Crypto 2022: $100k Bitcoin, $5k Ethereum – what 5 Aussie traders predict for the coming year

Pic: VallarieE, Getty Images

It was a wild ride on the crypto markets in 2021, even if the year-end prices didn’t reflect the lofty predictions that some were calling for back in the first half.

Still Bitcoin was up 62 per cent for the year, as of December 21, and most other major crypto assets posted triple-digit gains. Sixteen of the top 100 were up by quadruple digits and six – Solana, Polygon, Terra, The Sandbox, Axie Infinity and Ecomi – were up by more than 100x.

As part of Stockhead’s Crypto 2022 prediction series, we asked five of Australia’s top crypto traders and technical analysts to give us their forecasts for what the new year might bring.

Ethereum to break $5k

“My strongest view is in Ethereum, for a couple of reasons,” says Sydney-based City Index market analyst Tony Sycamore.

“Firstly the technical backdrop – the pullback from the $4868 (all-time high on November 8) to the flash crash $3470 low (on December 4) appears to be a correction after a strong bull run higher.

“Secondly due to the burn rate and diminished supply following the London hard fork.

“I like Ethereum to make new highs near $5200.”

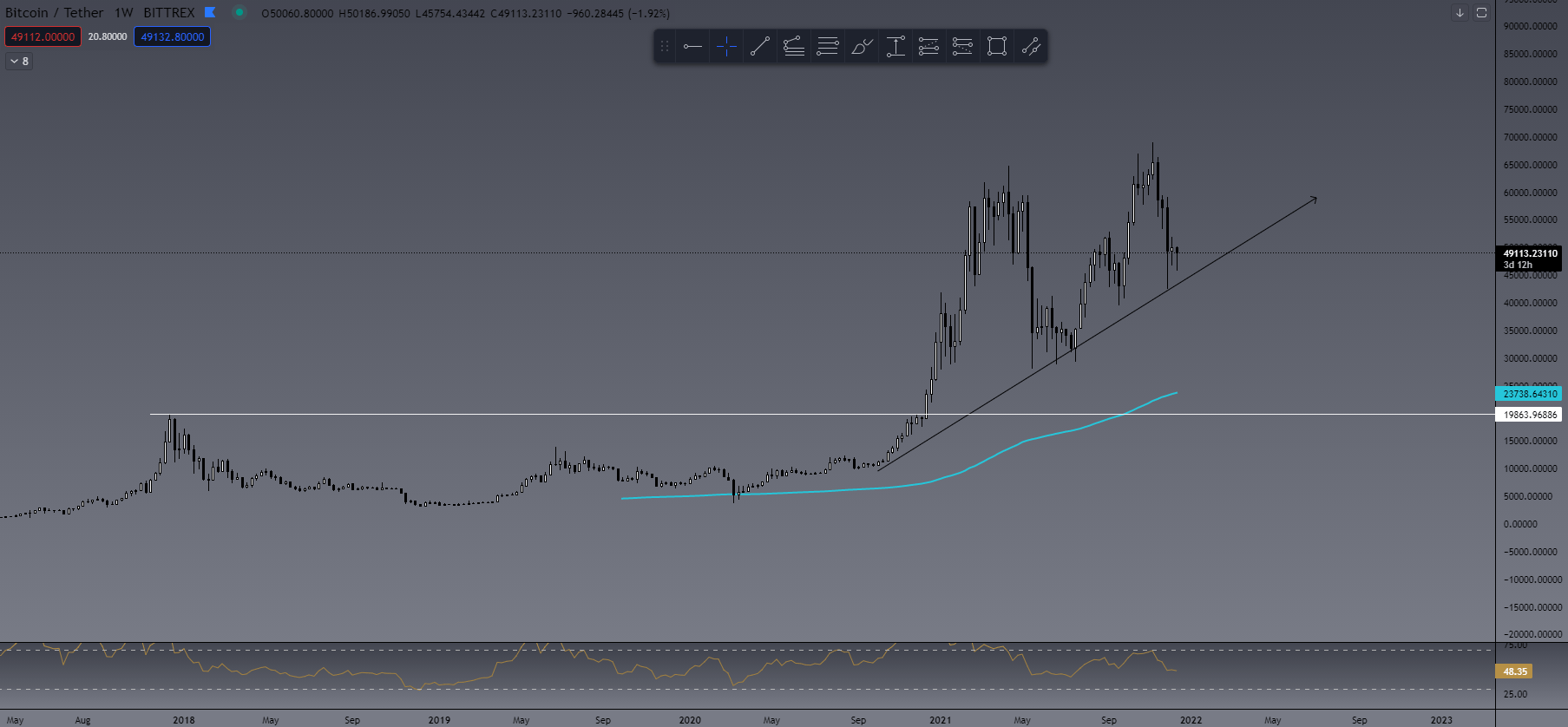

Six-figure BTC in 2022

“I think we’ll see 100k BTC soon,” says Dave Haslop, founder of the Gold Coast-based Crypto Den, which offers livestreamed courses in crypto trading.

“Not before the end of the year but early to mid 2022.

“I see alot of people around calling the top which is a suckers game. Weekly market structure is well and truly up and people just have short memories.

“The world we see some economic chaos in the coming years and I still firmly believe BTC will become (if not already) a safe haven for wealth.”

‘It’s going to be rocky’

Aussie crypto-trader Kyle Stagoll, the administrator of the Crypto Paradox Facebook group, there’s a big chance that 2022 could be bearish, depending on how the macroeconomic themes play out.

“It’s very hard to predict next year with so much uncertainty in global macro right now, with covid mutations, with inflation, hints at tapering faster + IR (interest rate) increases next year,” he told Stockhead on December 10.

“You have to expect its going to be a rough year with huge volatility, big swings up and down, if the world can recover from covid and supply constraints ease and that brings down inflation then we could be alright and there’s smooth sailing, but any more deadlier variants of covid is going to make life on the FED extremely tough to balance next year so there’s not a crash and there’s not out of control inflation.

“So in short I think its going to be rocky and high chance of BTC having a bearish year, but that can change quickly,” he said.

“My other theory is that this is just another large reaccumulation range similar to mid-year 2021 but we have to wait and see how that develops.”

Metaverse tokens and OHM forks

Perth-based trader David Pugh, who managed to sell the top on Bitcoin in April when it set new highs around $64,000, is looking to invest in metaverse tokens and Olympus DAO (OHM) forks — but tries not to make predictions when trading.

“From a day trading perspective, I come to the charts with no expectations – you just need to play the game that’s in front of you for that session,” he said.

“I’m not diamond handed, nor paper handed for that matter. I’m a non-biased trader, if the market looks over heated and needs a correction, I short. If we’ve hit a local bottom and looking at an upward reversal, I long.

“The market provides countless opportunities to make money every day – you’ve just got to be open to them. If Bitcoin goes on a rally up to $100k, I’ll enjoy the gains on the way up but will be looking to level in short positions back down to 70k or even 40k if we enter a bear market.

“You need to keep in your mind ‘what is the big money doing’, the reality is the big money doesn’t give a stuff about your small account, they will be shorting BTC into the ground whenever the top sets in.

“Areas in the cryptosphere that I’m looking at other than day trading are Metaverse projects, Gaming projects with more than one offering, GALA, Game Guilds etc.

“ZK rollups are gaining momentum and anything that will lower these crazy high ETH gas fees. I’m keeping my ear to the ground to what is going to be the next Shiba Inu for 2022 – $CINU looks like a good candidate at this stage,” he said.

(That’s Cheems Inu, a tiny Crypto Messiah-endorsed project that is trying to be the “future home of meme tools“)

“OHM forks are interesting if they can build utility and they look like a potential bear market hedge if they can survive – only time will tell.

“Don’t follow moon boys – no one can tell the future. Play the game as is laid out on the chart. Happy trading for 2022.”

‘Let the coin act’

View this post on Instagram

Crypto trader Eunice Wong was reluctant to offer predictions for 2022, cautioning that having a bias when it comes to trading can lead to poor results.

“There’re two type of traders, predictive traders and reactive traders,” she told Stockhead.

“A predictive trader creates a price bias and makes a prediction based on where they THINK the price will go.

“The issue with this strategy is, it allows confirmation bias which filters into their trading strategy — meaning if the trade moves the opposite direction of the price they predicted, they become reluctant to take the trade, in worst-case scenarios, they hodl the losing position.”

“Then there’s reactive traders. Who let the price contract and then buy volume breaks at the direction of the trend and follow the money flow – which is what moves the market.

“In summary, I will let the coin act and let them react because trading at its purest form is following what moves the market and that is not based on an OPINION.

“In short, it is the money flow that MOVES the tape, everything else is just NOISE.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.