Crypto funding: ‘Everything is on sale’ – VC firm 776 creates bear market fund; Galaxy and Genesis team up

New, improved 'Kryptos'… get yours while stocks last. (Getty Images)

Bear market? What bear mar… okay, it’s time to retire that cliché. But crypto VCs are at it again, with hefty raises coming from 776, Galaxy and Genesis…

776 to launch bear-market capitalising fund ‘Kryptos’

Back in February this year, Bitcoin was sitting around $42k USD – a number that represented something closer to the “answer to life, the universe and everything” than the current doldrums – for not just Bitcoin maxis, but FOMO-chasing retail investors alike.

And at that time, we relayed the news to Coinhead readers that multi-millionaire Reddit co-founder Alexis Ohanian was aping into the crypto-funding/VC game with two funds focused on Web3/crypto startups – worth US$500 million in total.

Now he and his VC firm Seven Seven Six (776) are at it again, all set to launch a crypto-investment fund in October, worth another US$177.6 million. They really do like sevens and sixes.

This one is called “Kryptos” (yep, with a K) and, according to a report this week from The Information, it differs from the firm’s other funds in that it’s the only one that has focus on investing in, and managing, specific cryptos/digital assets – enabled through regulated, Securities and Exchange Commission compliancy.

According to 776 founding partner Katelin Holloway, it’s doing so in an attempt to capitalise on the current bear-market conditions for its investors…

“This is the best time to buy if you’re really long on the industry,” said Holloway. “It’s on sale. Everything is on sale.”

The firm is reportedly planning to charge investors a fee of 2.5% with a “universal profit-sharing plan” of 25%.

Galaxy and Genesis gee up with joint $500 million fund

Credit to Cointelegraph here for spotting this one… Two huge crypto investment managers – Galaxy Digital (run by the LUNA-tatt-tastic Mike Novogratz) and Genesis (the Winklevoss twins’ company) are apparently co-creating a whopping big US$500 million fund.

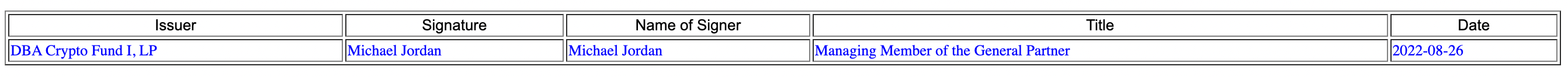

The New York-headquartered media outlet notes that the two companies have filed it with the SEC and it’s to be called the DBA Crypto Fund I, LP. Catchy stuff.

Other than the huge capital behind this one, there’s not much else to note about it at this stage, other than the words: “pooled investment”, “private equity” and “Managing Member of the General Partner, Michael Jordan”. (Nope, very probably not that MJ. Unless NFT fan Shaq has encouraged him to get into the sector.)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.