins “appear to be flowing into wallets with no history of spending”, with the balance growth and exchange withdrawal activity of both shrimps and whales “at historically aggressive levels”.

• In particular, the whales exchange volume activity since April has been “predominantly withdrawals, reaching a significant rate of 140k BTC/month in June” – the second-highest rate in the past five years.

Largest #bitcoin exchange outflow on record.

Probably nothing… pic.twitter.com/JaIcnAa2Tz

— Lark Davis (@TheCryptoLark) July 5, 2022

• Shrimps, meanwhile, appear to view Bitcoin around US$20k as an attractive price and are accumulating BTC at a rate of almost 60,500 per month. That’s the most “aggressive rate in history”, says Glassnode, equivalent to 0.32% of the circulating BTC supply per month”.

• The number of addresses with a non-zero balance, those that hold at least some Bitcoin, continues to hit all-time-highs and is currently at more than 42.3 million addresses. Past bear markets apparently saw a greater purge of these wallets.

• Overall, despite the plummeting price and Bitcoin network activity being at the “lower end of the ‘Low Activity’ channel typical of bear markets”, strong HODLer undertones persist.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.