Crypto crash: Celsius tanks as user withdrawals paused amid liquidity crisis

Bear market? How about another crypto winter? (Getty Images)

About the same time Bitcoin dipped to its lowest weekly close (roughly US$26k) since December 2020, one of the biggest crypto-lending platforms in the space, Celsius, decided to pause all customer withdrawals, swaps, and transfers.

Cue a huge sell-off in the CEL token, not to mention plenty more pain for the entire market (currently close to three billion USD has been wiped out since Friday), plus growing fears of the next major-player domino to fall.

Note, those are largely just fears for now, but after what happened with Terra LUNA, panic regarding potential financial complications for Celsius are beginning to spread like [insert latest Greek-alphabet-named variant here] across Crypto Twitter.

.@CelsiusNetwork is pausing all withdrawals, Swap, and transfers between accounts. Acting in the interest of our community is our top priority. Our operations continue and we will continue to share information with the community. More here: https://t.co/CvjORUICs2

— Celsius (@CelsiusNetwork) June 13, 2022

JUST IN: Celsius reportedly transferred $320,000,000 worth of #crypto to FTX, before announcing they would halt all trading and withdrawals on the platform.

— Watcher.Guru (@WatcherGuru) June 13, 2022

After the Celsius announcement, CEL tanked more than 70 per cent in the early hours of Monday morning, from about US$0.49 down to below $0.15, according to CoinGecko. At the time of writing, the token is changing paper hands for about $0.19, down around 97 per cent from its $8.05 all-time high of a year ago.

Could get ugly. https://t.co/0ghQ4rmHif

— Ben Simpson (@bensimpsonau) June 13, 2022

Staked ETH and the Celsius liquidity crunch

The worrying move can be put down to what’s being described by some as a “liquidity crunch” and a form of “bank run” on the platform with panicked users rushing to withdraw their funds.

There are some underlying factors at play:

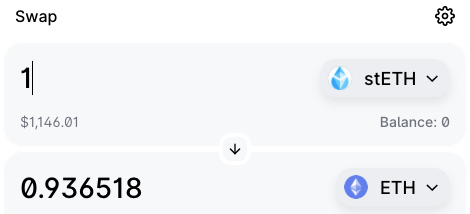

• Right now, there is an imbalance in the price of staked Ethereum (stETH), meaning that it’s trading at less than one ETH, as you can see from the Uniswap image below. Staked ETH is a Lido Finance product that enables liquid staking for ETH 2.0 – the upcoming iteration of Ethereum, currently in testing phase.

• The thing about that is, Celsius has been one of stETH’s heaviest users. Celsius has been previously rumoured to sell stETH in large amounts to help restore liquidity to its users’ withdrawals. With the current stETH depegging, the implication is that Celsius is significantly down on its investments/stETH trade.

• At the time of writing, Celsius has reportedly been transferring large amounts of ETH and wBTC (wrapped Bitcoin) to the FTX crypto exchange. BTC is currently trading down 12.5% in the past 24 hours, while ETH is down more than 15%.

Crushed by a liquidity crunch…

Do you think they will be able to realise enough from assets over time to meet withdrawals? pic.twitter.com/AkJOVxJq3W

— Coin Bureau (@coinbureau) June 13, 2022

https://twitter.com/cobie/status/1536314511514279939

Note: this is a developing story…

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.