Crypto Espresso: Your quick shot of the latest crypto moves and news

See, Andy? I told you'd feel better once we've burnt all the evidence! Pic via Getty Images.

Goooood Mornin’ Coinheads!

We’ll get straight into it, because it’s best to just rip the band-aid off, right?

The market was soft overnight, like a weirdly smooshy mattress in a regional B&B that’s run by an older couple who you just know only opened their place of business because they like to ‘mix it up’ with other couples who stay there, but only if they’re “cool” with it, and don’t mind that Hector basically lives in the spa from sun-up til midnight.

Anyway – that overall market swampiness led to some poor (but not drastically bad) performances from the majors, with a noticeable dip across the board that looks to be in the process of correcting as we’re putting this together today.

There were some standouts, including a stellar run from HIVE, which saw it surge from US$0.52 to an all-time high of $0.95, but it’s plummeting this morning in a most disappointing fashion.

Summing up the week that’s been, Simon Peters from eToro has quite helpfully written that “cryptoassets such as bitcoin are witnessing a mini revival”. Nice.

“Bitcoin last week touched above USD$24,000, having begun the week below USD$20,000. Bitcoin is currently trading around USD$23,000,” Simon says.

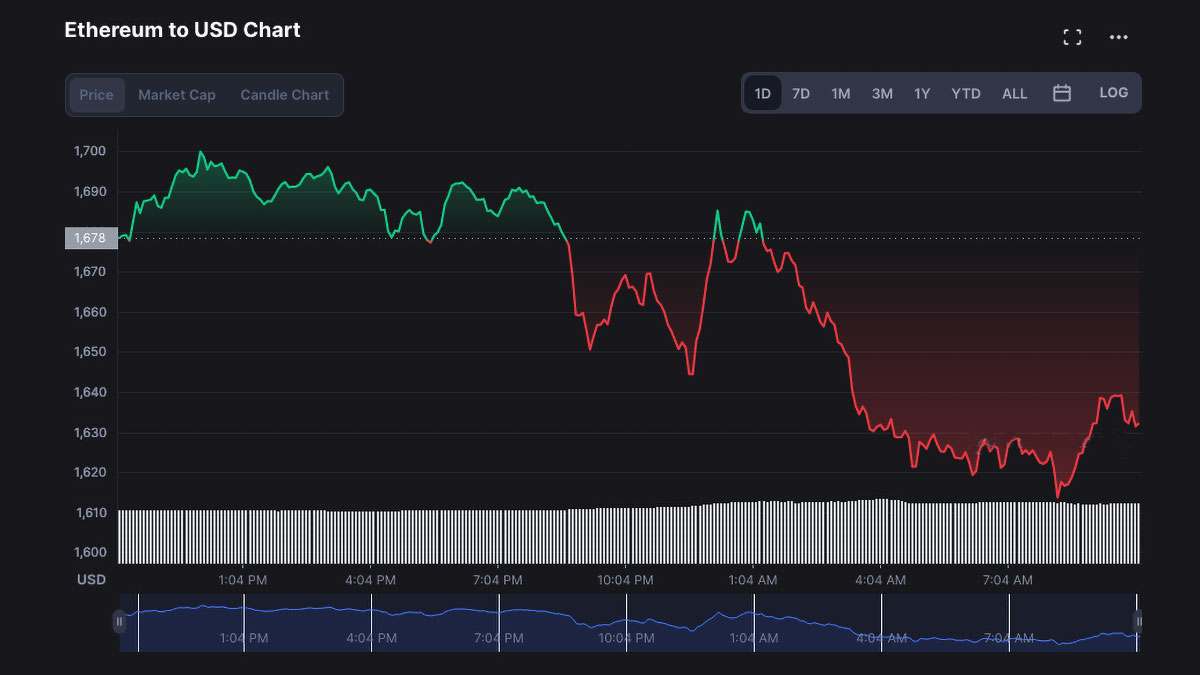

“Ether likewise began the week below USD$1,200 but rose above USD$1,700 over the weekend and is currently trading around USD$1,661.”

Thanks Simon. Fascinating stuff.

At the time of writing this morning, BTC was edging up over break-even, with BNB (-0.17%) and XRP (+0.02%) not far behind.

Solana was doing it tough (-1.55%) while Ether, which has been on a real charge recently, bore the brunt of the negative sentiment in the wee hours of this morning, but was doing it’s darndest to be The Little Crypto that Could, climbing off a -2.70% low.

There’s an interesting and possibly market-moving piece of news about ETH in this morning’s wrap up, so we may as well double-fist a couple of latte’s and jump on in.

Chinese ETH miner touts fork ahead of The Merge

In the world of Crypto, there’s always one, right? As Ethereum approaches its much-vaunted Merge, Chinese ETH-mining heavyweight Chandler Guo is agitating to resist the transition from proof-of-work to proof-of-stake.

Guo is arguing for the fork, to create a spinoff, proof-of-work version of ETH called ETHPOW, which would allow those currently set up to use energy-hungry mining rigs to continue to operate and generate cryptocurrency.

The motivation behind Guo’s push for a fork is very simple – when ETH merges and moves to proof-of-stake, pretty much everyone who is currently using hugely expensive and highly specialised ETH mining rigs to do the proof-of-work calculations that drive ETH will be left with vast quantities of essentially useless gear.

It’s a pretty big play by Guo, who – as one of China’s biggest ETH miners – clearly has a massive hardware investment at stake if the Merge goes ahead and renders his rig farm redundant.

Also, if you’re keen to get a better handle on what the ETH merge is all about, there’s a great piece explaining it here at ethereum.org, which highlights the environmental benefits of the Merge, including how it will vastly reduce the outrageous quantities of power that ETH currently uses and is expected to consume in the years ahead, unless the Merge goes ahead.

Tiffany’s NFTiffs spark a rush on CryptoPunks.

On the heels of yesterday’s news that Tiffany & Co.is offering 250 lucky people the chance to spend US$51,000 on an NFT linked to CryptoPunks NFTs , comes news that there has been a massive spike in CryptoPunks sales.

The renewed interest in one of the earliest NFT fads caused a remarkable 248% spike in trading volume, driven largely by the opportunity to get their hands on an NFTiffs – one of 250 digital passes offered by the New York jewellers.

The NFTiff, in return, can be minted to produce a custom pendant in the likeness of the holder’s CryptoPunks, made from solid yellow or rose gold with some pave set diamonds, some enamel colouring and maybe some other gemstones scattered about.

Before you get too excited, it’s worth noting that pave set diamonds are usually the really, really tiny ones – the “oh… those are diamonds?” ones, not the big, flashy “I’m a Kardashian and my boyfriend gave me this ring for learning how to say the word ‘onion’ right” ones.

Anyhow – it’s an interesting play by Tiffany & Co, and we look forward to the idea being copied ad infinitum until the heat death of the universe, or whatever.

Californian pair sentenced to prison over DROP scam

Two men have received custodial sentences for their starring role in an infamous US$1.9m crypto grift, according to a report over at Coindesk.

Jeremy McAlpine, 26, and Zachary Matar, 29, from Orange County, California, pleaded guilty last year to one count each of securities fraud, following the collapse of Dropil Inc. in March 2020.

Dropil was touted as an automatic investment scheme, with investors pushed towards buying up Dropil’s native token, DROP, which would then give them access to a bot called “Dex”.

Dex would do its Mr Roboto Crypto-Exchango magic, supposedly providing annual returns of up to 63% in DROP and distribute them every 15 days.

Spoiler Alert: It didn’t.

McAlpine and Matar will now have 3 years and 2.5 years respectively to consider their actions and get super-buff in a federal prison gym – which isn’t great news for other crypto-folks who have pleaded guilty to similar charges recently.

Meanwhile the rest of us get a timely reminder that if a crypto offering walks like a duck, and talks like a duck, then it’s probably a scam.

Because ducks, generally, are unable to talk.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.