Chain Reactions: Bitcoin and Ethereum are a ‘flight to safety’, believes Ark Invest’s Cathie Wood

Getty Images

It’s turned out to be a bit of a choppy day for Bitcoin (AEDT), which at time of writing is struggling to hang on to the US$30k level.

That said, Ethereum seems to be holding near US$2,100, and there are plenty of strong-performing altcoins on a daily and weekly timeframe.

Cathie Wood, CEO of tech-sector-loving Ark Invest, meanwhile is beating the drum once again for both assets, talking up their resilience during the ongoing wobbly macroeconomic environment and US/European banking crisis.

In fact, in her latest “In the Know” YouTube-posted webcast, Wood even described the two leading cryptos as being “risk-off” assets, as well as a “flight to safety” during these uncertain times.

“They’re going to disrupt the traditional world order,” enthused the Ark boss. “What are Bitcoin and Ether doing? I mean by the very fact that they’re being considered flight to safety like gold, that’s really interesting and suggests much broader-based adoption and acceptance than I think most people understand.”

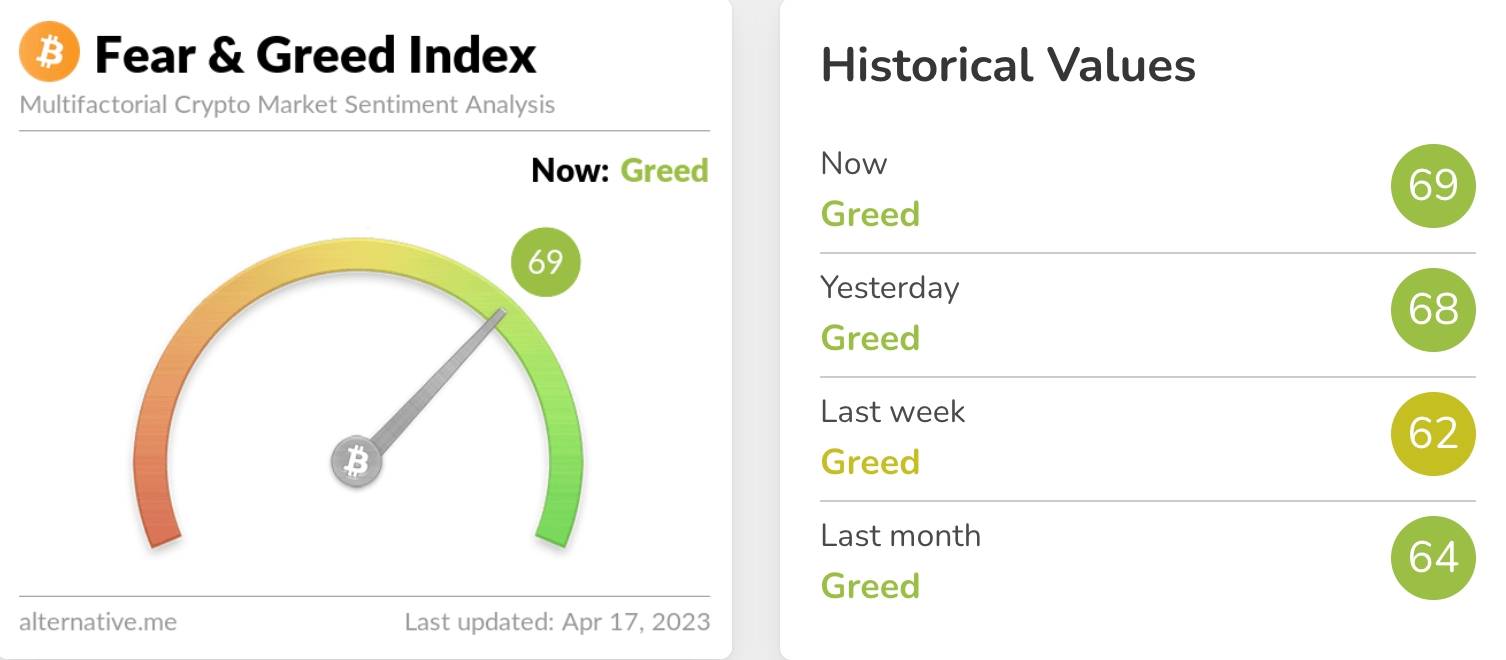

Fear and Greed time. Bitcoin might be down a fraction today, but the Greed factor has ticked up a notch in the market’s leading sentiment tracker…

Top 10 overview

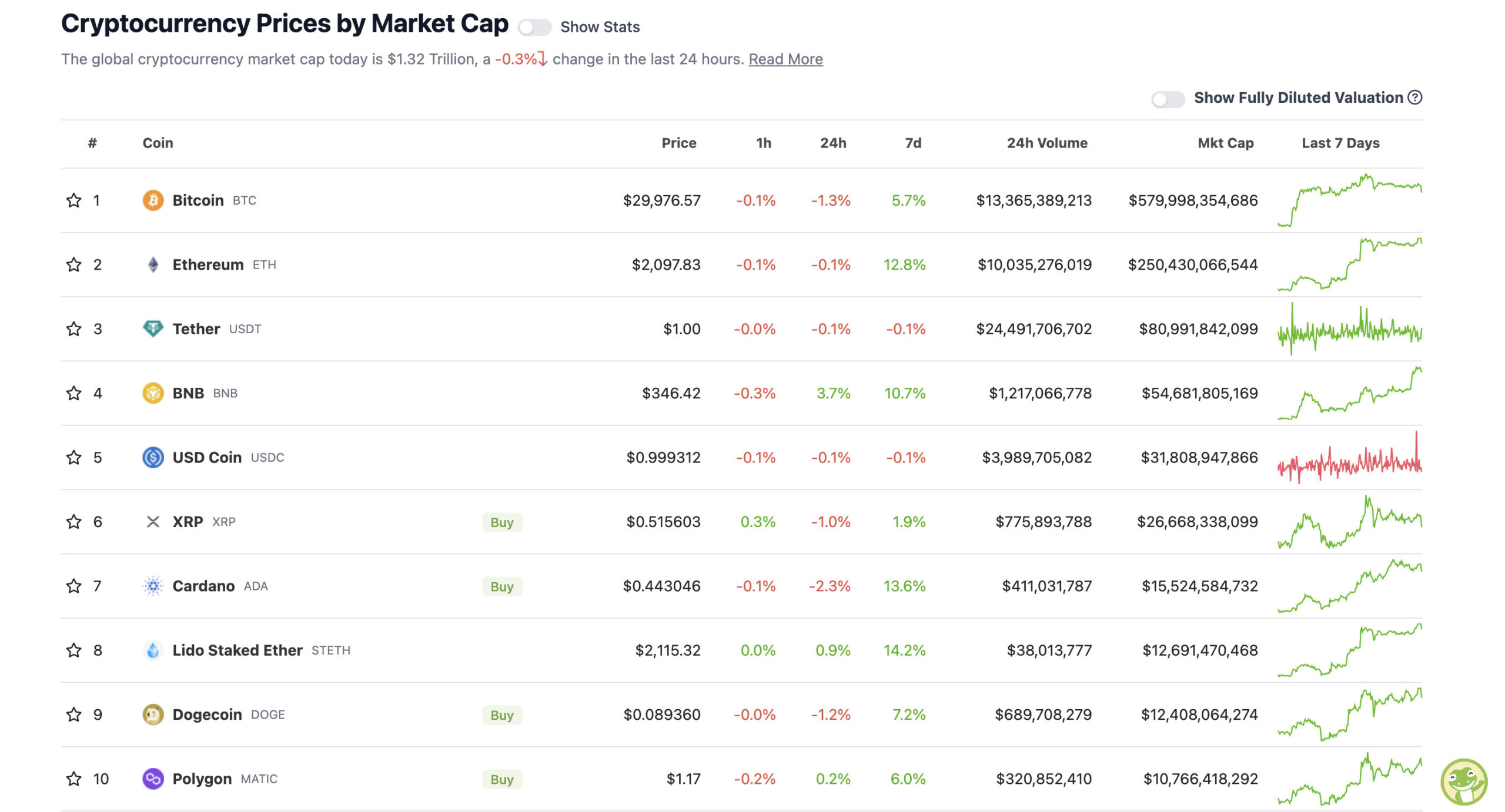

With the overall crypto market cap at US$1.32 trillion, down 0.3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Some daily chop since this morning, then, and some encouragement there for avid Bitcoin/crypto bears, some of whom have been sticking to their shorting, or at least cautiously negative, guns. Such as il Capo “Biggest Bull Trap Ever” of Crypto…

Congratulations to the bulls that were respectful and were calling for 30k.

My bearish scenario is NOT invalidated yet.

— il Capo Of Crypto (@CryptoCapo_) April 11, 2023

… and Nicholas “DataDash” Merten, too, who told his 511k+ YouTube followers in his latest update that he thinks the recent Bitcoin and crypto pumpage is a relief-rally trap.

“So far, we’ve seen about a 100% move. So I really don’t like when people make this comparison,” said Merten referring to other influencers likening current market conditions to a 300% BTC rally in 2019.

“What I really think is a lot more fair when it comes to percentage terms and is more relevant to what we’re experiencing right now is the same relief rally trap that has constantly played out during this bear market.”

Bearish crypto voices seem to be in the minority right now, but it’s good to keep an open mind to both sides of that equation.

Regarding today’s Bitcoin dip, meanwhile, here’s another popular crypto chart watcher, Dave the Wave, who tells his 138k Twitter followers that there’s “plenty of room to remain bullish” right now, even with the odd little dip or “consolidation”.

#BTC

Plenty of room to remain bullish even if we do see some consolidation… pic.twitter.com/Kp1kW7YPpy— dave the wave🌊🌓 (@davthewave) April 17, 2023

And here’s flying Dutchman (he flies now and then) Michaël van de Poppe with a similar sentiment…

#Bitcoin is getting towards the long areas.

Back towards the range low, through which a sweep can be granted as an entry point towards $32K.

$28,600 could also be a long entry, but then I think we won't be starting to make new highs, for now. pic.twitter.com/C5ZqJjkPap

— Michaël van de Poppe (@CryptoMichNL) April 17, 2023

Annnnd…just in the spirit of keeping things completely confusing in Cryptoland, here’s another one for the bears, courtesy of Kevin Svenson.

Daily RSI breakdowns have been the most reliable bearish signal in the past year.#BTC is close to one now. This is the first potential bearish signal I've seen in a while.

It's only confirmed when the market reacts to it. Still waiting for confirmation. pic.twitter.com/XhD7T36MKw

— Kevin Svenson (@KevinSvenson_) April 17, 2023

Uppers and downers: 11–100

Sweeping a market-cap range of about US$9.99 billion to about US$502 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS

• Rocket Pool (RPL), (market cap: US$1.17 billion) +15%

• Render (RNDR), (mc: US$710 million) +13%

• Radix (XRD), (mc: US$868 million) +9%

• Avalanche (AVAX), (mc: US$6.8 billion) +8%

• Fantom (FTM), (mc: US$1.49 billion) +5%

• Solana (SOL), (mc: US$9.99 million) +5%

SLUMPERS

• Kaspa (KAS), (market cap: US$502 million) -16%

• Klaytn (KLAY), (mc: US$790 million) -6%

• OKB (OKB), (mc: US$3.12 billion) -4%

• ImmutableX (IMX), (mc: US$1.07 billion) -3%

• Shiba Inu (SHIB), (mc: US$6.76 billion) -2%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Uh-oh, another crypto exchange is being targeted by Gary “the Destroyer” Gensler and the US Securities and Exchange Commission. Highly doubt this Bittrex news will be a big price-needle mover, though.

So the SEC plans to sue Bittrex even after they said that they are winding down their US operations. Seems like they won't stop until every US exchange has left its shores 🤷♂️https://t.co/COBiMIvLfJ

— Coin Bureau (@coinbureau) April 17, 2023

https://twitter.com/naiivememe/status/1647827112865460224

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.