Buy Now Bitcoin Later. Australia’s Zip Co confirms plans for crypto move

Aussie buy-now-pay-later (BNPL) firm Zip Co has reiterated plans to move into crypto and launch a trading service in Australia and the US within 12 months, according to a report today.

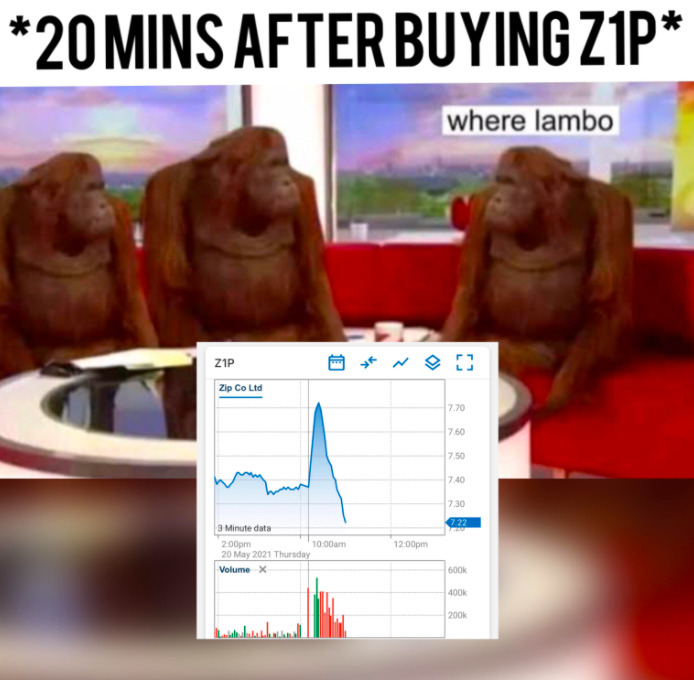

Zip Co’s share price (ASX:Z1P) has been taking a zip down in the past 24 hours on the back of some typically bearish UBS forecasting analysis, so finding fresh ways to power growth might not be a bad idea.

That’s not to say it’ll give Z1P’s meme-loving fanbase cause for excitement any time soon, although you never know.

The company’s co-founder, Peter Gray, told Reuters that trading in crypto through the use of a native Zip digital wallet was one of the most sought-after features from its users.

“We know our younger generation of customers seek additional products and services that are relevant to them,” Gray said.

Gray also told the news outlet that a broader range of products, such as budgeting tools for Zip users, was likely to be launched first in Australia, given the fact around 30% of adults have a BNPL account.

Zip Co seems tight-lipped for now on how the trading service might actually work, and which cryptos will be integrated.

BNPL competition heating up

Zip Co’s crypto move certainly represents a different hand at the table (a diamond hand?) from that of BNPL rival Afterpay (ASX:APT), which has been making moves into the more traditional banking sector with Westpac.

That said, according to the Wall Street Journal, Zip Co is also looking to move into stock trading as well as cryptocurrencies.

It’s unclear at this time whether Zip Co will test the waters with stocks or crypto first. A launch of one of these services in the US, where BNPL demand is particularly high, could be on the cards before Australia initially.

Competition is fierce across the BNPL landscape and Zip Co is clearly keen to stay in the race. Afterpay and fellow rival Klarna are expanding their reach into more countries, and PayPal and Apple are now shoulder-charging their way into the sector, too.

Not unlike crypto, the BNPL space gained a lot of traction during the earlier stages of the global pandemic, particularly with the younger “need it now” shopping crowd.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.