In March, Swyftx reports, there was a hefty increase in individual trades by Australian high-volume traders – a 17% increase in trades of AUD $20,000 or more, and a 14% increase in trades of more than $100,000.

Chain Reactions: Hong Kong classifies crypto as ‘property’; Bitcoin ‘halving’ anticipation grows

Getty Images

Price action-wise, it’s been a slow day for Bitcoin and the crypto market, but there’s still a bit of news about of interest you might’ve missed, including the fact that Hong Kong’s High Court has declared crypto as property in an eye-opening new ruling.

The new decree states that crypto is classified as “property that can be held on trust”, which is the first time a definitive decision regarding classification of the asset class has been handed down in the special administrative region.

Justice Linda Chan, who presided over the case, said that “like other common law jurisdictions, our definition of ‘property’ is an inclusive one and intended to have a wide meaning.”

Global law firm Hogan Lovells first reported on the judgment last week and indicated that the decision provides clarity and places cryptocurrencies “on a par with other intangible assets such as stocks and shares” in Hong Kong.

Hong Kong has been increasing its moves to embrace the crypto industry, and attaining a level of classification clarity from an official governance body puts the region streets ahead of the USA at present, where the US Securities Exchange and Commodity Futures Trading Commission can’t even agree on whether Ethereum and co are securities or commodities.

Halving anticipation grows: Swyftx

The balances of Bitcoin (BTC) on exchanges have reportedly decreased significantly (as a percentage of circulating supply) in this halving “epoch” cycle compared to the three preceding epochs.

What does that mean? It can possibly mean an increase in the HODLing (hold on for dear life) narrative over the past few years of this latest four-year cycle for Bitcoin. And that can indicate strength in the resolve of long-term BTC holders as they presumably seek to store the asset in cold storage and away from centralised exchanges.

This is the first epoch where the #bitcoin balance on exchanges has gone down…

This time is different.#BTC pic.twitter.com/4QmoZ7Mo6I

— A u s t i n | Open Source Fitness (@_AustinHerbert) April 21, 2023

This chart, if accurate, would tie in well with some of the other stats and opinions we’ve been hearing lately.

For instance, Tommy Honan, the Head of Commercial Operations at the Brisbane-based crypto exchange Swyftx, mentioned to Coinhead in an email note that:

“Anticipation around the next Bitcoin halving is suddenly very real.”

And that comes off the back of some head-turning data the exchange witnessed in March for Bitcoin – a month in which the five top days of Australian BTC trading so far this year all occurred.

“There are no clear and obvious triggers for Bitcoin’s 80% price rise this year beyond some concern around recent turmoil in US banking,” noted Honan.

“So we’re applying the Occam’s Razor rule that the simplest explanation is the most likely. We think the most plausible explanation for Bitcoin’s price movement is anticipation around the halving and that this, in turn, is fuelling local trading activity.”

#Bitcoin Halving is less than 1 year away! 🔥 pic.twitter.com/JBJSBnam4i

— Crypto Rover (@rovercrc) April 22, 2023

The halving, in case you weren’t aware is the built-in four-year mechanism that serves to halve the reward of Proof-of-Work miners that operate in the Bitcoin network.

Halvings reduce the rate at which new coins are created, effectively reducing the supply. The Bitcoin halving occurs every 210,000 blocks, or roughly every four years. In the past, Bitcoin halvings have subsequently resulted in significant price surges.

“We’re not near all-time high trading territory,” continued Honan. “But local Bitcoin trades are clearly trending up with hundreds of millions of Aussie dollar denominated Bitcoin trades in March.

“We hit the one-year countdown to the halving this month and it seems to be a factor impacting Bitcoin price action and national trading activity.

“Bitcoin trading this month remains elevated on January and February levels and we’re seeing a strong trend towards accumulation, with buy orders outnumbering sells by a factor of three.”

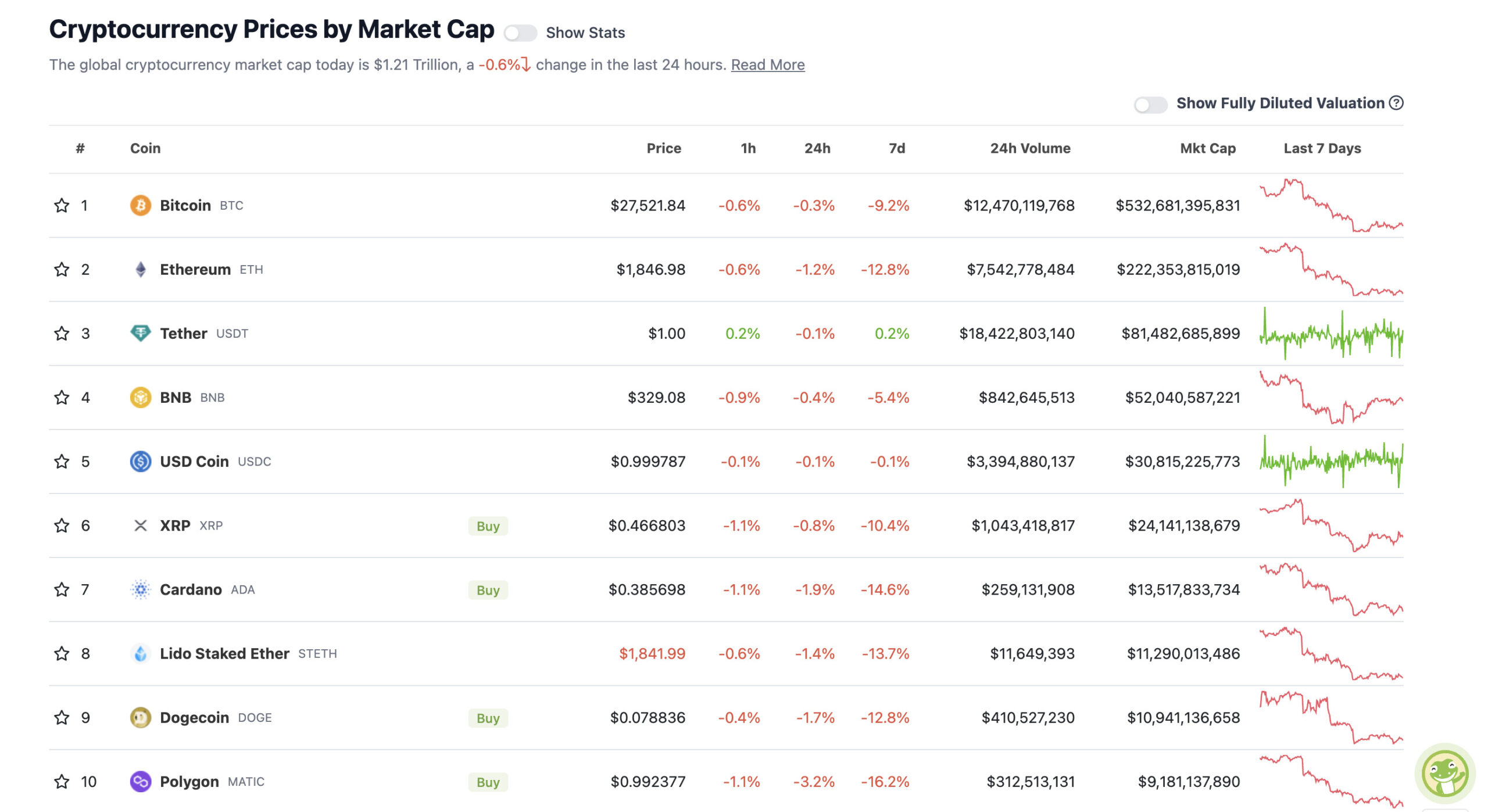

Top 10 overview

With the overall crypto market cap at US$1.21 trillion, down about 0.6% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

It is over, #Bitcoin is dead. pic.twitter.com/ejxVKOGVyF

— JJcycles (@JJcycles) April 23, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.