Crypto: Ethereum 2.0 rebranded, bruised and battered Bitcoin edges higher from 6 month low

Pic: Getty

It turns out those who said that Ethereum 2.0 would never happen were right after all.

The Ethereum Foundation is phasing out the term “Ethereum 2.0” as it prepares for the network’s upgrade in a few months.

Instead of “Eth1″ and Eth2” the foundation says the new terminology will be “execution layer” and “consensus layer”.

The terms Eth1 and Eth2 led people to think that the latter would replace the former, which isn’t true, the foundation said in a blog post.

We’ve removed all uses of ‘Eth2’ terminology on https://t.co/v9gxnMUQFz

Find out why https://t.co/84uJXSD4q1

— ethereum.org (@ethdotorg) January 24, 2022

“As the roadmap for Ethereum has evolved, Ethereum 2.0 has become an inaccurate representation of Ethereum’s roadmap,” the foundation said.

“Being careful and accurate in our word choice allows content on Ethereum to be understood by the broadest audience possible.”

Ethereum is still planning to merge the network into the Beacon chain sometime in the second quarter, transitioning the platform from proof-of-work to proof-of-stake. That will make mining Ethereum obsolete; instead users will have the opportunity to stake their Ether for rewards.

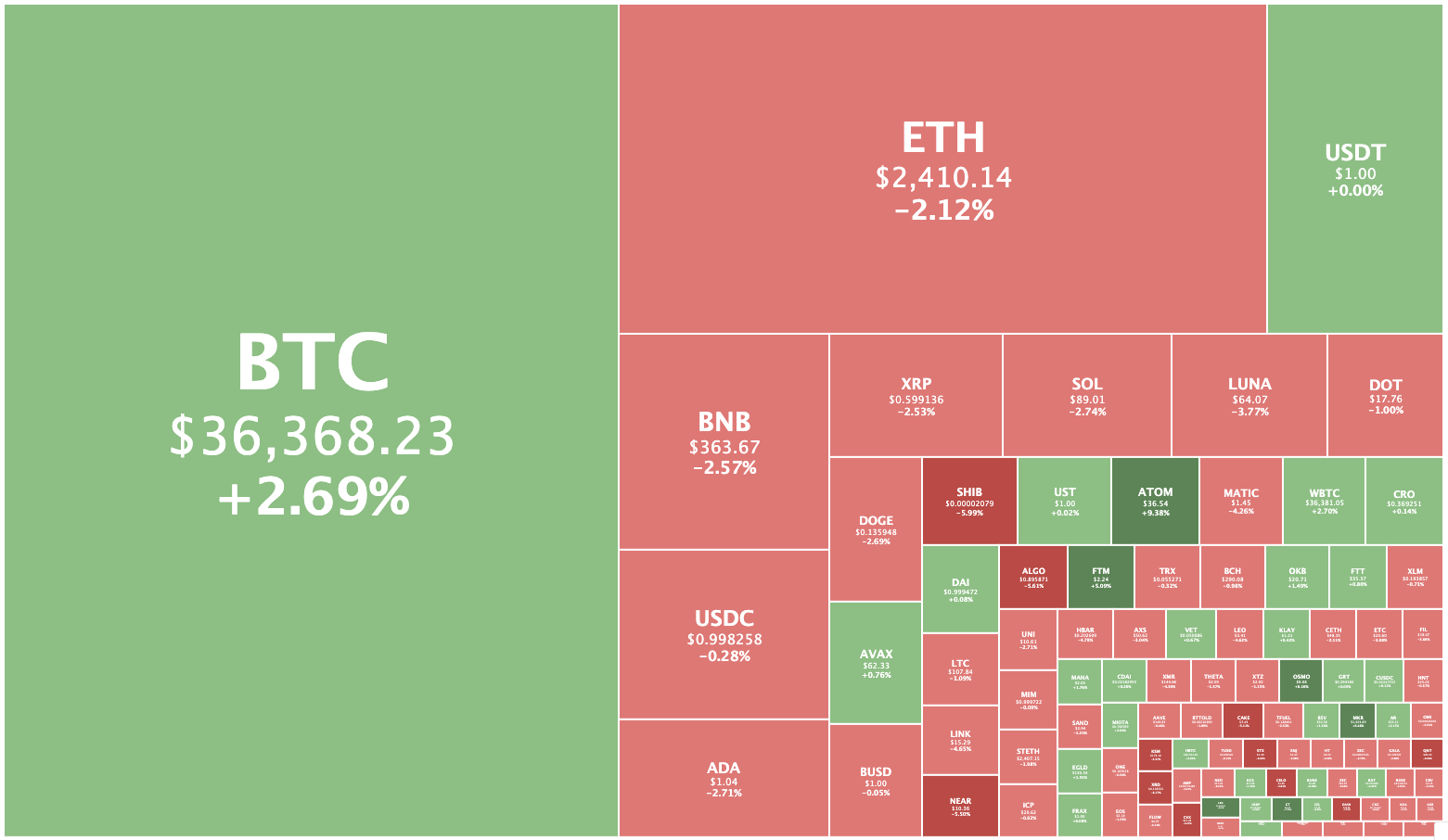

Crypto market up 0.2%

Meanwhile the crypto market has been edging higher on Tuesday after Bitcoin sunk to a six-month low of US$33,064 overnight.

At 3.38pm AEDT, Bitcoin was changing hands for US$36,367, up 2.7 per cent from 24 hours ago.

But every other major crypto was down slightly, with Ethereum dipping 2.1 per cent to US$2,409.

The total crypto market stood at US$1.73 trillion, up 0.2 per cent from yesterday.

Cosmos was the biggest gainer in the top 100, up 8.9 per cent to US$36.28.

Radix was the biggest loser, falling 8.3 per cent to 15.8c.

Glassnode: We’re in a bear market

It looks like we’re bear market, at least according to Berlin-based blockchain data company Glassnode, which writes in its latest weekly report that “numerous signals point to a macro scale bear trend in play”.

“Bear markets are hard to define in Bitcoin, as the traditional 20% drawdown metric would trigger a bear almost every second Tuesday given the volatility,” the report says.

But Glassnode’s on-chain analysis points to “significant realised losses, a steep drawdown, a return to HODLer led accumulation, and top buyers taking any opportunity to get their money back”.

“If it looks like a bear, and walks like a bear, it could very well be a bear. But as with many things over the last two years…could this time different?”

Glassnode says it’ll explore that question in the coming weeks. Read its report in full here.

#Bitcoin bulls have been put firmly on the back-foot, with prices cut in half since the Nov ATH.

In our latest analysis we seek to define whether #Bitcoin has entered a prolonged bear, using investor psychology, behaviour, and network profitability.https://t.co/4N1FKeHZHM

— glassnode (@glassnode) January 24, 2022

FOMC meeting early Thursday

There’s a lot riding on this week’s US Federal Reserve Open Markets Committee meeting, with Fed chair Jerome Powell set to brief the media beginning at 6.30am AEDT on Thursday.

With inflation raging, the traders will be looking for clues on whether the US central bank will raise interest rates more quickly than previously expected. The monetary stimulus measures the Fed adopted during the coronavirus crisis have been a big part of the reason for the bull run in risk assets, experts say.

Now is not the time for fear… that comes after the FOMC #cryptocrash #Bitcoin pic.twitter.com/OsRZzft5tR

— bread.crmbs (@DidNotHODL) January 22, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.