CoinJar’s Three Ts: Metaverse rising, DeFi’s return and BTC powers on

Pic: d3sign / Moment via Getty Images

Welcome to the Three Ts with CoinJar. Each fortnight we explore a big Theme, an interesting Trade and some good, old-fashioned Technical Analysis (courtesy of Tom from trading gurus FX).

I never metaverse I didn’t like

After Mark Zuckerberg fronted Facebook’s Q2 earnings call and announced that his company would be pivoting towards the ‘metaverse’, the concept has been the hottest of topics in the tech world. The tl;dr: as our identities and activities become ever more ‘online’, the next big shift will be towards platforms that allow us to bring together these many different profiles and aspects into a single, cohesive whole. Think of it as the Internet of Identity.

Yet it’s in crypto where the idea has been most immediately and fully adopted. With the NFT boom only growing in intensity, the metaverse has become a handy catch-all to describe the rapidly expanding universe of pictures, songs, videos, tickets, fan tokens, gaming items and more that fall under its banner.

In twenty years the Fortnite generation will rule the world. They will all use crypto, habitate metaverses, and organize in DAOs.

The metaverse will be one of the largest investment themes in history. It is very early.

— Alex Krüger (@krugermacro) September 5, 2021

It may all seem silly and insubstantial from the outside, but what these collections are revealing is the growing power of status symbols and signifiers in a purely online realm. What’s it going to be like when NFTs underpin your house purchase, your new car, your passport, health records, employment history and more?

Facebook and crypto both want to build the architecture of the digital you – let’s hope for all our sakes it’s the latter that wins.

1/ On Metaverse

"But in the metaverse" is a running joke on cryptotwitter

I regret to inform you that it is no joke.

What we are playing for is whether our children will be fully free or residents in a digital company universe – with the illusion of free, but not really free

— 6529 (@punk6529) August 22, 2021

Springtime for DeFi

Back in early May there were a lot of predictions that we were looking at a ‘Summer of DeFi’ (thank you, northern hemisphere bias). Well, we all know what happened next and NFTs have well and truly taken charge of the so-far booming recovery.

But now there’s a sense that it might be time for DeFi to have its turn. A lot of the so-called ‘blue chips’ of the DeFi space – coins like AAVE, COMP, UNI, SUSHI, CRV and BAL – have roughly identical charts that all show the coins bumping up against the last major resistance before April’s highs.

While buying at resistance has its risks, ‘seasons’ in crypto rarely last longer than 2-3 months and with ETH on a seemingly unstoppable tear it feels like it might be time for the financial backbones of the Ethereum universe to play catch-up.

Been accumulating (mostly) blue chip DeFi tokens during a mini bear the past couple months. Firmly believe that NFT Summer will make way for DeFi Fall. Everything is cyclical. But I’m expecting a NFT x DeFi Winter Wonderland. This is gonna rip faces off. ETH rebound moons yields.

— Beanie (@beaniemaxi) September 1, 2021

Shorts not found

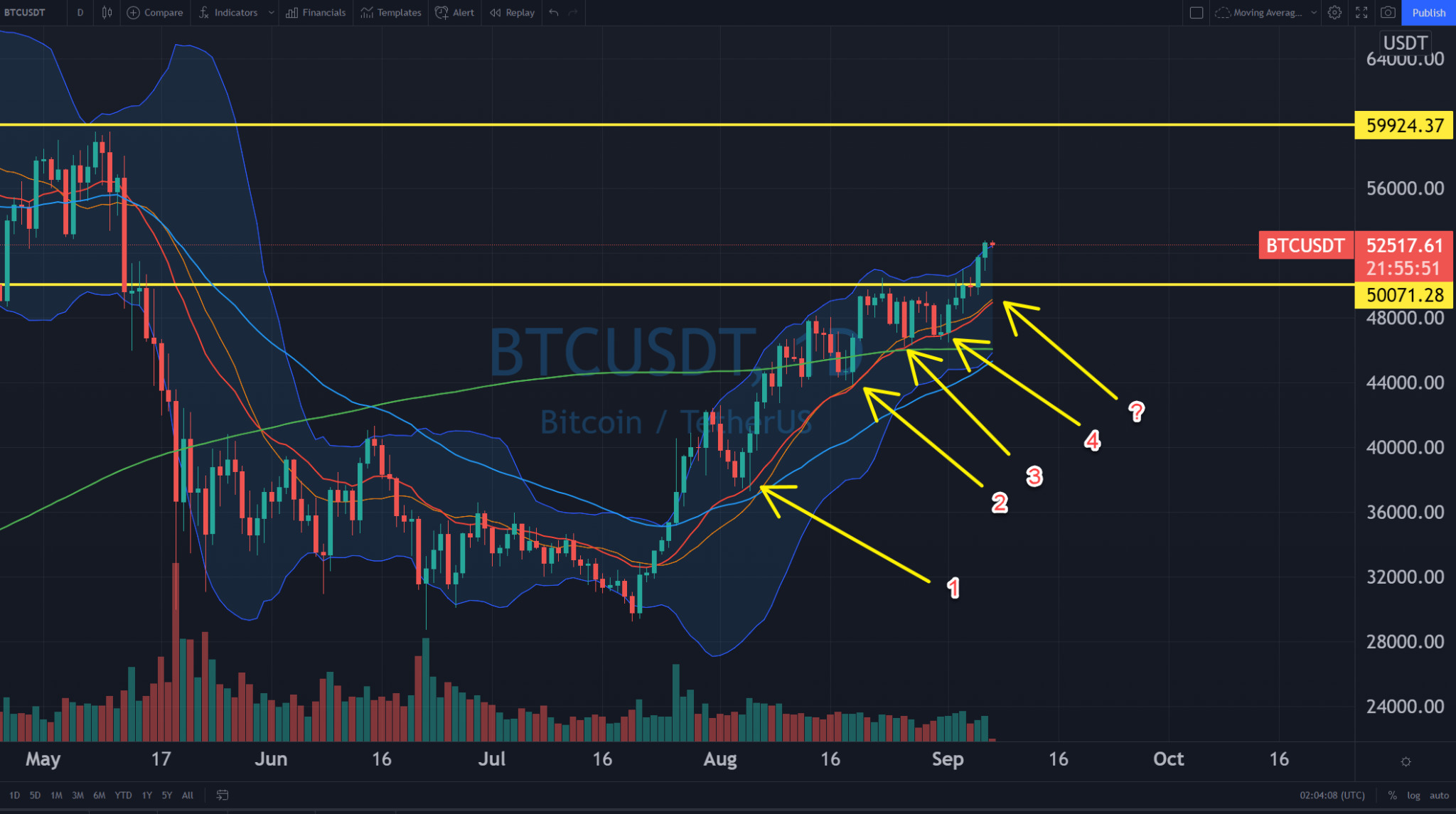

Bitcoin continues on its merry way, pushing past the US$51.5k barrier we discussed in the last issue. Rather than the giant green candles we all know and love, it’s been a slow grind toward the highs, taking plenty of time to rinse out high leverage traders on both sides.

But one thing we haven’t seen on the way up, according to Tom from FX Evolution, has been an increase in net Bitcoin shorts. The brutal sell-offs during and after the May crash were all accompanied by massive increases in the cumulative value of shorts.

As you can see, right now the trend is actually in the other direction, shifting close to the yearly lows.

While this doesn’t promise anything of itself, it does suggest that whales aren’t interested in betting against Bitcoin right now and that bodes well for continuation.

On a lower time frame we can see that the 1D 20 EMA continues to act as a strong dip-buying opportunity during this move up, having now acted as support four times. If the price were to dip again, there could be confluence with the $50k level (i.e. resistance-turned-support). To the upside the next points of interest are $55k and $60k.

CoinJar is Australia’s longest-running crypto exchange. Since 2013, CoinJar has helped more than half-a-million Australians buy and sell billions of dollars in cryptocurrency.

FX Evolution is Australia’s premier forex, stock and crypto trading community.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.