Chain Reactions: Bitcoin resilient in face of US crypto regulatory turmoil

The sh*t(coins) hit the fan earlier this week. (Getty Images)

Bitcoin and most other crypto majors are holding strong this afternoon in the face of crypto market uncertainty related to intense regulatory scrutiny on Binance and Coinbase in the US this week.

The SEC chair meanwhile is certainly copping it left, right and decentralised centre from the cryptoverse, as you’d expect given his prominent role in America’s mission to completely knacker the crypto industry.

Updating our rolling Let’s All Hate Gary Gensler Together coverage then, here’s a few more relevant tweets…

This unelected bureaucrat @GaryGensler thinks he can dictate the American free market. We the people won't have it!

It's no longer about making money in crypto for me, I'm going to fight to make sure this corrupt regulator is fired and he doesn't get the treasury job that he so… pic.twitter.com/etlZS0cmCr

— Tony Edward (Thinking Crypto Podcast) (@ThinkingCrypto1) June 7, 2023

Did @GaryGensler call @brian_armstrong @jespow @bgarlinghouse @jerallaire etc “hucksters, fraudsters”, and/or “scam artists”? He wouldn’t give them a meeting because he was meeting multiple times with SBFraud himself, most likely cutting a regulatory capture deal. Gensler’s a 🤡 https://t.co/DSRIq6XQjQ

— John E Deaton (@JohnEDeaton1) June 9, 2023

Gensler needs to resign immediately https://t.co/VLp9Nq1QwM pic.twitter.com/FnboK0fQHc

— sassal.eth/acc 🦇🔊 (@sassal0x) June 8, 2023

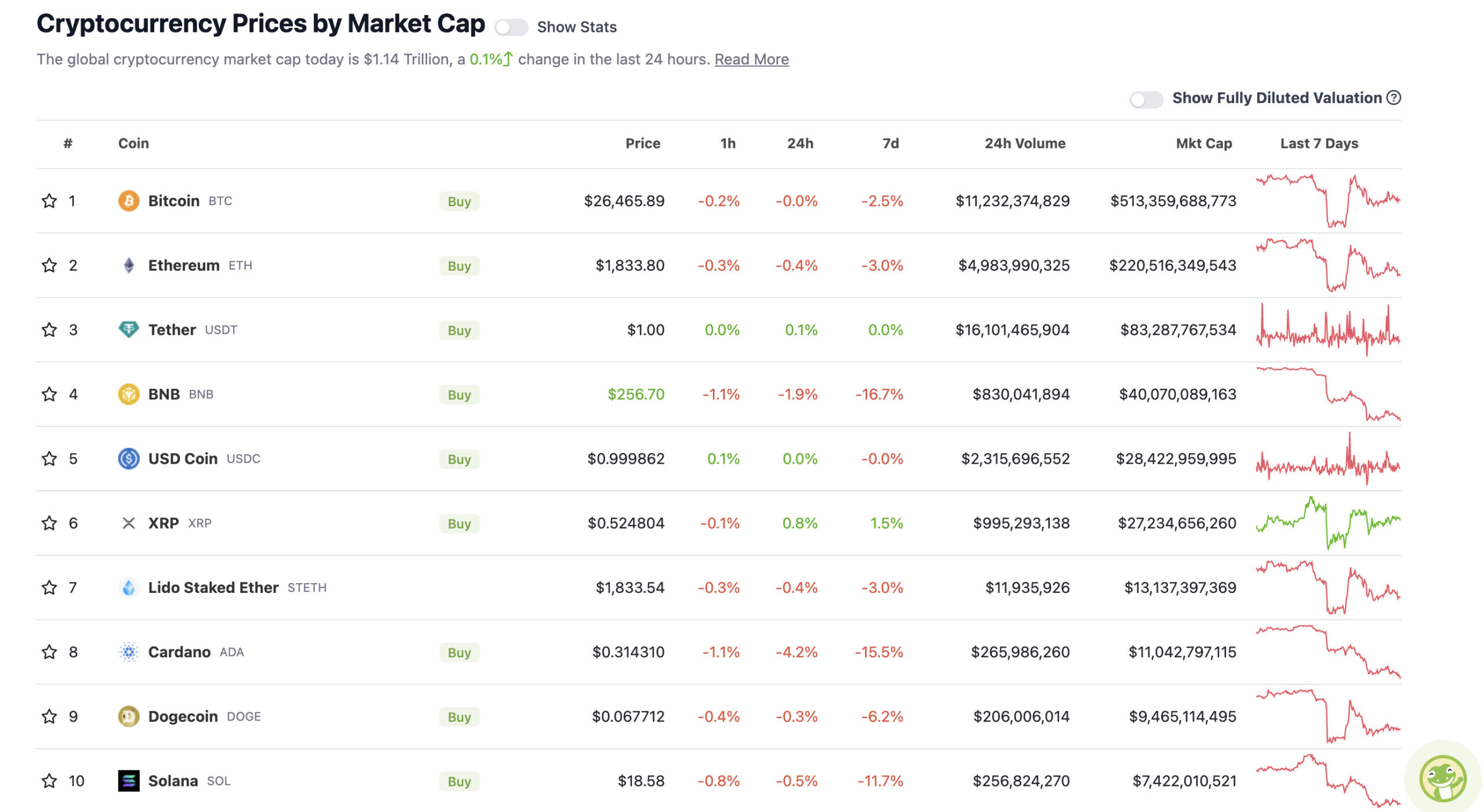

Top 10 overview

With the overall crypto market cap at US$1.15 trillion, up almost an entire percentage point since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Resilience. I mean, this week’s news has been pretty bleeding bearish, and yet, there’s been no cliff fall here. Well, not for Bitcoin (BTC) anyway. Ethereum (ETH), too.

Of course, the weekend’s coming up and anything can happen in the market that never sleeps.

That said, you’d like to think even crypto traders might just take time off to watch the footy, hang out with friends and family and… record scratch… yeah, okay, these are crypto traders. “Mom’s basement”, box of Kleenex handy and Uber Eats it is, then.

Before we get on out of here for another week, let’s take a quick look at the market sentiment, courtesy of the Crypto Fear & Greed Index. Remarkably, it’s still Neutral. Is the thing broken? Somebody give it a tap.

Perhaps the crypto market already largely had the US exchange scrutiny largely priced in. Perhaps we have a real case of bearish exhaustion. Perhaps folks are looking ahead to a possible Fed interest-hike pause announcement next week, and perhaps it’s all trading off the correlation to the US stonks markets and tech stonks, which have had a pretty decent couple of days.

Timeline is more scared now than it was at $20k, and we’re still holding above $26k $BTC.

That’s saying something..

— Miles Deutscher (@milesdeutscher) June 8, 2023

Around the blocks

Some pertinence and randomness that stuck with us on our arvo moves through the Crypto Twitterverse.

BTC Markets, whose CEO, Caroline Bowler, we spoke with earlier this week, has sent out a response to the announcement by the Commonwealth Bank regarding restrictive measures on crypto deposits into exchanges.

Worth a look, but in a nutshell, the exchange plans to “closely monitor the impact of these scam response measures” implemented by the CBA, which will undergo ongoing review.

“We believe that a comprehensive whole-of-ecosystem approach, involving collaboration among government, regulators, banks, telcos, and other industry sectors, is essential to effectively combat scams and protect consumers,” the exchange added.

In other words, watch its space. And this one, too.

BTC Markets responds to @CommBank announcement on #crypto payment restrictions.

Read the official response on our website: https://t.co/Br0IMSDne3@CaroBowler pic.twitter.com/e8T09IXDCZ

— BTC Markets (@BTCMarkets) June 9, 2023

https://twitter.com/naiivememe/status/1666682964166729729

IOG response to SEC filing – "Under no circumstances is ADA a security under U.S. securities laws. It never has been." https://t.co/AEvNIwRYdq

— P₳ul 🇮🇪 (@cwpaulm) June 7, 2023

Huge #Bitcoin poster spotted at Zurich Airport 🇨🇭 pic.twitter.com/cy4v4rcLYX

— Bitcoin Magazine (@BitcoinMagazine) June 8, 2023

Ah, okay then, one more Gensler-related tweet before we go – from Ripple CEO Brad Garlinghouse…

It’s embarrassing to watch an unelected bureaucrat flail like this to mask the fact that he and his agency don’t have the power that he so desperately craves. No one is fooled.

— Brad Garlinghouse (@bgarlinghouse) June 6, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.