Chain Reactions: Bitcoin consolidates above $29k as analysts eye bullish ‘cup and handle’ formation

Are things about to get frothy in the crypto market once again? (Getty Images)

Bitcoin and crypto are keeping heads above water as we draw to another work-week end around Australia.

Maybe it’s time the crypto market put its feet up with a cold beer after working overtime on the charts these past couple of days.

One of the most telling charts we’re noticing right now (although there’s a good one further below, too, in the shape of a cup and handle) is the Crypto Fear & Greed Index.

And that’s because it’s ticked sharply back into a relatively verdant area of Greed after wavering somewhat in the olive groves of doubt during some choppy, slightly dumpy price action just lately.

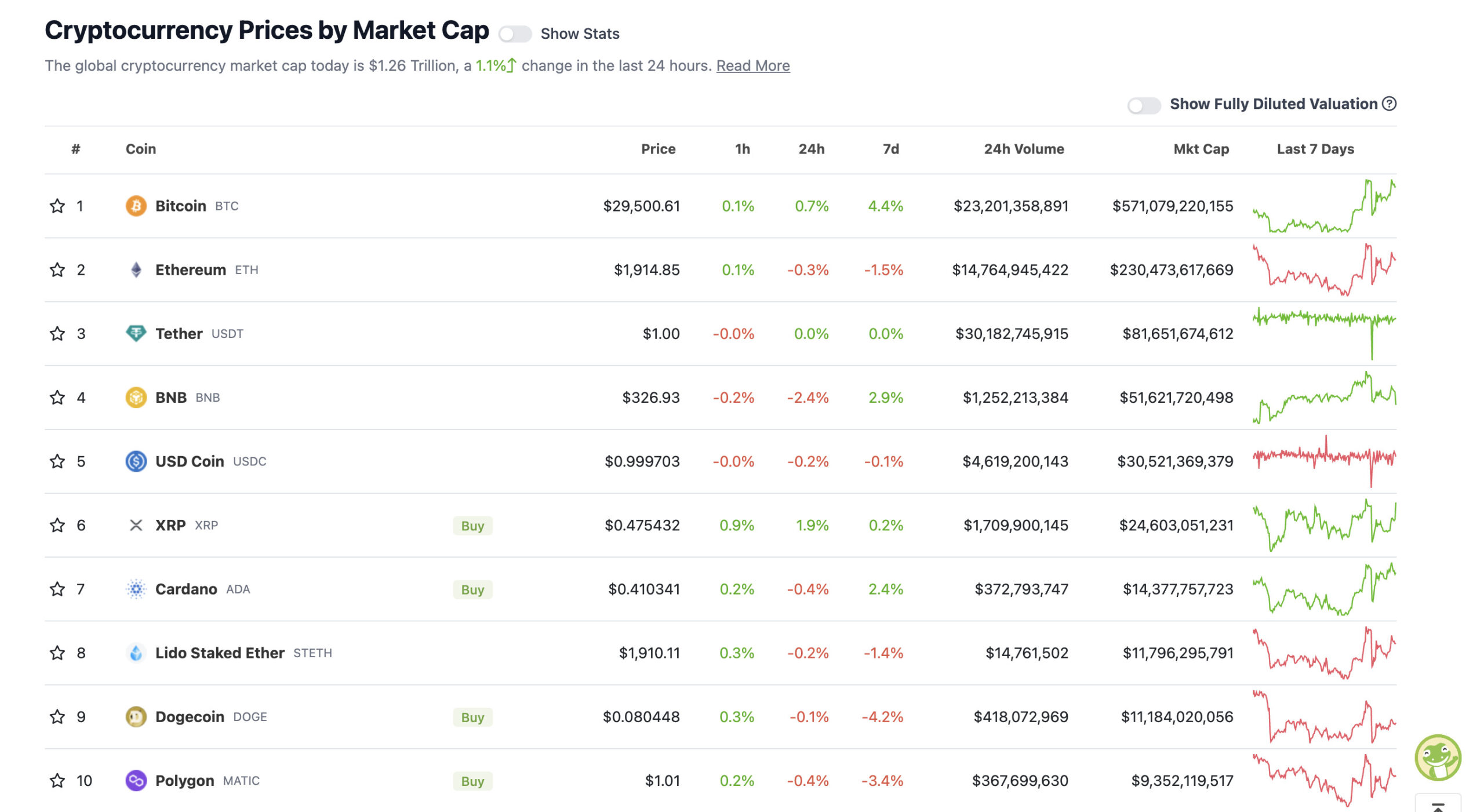

Top 10 overview

With the overall crypto market cap at US$1.26 trillion, up about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Despite some minor paper cuts, it’s not looking too shabby in the crypto majors at present, with the most encouraging thing being the top two cryptos regaining support levels of US$29k and $1,900 respectively.

We’re seeing the usual amount of conflicting analysis from crypto tea-leaves-examining types, but one chart formation seems to be standing out for the particularly bullish right now, and that’s what’s known as a “cup and handle” pattern.

Swissblock, a crypto-focused data analytics outfit shows it off (below) and explains it well in its latest Insights analysis, published on April 26.

Some of its key takeaways include:

- “Risk assets are close to bottoming out as rates are putting in a significant top.”

- “A short-term DXY rally should not invalidate risk asset bullishness.”

- “Bitcoin could see $26k before $35k settles in.”

On that last point there, perhaps the dip down to $27k the other day was far enough?

Swissblock explained the formation further:

“The cup-and-handle pattern is still in play. The neckline break has happened – and it is quite normal to see a retest of the neckline area before the price moves higher. We have that setup now, only the current wave (2) is developing in an “Extended Flat”. This is bullish and the move seems to be coming to an end.”

And here we go: #Bitcoin's rise towards $35k until summer is on.

Short-term correction ✅

Key-level held ✅

Gap in market avoided ✅Why yesterday's correction was bullish

👉 https://t.co/wIIHDRM5Jx#crypto #buythedip https://t.co/vg2k7jU8YQ— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) April 26, 2023

Not everyone is super convinced of bullish moves, though…

GM fam. ☕️

Did everyone survive?

It usually takes a few days after volatility like this to find resolution, so be careful out there.

I still think we see lower, but I could be wrong. $BTC pic.twitter.com/tGttowsB0A

— Justin Bennett (@JustinBennettFX) April 27, 2023

And let’s not forget, we could be in for some further potential volatility next week as the Fed reveals its next rate-hiking move and general sentiment about how it intends to handle the US economy.

Speaking of the Fed and its chair Jerome Powell…

MUST WATCH:

Jerome Powell was prank called by Russians pretending to be Zelenksky.

In the call, the Fed Chair admitted that a US recession is likely. “This is what it takes to get inflation down.” pic.twitter.com/t61gZGqw16

— Geiger Capital (@Geiger_Capital) April 27, 2023

So the man who is supposed to have his thumb on the US economy fell for a prank call? Also, why is the head of the Fed taking private calls with Zelensky? https://t.co/Hdf686r6jD

— Coin Bureau (@coinbureau) April 28, 2023

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

BREAKING‼️🇺🇸 Billionaire Hedge Fund manager Stanley Druckenmiller has shorted the US Dollar – Financial Times pic.twitter.com/3kFdBcBPS9

— Radar🚨 (@RadarHits) April 26, 2023

https://twitter.com/naiivememe/status/1651396462390153216

Oh, one more thing. The major crypto conference Consensus is on in Austin, Texas right now. Aussie crypto educators Collective Shift are there, on the ground, bringing the updates. We might try to check in with them some time next week for further insights…

Day 2 at @consensus2023 (Day 1 for the public)

Here's what you need to know👇

– @playSHRAPNEL was a promising, genuinely good game, launching soon

– No crypto exchanges or projects here

– Big focus on layer 1's and infrastructure

– No retail investors here (too expensive..… pic.twitter.com/Sf0K4wSfJh

— Ben Simpson (@bensimpsonau) April 28, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.