Chain Reactions: Bitcoin bull MicroStrategy outperforms Apple and Google; BTC clings on

Getty Images

Bitcoin is hanging in there by the skin of its teeth this afternoon. If hanging in there means losing US$28k just now and clinging tentatively to a branch just below it, that is.

Let’s take a gander at the market sentiment right now. Maybe that’ll give us some non-technically-analysed clues as to which way the market might be heading.

Actually, no, that tells us pretty much bugger all, other than, perhaps Tedtalksmacro was probably right when he tweeted earlier that investors are moving into defensive positioning ahead of the Fed’s FOMC meeting this week, which is scheduled for May 2 and 3 in the US.

A 25bps rate hike is largely expected from that congregation of centralised puppet mastery. The big unknown is Jerome Powell’s tonality, although we’re betting it’s fairly robotically deadpan with language that suggests a bet each way.

And this oughta leave any crypto investors who actually half keep an eye on the Fed’s actions scratching their heads, before throwing more loose change at memecoins regardless.

In the meantime, Bitcoin-guzzling software and cloud-based tech company MicroStrategy has managed to nail down a US$94 million profit in the first quarter of 2023. And that’s being largely attributed to a one-off income tax benefit of US$453.2 million.

https://twitter.com/TokenJay/status/1653206058813517825

The firm has also reiterated its commitment to its Bitcoin strategy in a statement this week, with CEO Phong Lee (Bitcoin Moon Boy in Chief Michael Saylor is Executive Chairman these days) explaining that:

“The conviction in our Bitcoin strategy remains strong as the digital asset environment continues to mature.

“We remain disciplined on costs while investing in growth, and we will continue to execute our dual strategy of growing our business intelligence software business and acquiring Bitcoin for the future.”

Lee also emphasised that its “core business” is not affected by the short-term price movements of Bitcoin.

Saylor, meanwhile noted that “ultimately, it’s not easy to see what better strategy there might be. And so, we are strong proponents of a Bitcoin strategy. And as you can see from this chart [see tweet below], simply acquiring and holding Bitcoin in a prudent fashion is a pretty good way to outperform the market.”

Since @MicroStrategy adopted a #Bitcoin Strategy: pic.twitter.com/rrYTbvOkUS

— Michael Saylor⚡️ (@saylor) May 1, 2023

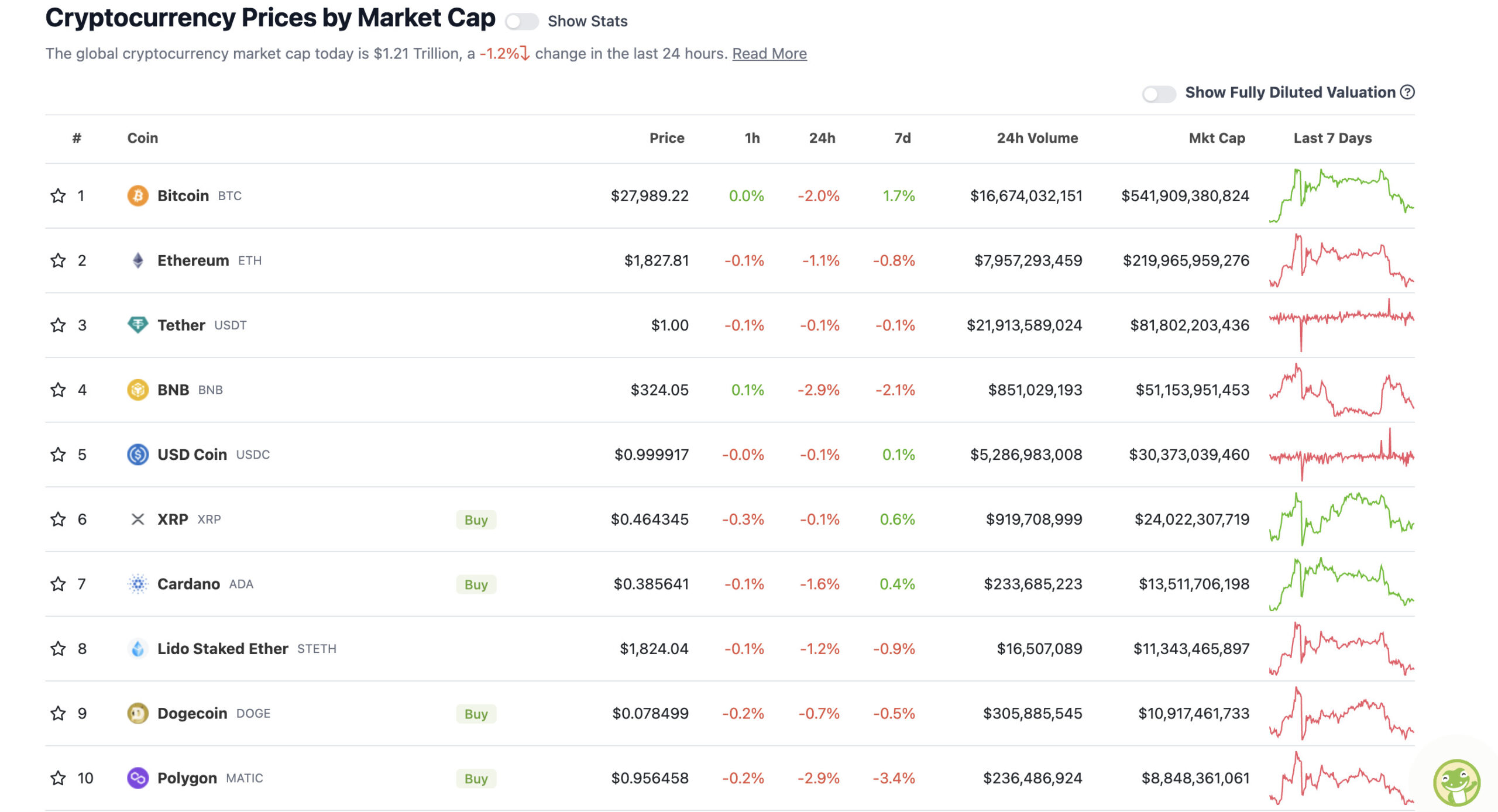

Top 10 overview

With the overall crypto market cap at US$1.21 trillion, down about 1.2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

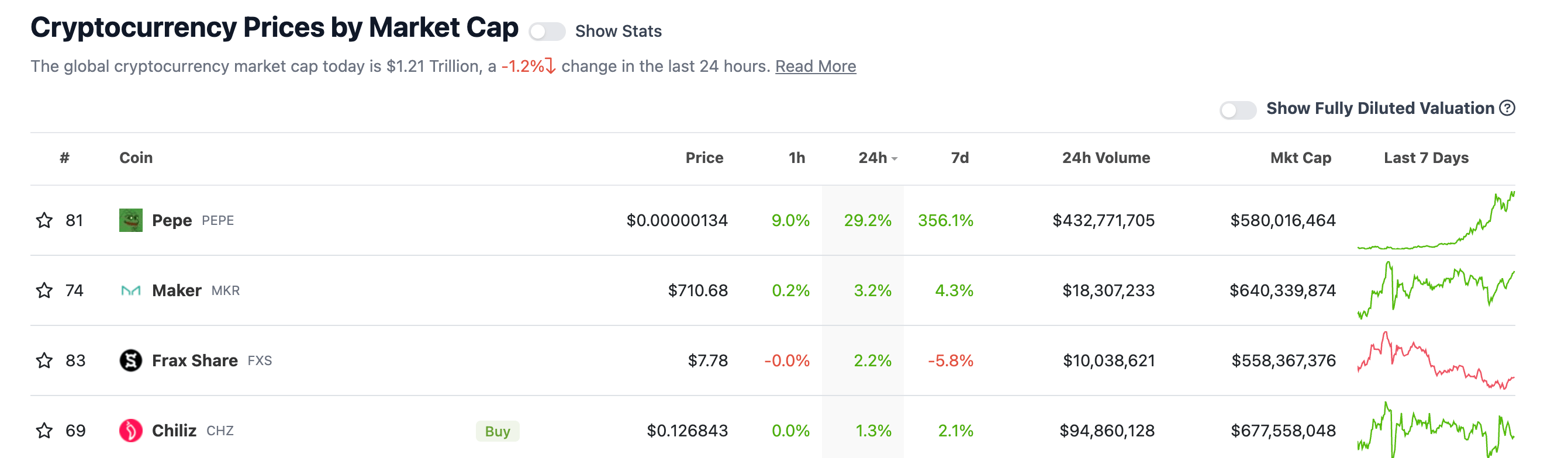

That’s all very well, but what about $PEPE? It’s a top 100 coin now, didn’t you hear?

Yep, a cartoon frog-themed token with nothing but the power of a meme behind it, “built” in super fast time on the Ethereum blockchain two weeks ago, now has a US$580 million market cap.

Well, we say “nothing but the power of a meme”, but that’s actually just about the most powerful attribute of all in a frothy crypto market. More so than “sustainable tokenomics” for those super-duper, short-term, degen-tastic, non-financially advised sugar-rush gainz, anyway.

Anyway, here’s where it’s at. Still easily leading the top 24-hour gainers in the top 100.

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Powell: “There will be pain. Mild recession ahead.”

Crypto Investors with meme coins: pic.twitter.com/Fzb22MJCyi

— Benjamin Cowen (@intocryptoverse) May 2, 2023

Just wait until the hearings on the First Republic collapse start 🙄 pic.twitter.com/Hjr9Z2t3JY

— Coin Bureau (@coinbureau) May 2, 2023

https://twitter.com/tedtalksmacro/status/1653291206682746880

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.