Crypto: Acala maintains lead over Moonbeam; Japanese assets to get tokenised

Getty Images

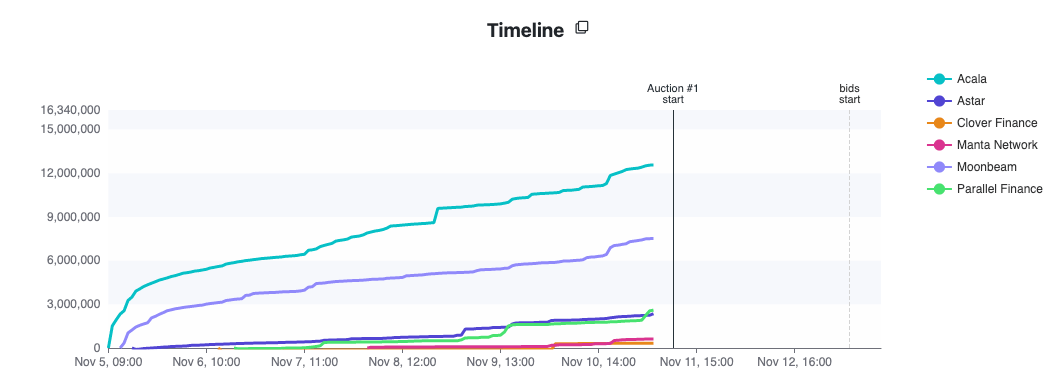

With just hours to go until the start of Polkadot’s parachain auctions, Acala is maintaining its lead over Moonbeam, while Parallel Finance has moved past Astar for third place.

The auction begins at 8am UTC (7pm AEDT) and runs for a week, using an unusual “candle auction” format to determine the victor. The winner won’t be determined by who leads the auction at its end, a format that typically leads to last-minute bidding. Instead, the winner will be determined by who led the auction at a random point in time between this evening and its finish on November 18.

According to Parachains.info, Acala currently has 12.6 million DOT (US$598 million) pledged to it from 20,140 contributors, compared to Moonbeam with 7.5 million DOT (US$358 million) loaned to it from 32,971 people.

Parallel Finance has 2.6 million DOT (US$124 million) from 671 contributors while Astar has 2.3 million DOT ($112 million) from 13,582 contributors.

There are five different spots up for grabs, with the auctions running consecutively through December 16, so on some level, it doesn’t matter who wins the first one. But it would make for some nice bragging rights.

Japanese real estate, securities to get tokenised

Singapore-based private market exchange ADDX and Japanese financial services company Tokai Tokyo Financial Holdings expect to start tokenising investment products for Japanese investors under a new partnership.

The deal came together after Tokai Tokyo received a securities token license from Japanese regulators, allowing the Tokyo Stock Exchange-listed company to deal in digital securities.

With the new license, Tokai Tokyo and ADDX plan to collaborate on security token issuances by Japanese real estate companies and banks. The assets will be tokenised for trade on ADDX’s permissioned blockchain, which is based on Ethereum technology but only open to accredited investors.

The license allows Tokai Tokyo, which has $38 billion in client assets under management, to issue tokens for both non-liquid assets such as collective investment schemes and trust certificates, as well as liquid assets like listed securities and listed bonds.

ADDX says the self-executing nature of its blockchain platform allows for greater efficiency, allowing it to reduce the minimum ticket size for private products from US$1 million to just $10,000.

“The community of individual sophisticated investors in Japan is deep and sophisticated,” said Oi Yee Choo, ADDX chief commercial officer.

“Historically, they have shown a strong interest in real estate investments. But the opportunities open to them – whether in real estate or other asset types – are curtailed because of the high minimum investment sizes in the private markets.

“Digital securities can fractionalise investments, helping individuals to diversify their portfolios and to invest with a strategy and asset-mix closer to that of family offices or institutions.

“This promises several positive knock-on effects – from better retirement adequacy to a fairer distribution of wealth.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.