Crypto: Avalanche gathers force, while decentralised exchanges Trader Joe and Orca soar

Getty Images

Crypto markets are a sea of green this morning, with half of the top 100 tokens up by double-digits and Avalanche hitting an all-time high as another protocol upgrade took effect.

AVAX tokens changed hands at US$75.72 around 10am AEST, and an hour later still up 21.6 per cent to $74.20. At 7am AEST today, phase 4 of Avalanche’s Apricot upgrade went live, further reducing transaction fees and adding protection against “miner extractable value” (MEV) — basically, arbitrage attacks from flashbots front-running transactions.

“Incredibly proud of the latest Avalanche upgrade,” tweeted Avalanche founder Emin Gün Sirer.

“More details tomorrow, but I’ll just mention that this change makes #Avalanche the cheapest (lowest fees per transaction) and fastest (lowest time to finality) chain.”

Avalanche is currently the No. 11 crypto, up from No 44 in early August, according to Coinmarketcap. Avax tokens were available for under US$14 back then.

The smart contract platform still has a ways to go if it wants to keep rising up the coin lists, however. It’d take another 75 per cent rise for Avalanche to replace Dogecoin as the No. 10 crypto.

The meme coin, currently trading at US22.4c, has been quiet of late after a red-hot first half when it reached No. 6 on the rankings.

Elsewhere in the Avalanche ecosystem, decentralised exchange Trader Joe had hit an all-time high of US$ 4.54 – up more than sixfold in the past 30 days.

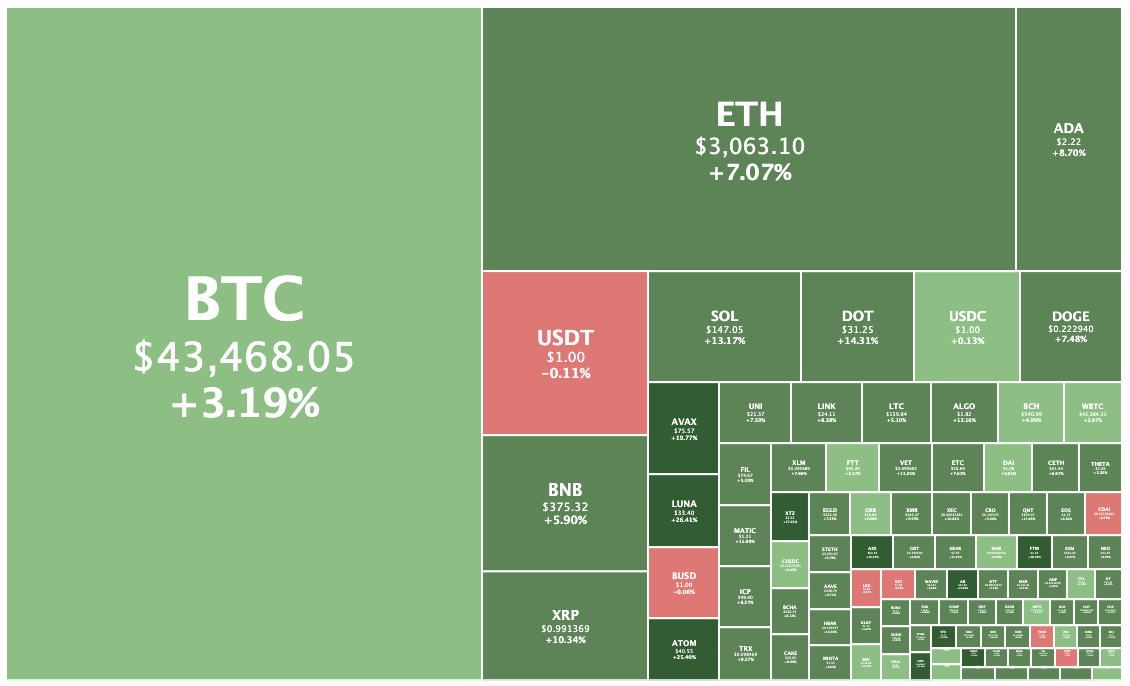

Crypto market back at US$2 trillion

Overall the crypto market was up 9.3 per cent to US$2.04 trillion, reclaiming that milestone level after dropping below it on Monday for the first time in a week.

Bitcoin was trading at US$43,468, up 3.2 per cent from yesterday, while Ethereum was changing hands for US$3,063, up 7.1 per cent.

City Index analyst Tony Sycamore wrote in his morning brief that a break and daily close above US$44,500 for BTC and US$3,150 for Ether was needed to provide further confirmation that the uptrend had resumed and that it was time to open longs.

Decentralised file storage network Arweave had been the biggest gainer in the top 100, rising 34.4 per cent to $51.98.

Terra (LUNA), Cosmos (ATOM), IOST, Osmosis and Fantom were all up by between 19.2 and 26.8 per cent as well.

None of the top 100 coins were listed as in the red on Coinmarketcap, aside from stablecoins that very marginally lose their dollar peg in bull markets.

A Solana-based decentralised exchange called Orca had soared more than 77 per cent to an all-time high of US$11 after raising US$18 million in a Series A fundraising round led by Polychain Capital, Placeholder and Three Arrows Capital.

The exchange launched in February and introduced its ORCA governance token last month. It’s had US$735 million in lifetime trading volume and $250 million in total value locked, compared to $18.8 billion in volume and $1.6 billion in TVL for Raydium, the leading Solana DEX

Orca’s eight-member team is aiming to create the easiest place to exchange crypto on Solana with a “truly delightful” simplified user experience.

We're excited to announce our $18M Series A!

And thrilled to partner with incredible investors from @polychaincap @placeholdervc, Three Arrows, @jumpcapital, @SinoGlobalCap, @Collab_Currency, @DeFianceCapital, @ZeePrimeCap, Coinbase Ventures, and @solana.https://t.co/rdrTTceE6l

— Orca ☀️ (@orca_so) September 22, 2021

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.