Collective Shift: The Aussie platform helping members navigate the 100mph madness of crypto markets

Image: Getty

A Tasmanian-founded remote crypto platform has been providing crypto education and analysis for thousands of subscribers around the world.

Collective Shift has around 3,000 members, half based in Australia and the rest overseas, all crypto-enthusiasts who pay for top-tier fundamental analysis from more than a dozen industry experts.

“I think at core, we’re providing crypto investors with a platform where they can save time and help them make better decisions,” says founder and chief executive Ben Simpson.

“At a simple level we provide really high-quality analysis to help people get from zero to one much faster than if they had to do it on their own.”

Crypto, says Simpson, “is absolute madness and moves at 100 miles an hour,” and Collective Shift’s clients are everyday investors who want to get involved but just don’t have the time to do all the work themselves.

Launched in October 2020, Collective Shift provides tutorials, ongoing analysis and even a model portfolio that users can copy without losing control of their capital.

Madness, in real time

“People can see – live – what we’re selling as a company, which has been super, super popular,” Simpson says.

There’s the equivalent of around 12 to 16 people working full-time at Collective Shift, including an internal research team of four, plus two or three contractors, the founder adds.

One of their contractors is Checkmate, the leading on-chain analyst for Glassnode, a well-known Berlin-based blockchain data firm whose clients include institutional investors.

“So we provide on-chain analytics, we provide fundamental valuations, we provide sentiment analysis, and then also NFT valuations,” Simpson says.

“We’re providing what you would get at a fund that’s taking your money – but we’re providing that back to the retail investor.”

Crypto-democratisation

Simpson says he’s passionate about educating people on finance and empowering them to make their own decisions – in a trusted environment.

“That’s a simple idea, yet a pretty rare thing. We don’t want people with the same passion and interests to go down the wrong path, if that makes sense, from an investment standpoint.”

The platform provides an active ‘Discord Channel’ where members can share investment ideas, Simpson said.

For now, only about 10 per cent of the community is women, Simpson says, but that’s climbing quickly now and up from about two to four per cent two years ago.

It’s a supportive and encouraging place, he says – one leading contributor to the community has started her YouTube channel with the full-throatedl support of the Collective Shift community.

“That’s really cool to see… how we’re able to bring people into the space, men and women, and super fast-track their knowledge.”

What this all costs

There are three tiers of membership at Collective Shift – including a bunch of free information for beginners, like a crypto-universe starter pack.

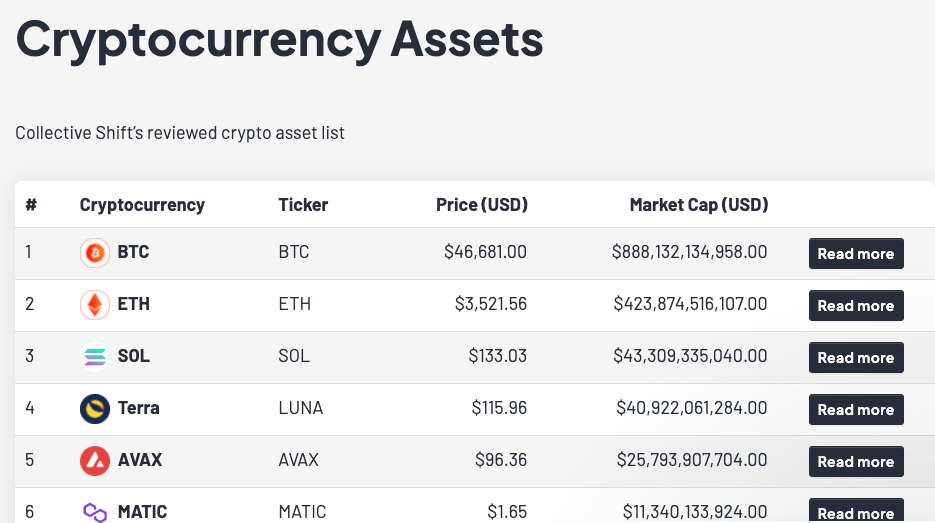

For US$99, members can access premium research and content and access Collective Shift’s asset library, where analysts have reviewed about 45 different tokens and given a bullish and bearish take.

Up a notch, for US$199 a month, members get to see Collective Shift’s investment portfolio. “So you get to see literally what we’re buying or selling,” Simpson says.

There are three different strategies: short-term investments, longer-term holdings and NFTs.

By “short-term,” Collective Shift means assets to hold for three to six months. The company doesn’t engage in much technical analysis or trading on shorter timeframes.

“We just try to find the next opportunities, the next trends, and help members get in front of it,” Simpson says.

To Tokenize, ot not to Tokenize…

With most of the team based in America, Simpson says he’s considering relocating to San Francisco to be closer to the action. As a native of the Tasmanian country town of Smithton, the 23-year-old appreciates the hustle and bustle of the US West Coast – and believes that if you can win in the US market, you can win everywhere.

Collective Shift actually isn’t Simpson’s first business venture – he dropped out of high school at 17 to run a sporting goods company that imported apparel from China and Pakistan and sold them to Tasmanian sports teams.

He discovered crypto in 2017, but thankfully didn’t start investing until 2018, missing the crypto-crash at the start of the year.

“I’m not dumb, but I’m not the smartest kid on the block,” Simpson quips.

“And this was really difficult to wrap your head around, and there wasn’t many places back then that you could actually learn it.”

Simpson says Collective Shift has even played around with the idea of issuing its own token, as many projects in the crypto space have done.

Members might be able to pay for their membership fees through the token, or get exposure to Collective Shift’s investments.

“But that obviously takes a lot of work and a lot of brain power, which we’re just not ‘round to just yet.”

Emphasis on just yet.

This article was developed in collaboration with Collective Shift, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.