BTC, Eth directionless as market waits for Bitcoin ETF ruling next week

Getty Images

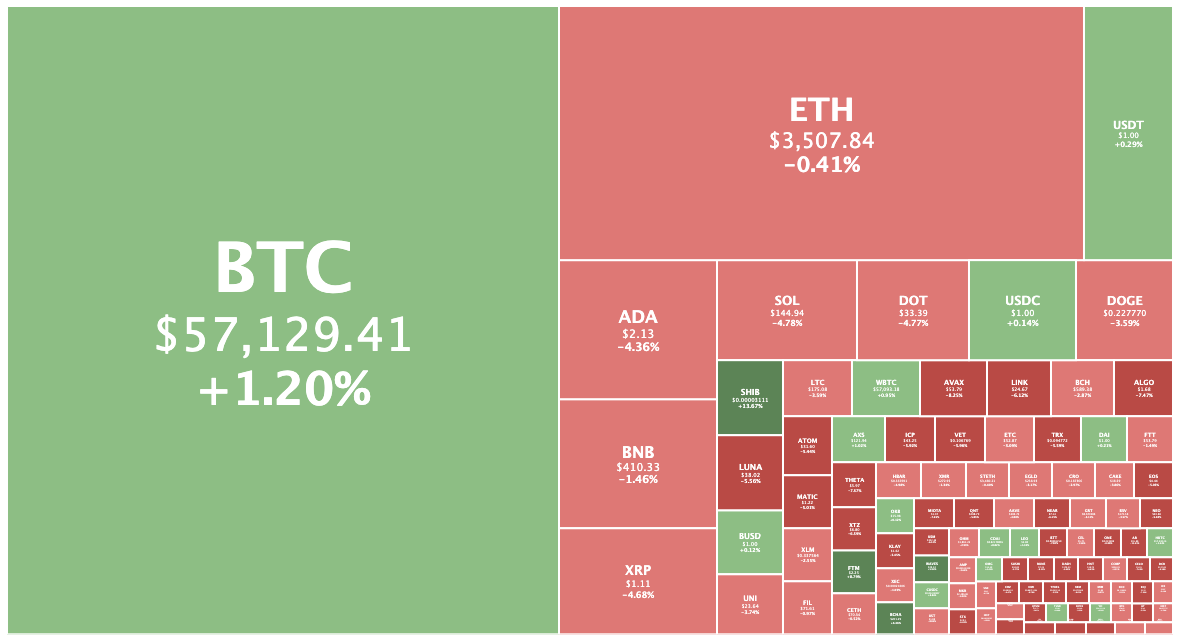

Crypto’s big two – Bitcoin and Ethereum – are little changed this afternoon as markets wait for news on the rumoured US Bitcoin ETF approval.

Bitcoin was trading at US$56,971, up 0.9 per cent, while Ethereum was changing hands for US$3,496, down 0.5 per cent.

The other top 20 cryptos were down slightly, except for stablecoins and Shiba Inu coin, which was up 11.3 per cent to 0.003102.

The meme coin is currently the No. 14 crypto, according to Coinmarketcap, ahead of Litecoin. It’s also overtaken Avalanche and Chainlink, which have faded to No. 17 and No. 18.

Overall the crypto market is down 0.8 per cent to US$2.31 trillion, with all but a dozen of the top 100 coins in the red.

Arweave, Ren, Flow and dYdX were the biggest losers in the top 100, all down about 10 per cent.

Shib was the biggest gainer, followed by Perpetual Protocol and Fantom, which had gained 10.3 and 8.8 per cent, respectively.

Fantom is up 58.8 per cent for the week, second only to Shib’s 131 per cent rise. The directed acyclic graph (DAG) smart contract platform set an all-time high of US$2.45 over the weekend.

$FTM flipped $LUNA on TVL. Coming for $SOL next. $FTM incredibly undervalued. At Solana MCAP/TVL ratio should be worth $16 right now People waking up to the potential pic.twitter.com/wvHlepc2ZX

— cryptoignition (@cryptoignition) October 8, 2021

‘Contango bleed’

There’s four different Bitcoin futures ETFs that the US SEC needs to rule on before the end of the month, with the ProShares ETF likely the first to be decided upon, on Monday.

Many crypto buffs are expecting that any Bitcoin ETF would be a hugely bullish sign for the market.

Of course, that was also the hope back on 18 December 2017, when the CME Group’s Bitcoin futures product began trading when BTC was just below US$20,000.

History shows that BTC peaked on same day, crashed into a brutal bear market and took three years to recover.

Economist and Bitcoin Alex Krüger is warning that a Bitcoin futures ETF would suffer from “contango bleed” and likely need to sell low and buy high.

Few understand this bitcoin ETF if approved would have futures as underlying. Futures are usually in strong contango (i.e. futures > spot), so at rollover the ETF would *sell low to buy high*, and suffer Contango Bleed.

Assets with strong contango bleed trend lower.

Example pic.twitter.com/fVa7Fu81Db

— Alex Krüger (@krugermacro) October 7, 2021

But others say even a Bitcoin futures ETF would be good for BTC.

Even a futures ETF would be indirectly bullish for price. Allows big money to pile in, raising futures prices, then hedge funds arb contango by buying spot bitcoin and selling futures. https://t.co/fJUYS3VczO

— Monetary Wonk (@MonetaryWonk) October 8, 2021

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.