Crypto Espresso: Your quick shot of the latest crypto moves and news

Bzzt. Bzzzt. Bzzzzzzzzt. Anything for a Friday morning buzz. Pic via Getty Images

Mornin’ Coinheads,

This morning it’s all about (allegedly) dodgy trades, impossible moon shots, and a fortune in misplaced Bitcoin lurking somewhere in a landfill in Wales.

But before we get into all that, a quick look at the charts this morning reveal that it’s been quite a happy 24 hours for crypto, with the majors building on yesterday’s gains in what looks to be far more measure ways than usual, leading the entire market to move sedately and gracefully into positive territory without lunatic-levels of clearly unsustainable growth.

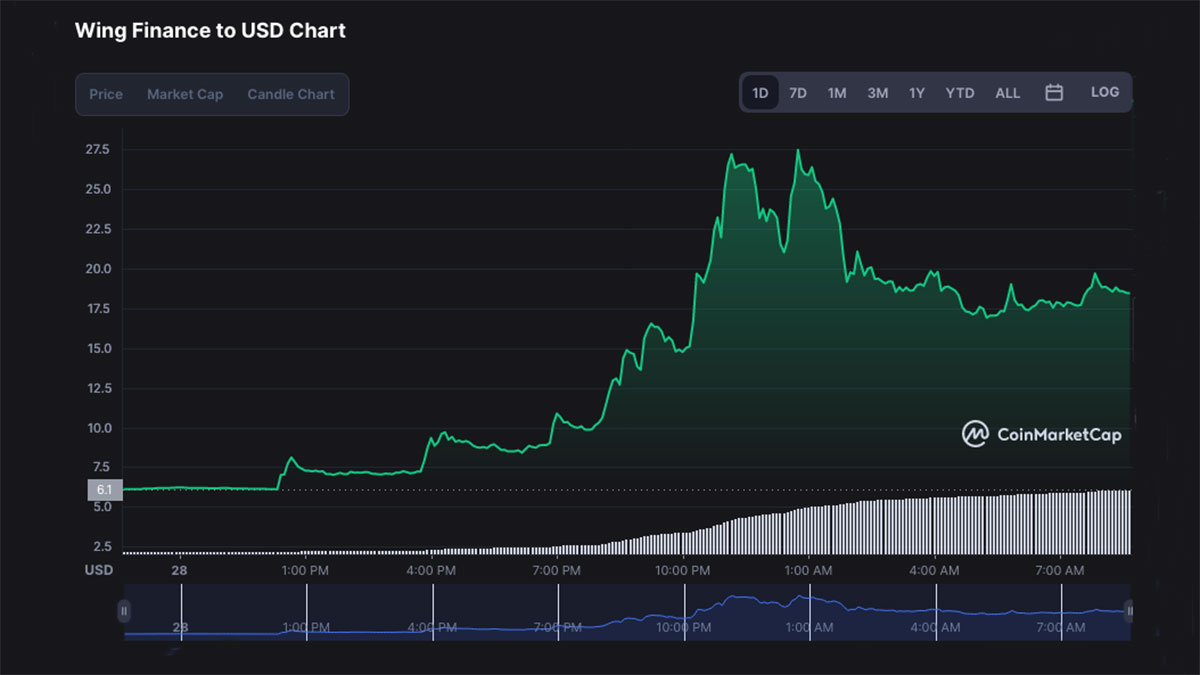

Nah… just kidding. Crypto outlier WING went completely berserk, running from ~US$6 to ~US$27 in a matter of hours, before setting at a comparatively paltry +200% gain. And here’s a picture:

ETH continued to gather pace as it heads for its merge in September, which is helping fuel positive sentiment across the crypto ecosystem. As we rubbed the sleep from our eyes this morning, ETH was up 6.4%, BTC up 4.0%, and XRP was up 3.7%. Noice.

Grab a coffee and find somewhere quiet – we’re just hours away from the sanctuary of the weekend, so here’s a few newsy things to keep us going through the morning together.

You comfy? All set? Great… then let’s go.

Zipmex surprises no-one by filing for bankruptcy protection

Thailand based crypto exchange Zipmex, which took the now well-worn path of freezing user withdrawals last week, has lodged paperwork in Singapore to seeking bankruptcy protection against legal action from creditors, according to a statement on its website.

The moratorium request is designed to give the exchange some breathing space while it works to resolve its catastrophic liquidity issues, but the protection the exchange is seeking will only last for 30 days.

Meanwhile, Zipmex has restarted its trade wallet and NFT platform – but the 30-day stay of execution might not be long enough for the company to get its feet back underneath it before that deadline comes due. Something, something, deck chairs, Titanic.

Regulators are cranky at Voyager this morning

US banking regulators have reportedly spent some time yesterday booping Voyager Digital on the nose with a rolled-up copy of the Wall Street Journal, after discovering that Voyager’s been a bit economical with the truth to potential customers.

According to a report over at Coindesk, The Federal Reserve and Federal Deposit Insurance Corporation have been irritated by Voyager’s “misleading” claims that the platform’s customers will have full FDIC insurance coverage in the event that the company goes bust.

You can catch the rest of this fun story over at Coindesk.

From bad to ugly for Sky Mavis CEO Trung Nguyen

Out of the rubble of the now-infamous Sky Mavis / Axie Infinity hack in March – which netted someone close to $900 million – comes some accusations levelled against Sky Mavis CEO Trung Nguyen which don’t look great at all.

Bloomberg says that, in the wake of the hack, all of AI’s gamers’ funds were frozen before users could react to the news. However, an investigation into the incident has revealed that Nguyen made a large transaction which included about $4.3 million worth of Axie Infinity’s main token, AXS in the hours before the freeze was announced.

Sky Mavis says Nguyen was moving the funds to try to shore up the company’s position and protect its user base. Regulators and invetigators are talking “insider trading”. This could get super-ugly for Sky Mavis and Nugyen, so watch this space.

And that poor bastard who binned 8000 BTC is back. Again.

This is still the ultimate tale of crypto heartbreak. Welshman James Howells, who quite famously claims to have thrown out a hard drive with 8,000 BTC on it nine years ago, is back, this time with a $15 million dollar plan (and a couple of venture capital guys on board) to dig up his local landfill and sift through all the trash to try to find it.

His local council has so far been adamant that Howell will never get to dig up what is now a local park to go looking for his lost treasure, but it’s understandable that he’s keen to do so – the drive, which might still be useable, has got about $275 million sitting on it. Business Insider’s got more on this horrific tale of woe, right here.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.