Crypto goes ‘mainstream’ in Australia as amount of women owning digital assets doubles: report

(Getty Images)

There’s been a big increase in the amount of Australians buying crypto this year, according to the Independent Reserve exchange’s latest report. And that includes more Aussie women than ever.

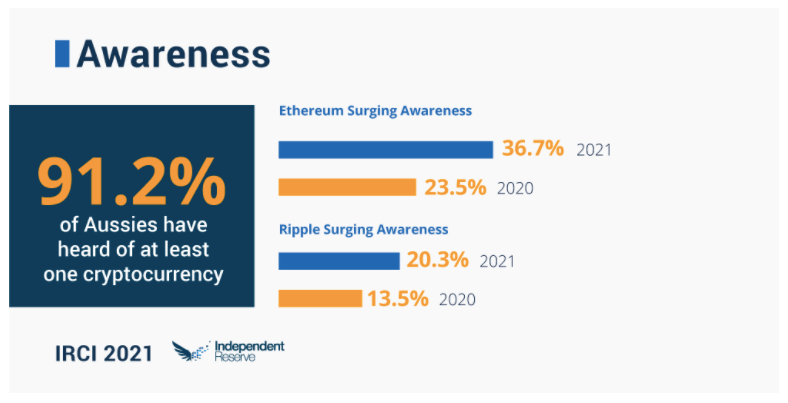

Now in its third year, the 2021 Independent Reserve’s Cryptocurrency Index (IRCI) is an annual survey of more than 2,000 Australians, tracking awareness, adoption, trust and confidence in cryptocurrencies.

Independent Reserve, which incidentally just partnered with the Sydney Swans AFL club, is one of Australia’s leading crypto exchanges, with more than 200,000 customers across Australia, New Zealand and Singapore.

Independent Reserve Market Update 📰

– Independent Reserve partners with the Sydney Swans 🦢

– 28.8% of Australians own #crypto (IRCI 2021) 📈

– BTC A$72K. Ether shows strength against #Bitcoin

#Cryptocurrency #BTC #ETHhttps://t.co/kJJOEzQIFh— Independent Reserve (@indepreserve) December 7, 2021

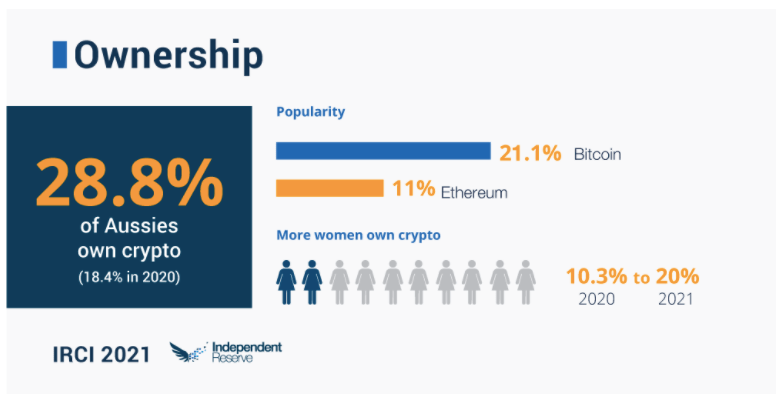

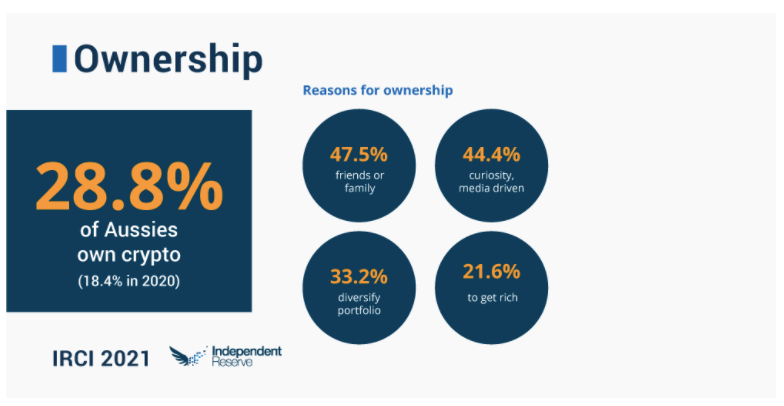

The report reveals that more than a quarter (28.8 per cent) of those surveyed say they own or have owned cryptocurrency, which is up from 18.4 per cent in 2020.

It’s a figure that might not surprise, given the growth of the entire crypto market cap valuation in 2021 (currently a bit above US$2.5 trillion) and the increasing institutional adoption globally and locally.

The other big takeaway from the report is the proportion of Aussie women getting involved in cryptocurrency. The survey’s figure has pretty much doubled since last year, moving from 10.1 per cent to 20 per cent.

“The data demonstrates how quickly crypto is moving into the mainstream as an asset class, from previously being perceived as fringe to now as an everyday investment opportunity adopted by more Australians of all ages,” said Independent Reserve CEO Adrian Przelozny.

The report’s key findings

• 28.8% of Australians now own or have owned crypto (up from 18.4% in 2020).

• The proportion of women who own crypto has doubled from 10.1% in 2020 to 20%.

• The percentage of female Bitcoin owners has risen from 8.3% to 14.8% over the past year.

• 89% of Aussie crypto owners have made money or broken even, up from 78% in 2020.

• Bitcoin remains the most well-known and popular crypto, ahead of Ethereum.

• 89.1% of surveyed Aussies are aware of Bitcoin and and 21.1% of them own it.

• 47.5% of Aussies say that “friends or family” are the most common influence on adopting crypto.

• The 24- to 34-year-old age group is the most trusting of crypto, with 27.6% saying they “bought in to get rich”.

• 26.6% said they would buy crypto if industry regulation was improved.

Related to this last point, Przelozny emphasised the Australian crypto industry “still desperately needs regulation to catch up” in order to give investors and businesses complete confidence to operate in the sector.

He did, however, acknowledge that October’s Senate Select Committee crypto-regulation recommendations were encouraging and that the exchange is “cautiously optimistic” about regulatory clarity.

“Although Australia’s regulators and government agencies may have taken a while to get their heads around cryptocurrency and other digital assets, Australians themselves have sped ahead into crypto, as the asset class moves from the fringe to the mainstream,” said Przelozny in the report’s foreword.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.